Robo-advisors are changing the way women invest, and the best part? You do not need to be a financial expert to use them. If you’re looking for a simple, low-cost, and stress-free way to grow your money, this beginner’s guide is for you. Whether you’re new to investing or want to make your finances work smarter, robo-advisors can help you achieve your financial goals with ease.

In this post, we’ll explain what robo-advisors are, how they work, and why they are one of the best investment tools for women who want to build wealth. From automated investing to goal-based planning, you’ll discover why more women are choosing robo-advisors to take control of their financial future.

Ready to learn how to invest confidently, even if you’re just starting out? Let’s explore how robo-advisors can simplify your financial journey.

What Are Robo-Advisors and How Do They Work?

If you’ve ever felt overwhelmed by the idea of investing, robo-advisors are a game-changer, especially for women who want to take control of their finances without needing a background in finance.

So, what exactly is a robo-advisor?

A robo-advisor is an automated online platform that uses algorithms to manage your investments. Unlike traditional financial advisors who charge high fees for one-on-one consultations, robo-advisors offer a low-cost, hands-off investing experience tailored to your goals.

Here’s how it works:

- You sign up on a robo-advisor platform like Betterment, Wealthfront, or Ellevest (designed with women in mind).

- You answer questions about your financial goals, risk tolerance, and investment timeline.

- Based on your answers, the robo-advisor builds a diversified portfolio for you, usually made up of low-cost ETFs (exchange-traded funds).

- The platform automatically monitors, rebalances, and reinvests for you over time.

Why Are Robo-Advisors Great for Beginner Women Investors?

- Automated investing tools mean you do not have to be a market expert.

- Lower fees (often 0.25% or less annually) compared to human advisors.

- Goal-based features, like saving for retirement, a house, or even starting your own business.

Unlike traditional advisors who might require high account minimums or complex paperwork, robo-advisors make investing more accessible, inclusive, and flexible, perfect for busy women looking to build wealth on their own terms.

Why Robo-Advisors Are a Smart Choice for Women Investors

Taking the first step toward investing can feel overwhelming, especially for women balancing careers, families, or just learning the ropes of personal finance. Robo-advisors are making it easier than ever to get started with low stress, low costs, and high accessibility.

Low Barriers to Entry

One of the biggest reasons robo-advisors are perfect for beginners is their low minimum investment requirements. Many platforms let you open an account with as little as $5 or $100. This makes it easier for women to start investing without waiting to build up large savings.

Hands-Off and Time-Saving

If you’re a busy professional or a mom with limited free time, robo-advisors offer a “set-it-and-forget-it” approach to investing. Once you answer a few questions about your goals and risk tolerance, the platform manages everything, from choosing investments to rebalancing your portfolio.

Designed for New Investors

Robo-advisors often come with user-friendly dashboards, clear reports, and educational content. These features help women who are new to investing feel more confident about managing their money without needing to become a financial expert overnight.

Accessible Wealth-Building

With robo-advisors, investing is no longer reserved for the wealthy. They make wealth-building accessible to everyone, especially women who are just beginning their financial journey and want to start building long-term financial security today.

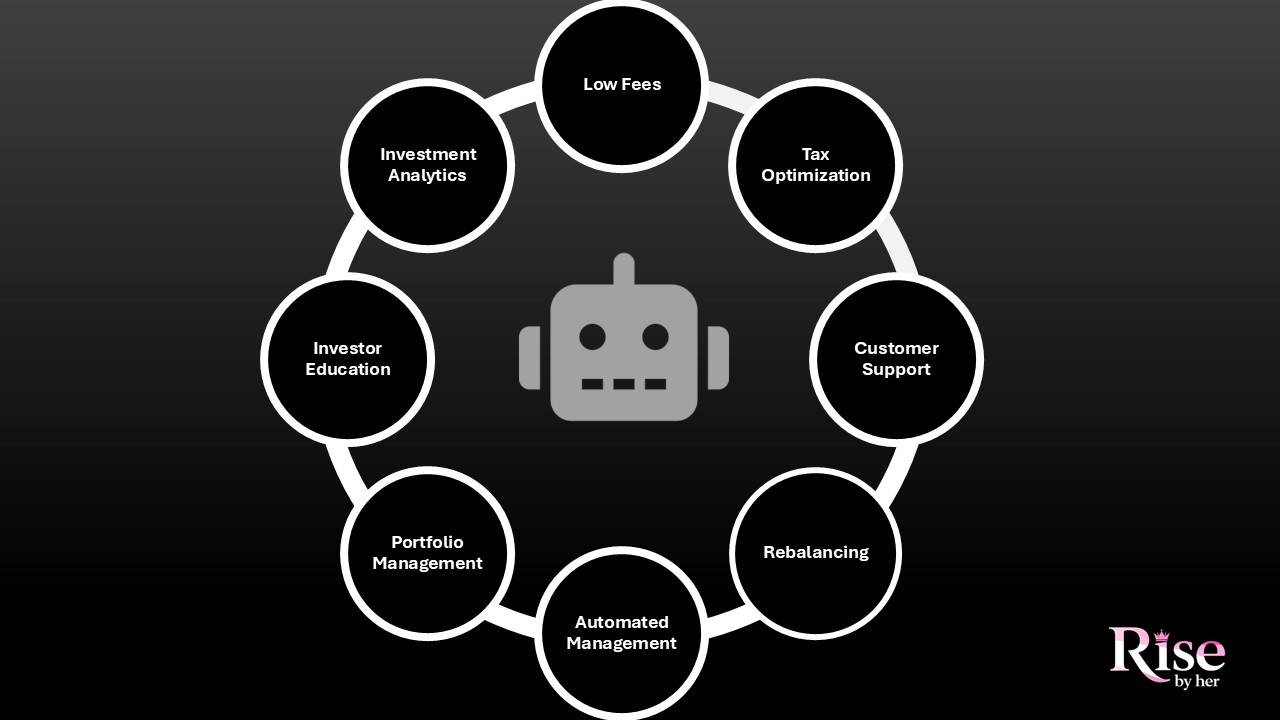

Key Robo-Advisor Features to Look for in 2026

When choosing a robo-advisor in 2026, it is important to go beyond just fees or brand names. The best platforms offer a mix of automation, customization, and educational support, especially helpful for women seeking financial independence and smarter wealth-building strategies. Whether you are investing your first $500 or expanding an existing portfolio, here is what to prioritize:

Automatic Portfolio Rebalancing

As markets change, your asset allocation can shift, increasing your risk exposure. A dependable robo-advisor will automatically rebalance your portfolio to match your original investment goals.

Why this matters for women:

- Keeps your risk profile in check without manual effort.

- Ensures long-term investing consistency.

- Removes emotional decision-making from investing.

Tax-Loss Harvesting

Tax efficiency is essential to building wealth over time. Some robo-advisors offer automated tax-loss harvesting, which can reduce your taxable income by selling losing investments and replacing them strategically.

Benefits:

- Lowers your capital gains taxes.

- Boosts after-tax returns.

- Ideal for high-income women and long-term investors

Ethical and ESG Portfolio Options

More women today want their money to reflect their values. That is where ESG (Environmental, Social, and Governance) investing comes in. Many robo-advisors now offer portfolios that screen for companies based on ethical and sustainable criteria.

Look for platforms that offer:

- Sustainable and impact investing portfolios

- Filters for diversity, environmental responsibility, or corporate governance

- The option to exclude industries like tobacco, fossil fuels, or weapons.

User-Friendly Mobile Access

Convenience matters. A top-tier robo-advisor should offer a clean, intuitive mobile app that allows you to manage investments from anywhere.

Key features to look for:

- Easy-to-navigate dashboard.

- Real-time portfolio tracking

- Push notifications for deposits, rebalancing, or market news.

Financial Education & Planning Tools

Many women are building their financial literacy while they invest. Choose a robo-advisor that provides high-quality educational tools and resources.

Great platforms include:

- Articles, webinars, and explainers on personal finance

- Goal-based planning (retirement, home purchase, kids’ education)

- Interactive calculators for growth projections and budgeting

A great robo-advisor does more than invest your money, it supports your journey to financial confidence and freedom. By choosing a platform that aligns with your values, needs, and goals, you will build wealth with purpose.

Best Robo-Advisors for Women in 2026

As more women seek to build wealth, it’s essential to choose the right platform that aligns with your financial goals and values. Below are some of the top robo-investment platforms that cater to a variety of financial objectives, including retirement planning, ethical investing, and long-term wealth accumulation.

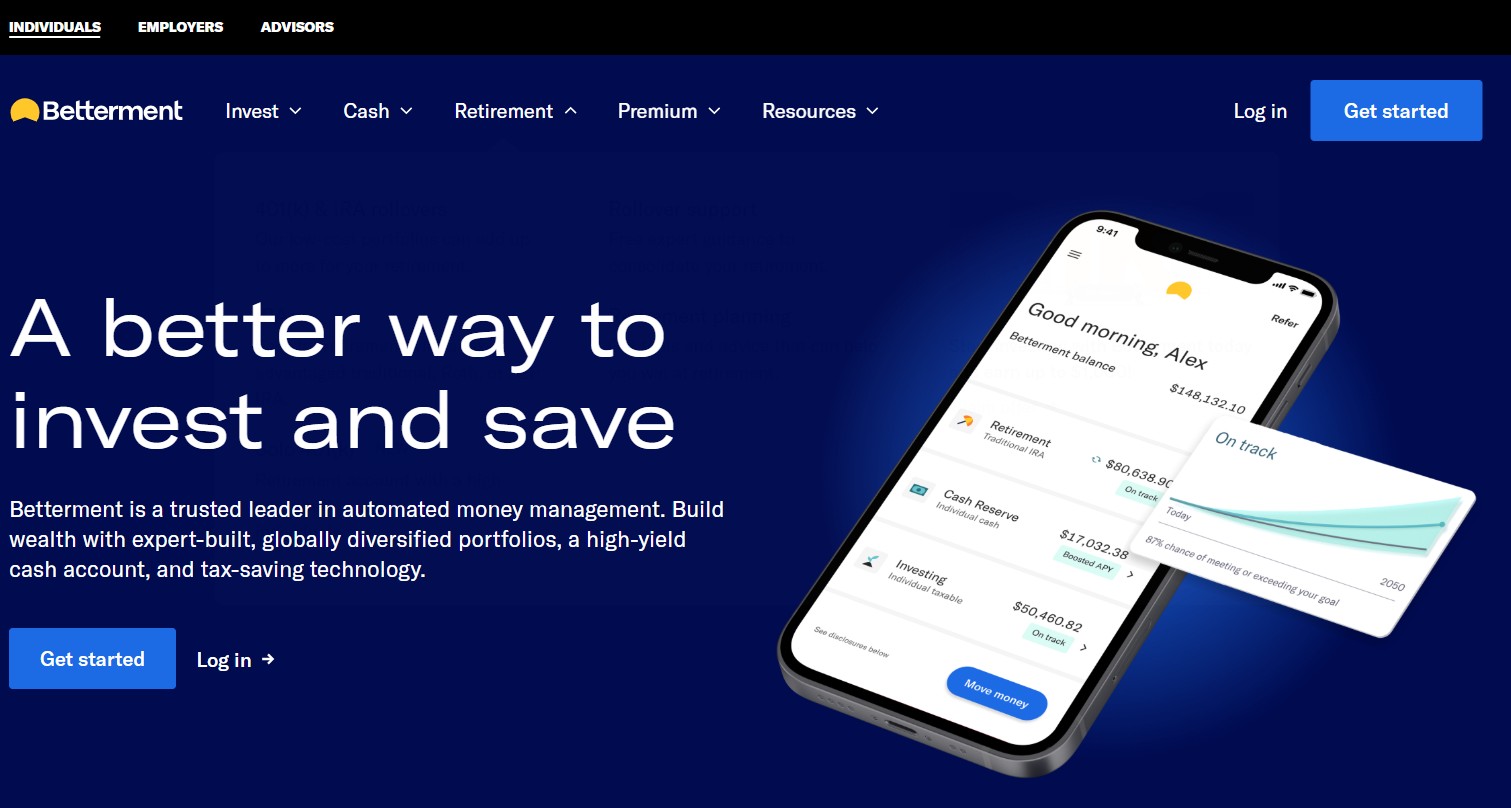

Betterment: Great for Beginners and Long-Term Growth

Betterment is one of the leading robo-advisors and is known for its easy-to-use interface, making it ideal for women who are new to investing. It offers a range of portfolio options, from basic plans to socially responsible investment strategies.

Best for: Women looking for long-term growth and low maintenance with socially conscious investment options.

Ellevest: Tailored to Women’s Unique Financial Needs

Ellevest is a female-focused robo-advisor designed with women’s financial needs in mind. It takes into account factors like longer life expectancy and career gaps, making it a great choice for women who want to plan for a secure financial future.

Best for: Women who want a robo-advisor designed specifically for their financial journey and who are focused on long-term goals like retirement.

Wealthfront: Ideal for Hands-Off Investors

Wealthfront is one of the most well-known robo-advisors, providing diversified portfolios and automatic rebalancing. It’s a great option for women who want a hands-off investment experience with a focus on retirement planning.

Best for: Women who want a set-it-and-forget-it strategy for retirement or long-term savings.

SoFi Invest: A Comprehensive Wealth Management Platform

SoFi Invest is a versatile robo-advisor offering both automated and self-directed investment options. It’s particularly popular among younger women who are just starting their investment journey and want a wide range of tools.

Best for: Women who want a combination of hands-off investing and access to educational resources and financial planning tools.

Acorns: Ideal for Small-Scale Investors

Acorns is perfect for women just starting to build wealth but who may not have large sums to invest initially. It rounds up your everyday purchases and invests the spare change into diversified portfolios.

Best for: Women who want to start investing with small amounts and build wealth over time, especially if they are new to investing.

Which Robo-Advisor is Right for Your Financial Goals?

- For Long-Term Growth: Betterment and Wealthfront are great for long-term investors looking for growth with minimal effort.

- For Women-Focused Plans: Ellevest offers a unique approach tailored to women’s financial needs.

- For Hands-Off Investing: SoFi Invest and Wealthfront are ideal for those who prefer a completely automated experience.

- For Starting Small: Acorns is perfect for those with limited funds looking to start their investment journey.

When selecting a robo-investor platform, consider your financial goals, time horizon, and comfort level with risk. Each platform offers unique benefits that can help you grow your wealth, whether you’re just starting out or looking to optimize your existing investments.

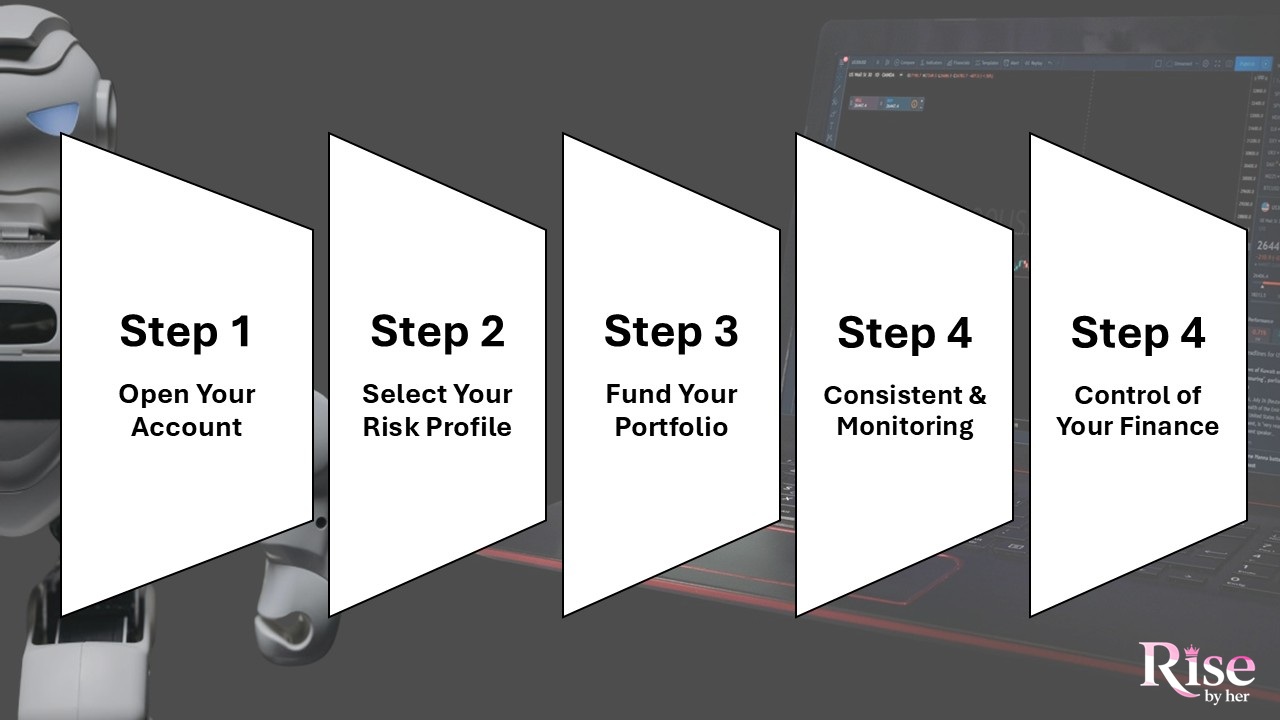

How to Get Started with a Robo-Advisor Step by Step

Starting your investment journey with a robo-advisor is easier than you might think. Follow these simple steps to get started and take control of your financial future today.

Open Your Account

The first step is to choose a platform and create an account. Most robo-advisors have an easy sign-up process, where you will provide basic personal and financial information. This usually includes your income, financial goals, and investment preferences.

Tip: Look for platforms that offer no minimum deposit or low starting balances, so you can begin investing with as little as $5 or $100.

Select Your Risk Profile

Once you have created your account, you will be asked to select your risk profile. This is an essential step as it determines how your investments will be allocated based on your tolerance for risk. Typically, the options range from conservative (low risk, stable returns) to aggressive (high risk, high potential rewards).

Tip: For women who are new to investing, starting with a more conservative profile can be a wonderful way to ease into the market. As you gain confidence and knowledge, you can adjust your profile to align with your financial goals.

Fund Your Portfolio

After setting your risk profile, it is time to fund your account. Many robo-advisors allow for one-time deposits, but you can also set up recurring contributions to make saving and investing a habit. Automated investing means your money is regularly put to work, even when life gets busy.

Tip: Automating contributions, even small amounts, is an excellent way to stay consistent and gradually build your wealth over time. Setting up an automatic deposit can take the guesswork out of investing.

Stay Consistent and Monitor Your Progress

Investing is a long-term journey. After your portfolio is set up, your job is to stay consistent with contributions and monitor your progress. While robo-advisors manage the day-to-day management, it’s still important to check in regularly to ensure your investments align with your goals.

Tip: Set a reminder to review your portfolio quarterly or after any major life events, like a new job or moving cities, to make adjustments as needed.

Take Control of Your Financial Future

By using a robo-advisor, you are empowering yourself to take control of your financial destiny. Whether you are saving for retirement, building an emergency fund, or working toward other goals, automated investing offers a simple, efficient way to grow your wealth.

Encouragement for Women: Investing is an essential step toward financial independence. By taking the first step today, you are making a commitment to your future and your financial security. You do not need to be an expert, just start where you are and let the tools available guide you toward success.

Robo-Advisor FAQs for Women Investors

As women increasingly turn to automated investment platforms to manage their finances, it is natural to have questions. Here are some of the most frequently asked questions about robo-advisors, along with answers to help guide your decision-making.

Q1. Are Robo-Advisors Safe?

Yes, robo-advisors are very safe. Most platforms are registered with the Securities and Exchange Commission (SEC) or relevant financial regulatory bodies, which ensures they adhere to strict guidelines. Additionally, they use bank-grade encryption and advanced cybersecurity measures to protect your data and financial transactions.

Make sure to check the platform’s security measures and its registration with financial regulatory authorities before opening an account.

Q2. How Do Fees Compare to Traditional Advisors?

Robo-advisors typically have lower fees compared to traditional financial advisors. The fees are often in the range of 0.25% to 0.50% of your assets under management, which is much lower than the 1% or higher that many traditional advisors charge. This lower cost can result in higher long-term returns, as less of your money is going toward management fees.

It is important to check the pricing structure of each platform to ensure there are no hidden fees or charges that might impact your investment returns.

Q3. Can I Still Speak to a Human If I Need Help?

Yes, many robo-advisors offer some level of human support. While most of your interactions will be automated, platforms like Ellevest, for example, allow you to speak with a financial advisor if needed. This is especially helpful for women who might prefer a personalized approach or need assistance during significant financial decisions.

Look for platforms that offer human support options for more complex financial questions or if you want reassurance about your investment strategy.

Q4. Can I Customize My Investment Portfolio?

Yes, most robo-advisors allow you to customize your portfolio based on your preferences, values, and financial goals. Whether you prefer socially responsible investing (SRI) or are looking for more traditional investment strategies, you can usually adjust your portfolio to match your risk tolerance and interests.

Explore the customization options available on your chosen platform to tailor the portfolio according to your values and financial objectives.

Q5. What Happens if the Market Drops?

Robo-advisors are designed to help you stay the course, even during market downturns. Since your portfolio is often diversified across various asset classes, it’s less likely to suffer the full impact of market volatility. Additionally, many platforms automatically rebalance your portfolio to maintain your desired risk profile.

Stay focused on your long-term goals and remember that market dips are a normal part of investing. It is essential to avoid making rash decisions during times of volatility.

Q6. Are Robo-Advisors Suitable for Beginners?

Yes, robo-advisors are ideal for beginners who are just starting to invest. The platforms are designed to be user-friendly, with simple sign-up processes and educational tools that guide you through your investment journey. They manage the technical aspects of investing, so you can focus on your goals.

If you are new to investing, start with a low-risk profile and gradually learn more about how your investments are managed.

Q7. How Do Robo-Advisors Handle Taxes?

Many robo-advisors offer tax-efficient strategies, such as tax-loss harvesting, to minimize the tax burden on your investments. These features automatically sell securities that have lost value to offset capital gains, which can be especially helpful when managing a taxable account.

Choose a robo-advisor that includes tax optimization features if minimizing taxes is a priority for you.

Q8. Can I Use a Robo-Advisor for Retirement Accounts?

Yes, many robo-advisors offer retirement account options such as IRAs and 401(k) rollovers. This allows you to automate retirement savings and take advantage of tax benefits. Some platforms even offer retirement-specific portfolios designed to optimize your savings for long-term growth.

Consider using a robo-advisor to manage your retirement account, as it simplifies the process and ensures consistent contributions.

Discover more financial strategies here: