In 2026, bootstrapping has become a popular and empowering choice for women entrepreneurs looking to start and grow their businesses. Have you ever wondered how to fund your business without relying on loans or investors? Bootstrapping involves using personal savings or resources to finance your startup, giving you full control over your business decisions and direction.

Are you tired of navigating the challenges of securing traditional startup funding? For many women, access to capital can be a significant barrier. Bootstrapping offers a solution, allowing you to build your business at your own pace while maintaining flexibility and autonomy. Plus, it eliminates the risk of accumulating debt: something every entrepreneur wants to avoid.

In this guide, we’ll explore why bootstrapping is not just a viable option, but a powerful strategy for women entrepreneurs in 2026. Ready to take control of your business and achieve your goals on your own terms? Let’s dive in.

The Basics of Bootstrapping: What You Need to Know Before Starting

Bootstrapping refers to funding your startup using your own resources, without external investors or loans. It’s a strategic approach for entrepreneurs starting a business with little money, enabling full control over decisions and growth. Below is an overview of the key principles of bootstrapping:

| Principle | Description |

| Start Small and Lean | Minimize initial expenses and focus on core business functions. Prioritize essential tools and services to keep costs low. |

| Personal Savings | Use your personal savings or income from side jobs as initial capital. Budget wisely and allocate resources efficiently. |

| Reinvesting Profits | As your business starts generating income, reinvest profits back into the company instead of drawing personal earnings. This fuels sustainable growth. |

| Avoid External Funding | Resist the urge to seek loans or investors in the early stages. This allows you to retain full control over your business decisions and equity. |

| Bootstrapping Basics | Focus on self-sufficiency by relying on your own financial resources and gradual growth instead of external assistance. |

Key Takeaways:

- Bootstrapping requires a disciplined approach to budgeting and spending.

- Reinvesting profits is crucial to fueling your business’s growth without taking on debt or sacrificing equity.

- Maintaining control over your business allows you to shape its direction without external interference.

By following these bootstrapping basics, you can build a self-sustaining business that grows organically over time.

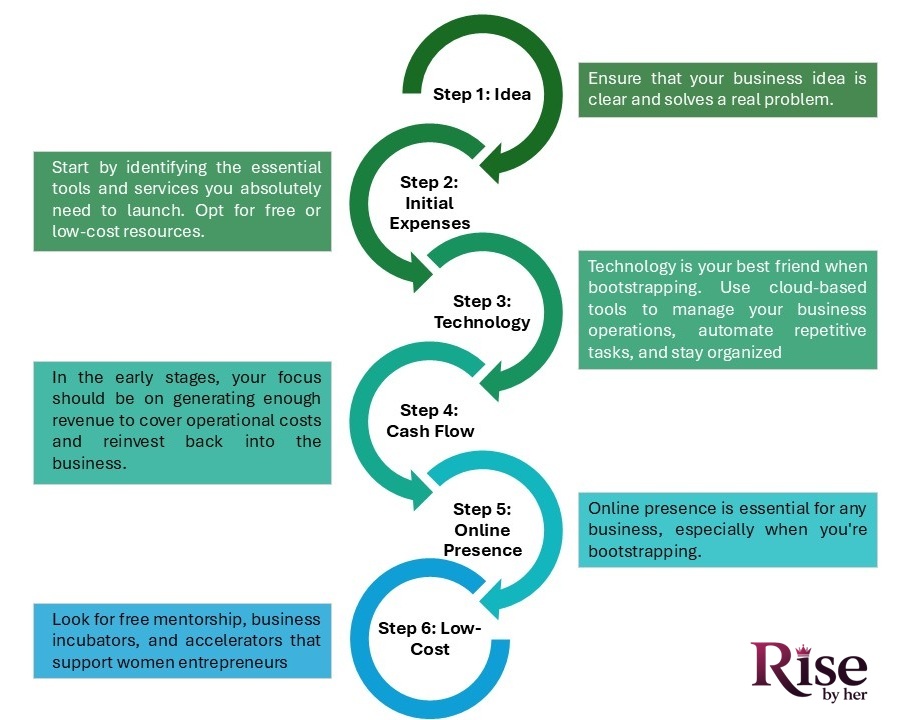

Steps to Bootstrap Your Startup in 2026: Practical Tips

Bootstrapping a startup in 2026 involves strategic planning and smart execution. Here’s a step-by-step guide on how to bootstrap your startup, with a focus on minimizing costs and maximizing growth:

Step 1: Develop a Clear Business Idea

Before diving into the operational side of things, ensure that your business idea is clear and solves a real problem. Focus on niche markets where you can offer unique value and do thorough research to validate your idea. This will save you time and money in the long run. Women entrepreneurship 2026 is about creating innovative solutions that meet market needs with minimal investment.

Step 2: Minimize Initial Expenses

One of the key bootstrapping steps is keeping your initial costs low. Start by identifying the essential tools and services you absolutely need to launch. Opt for free or low-cost resources like open-source software, remote work tools, and digital marketing strategies. Avoid spending on office space or hiring full-time staff at the beginning, this will help you save funds for reinvestment in other critical areas.

Step 3: Leverage Technology and Automation

In 2026, technology is your best friend when bootstrapping. Use cloud-based tools to manage your business operations, automate repetitive tasks, and stay organized. Platforms like QuickBooks for accounting, Trello for project management, and Mailchimp for email marketing are cost-effective and essential for streamlining your workflow. Technology will allow you to scale efficiently without significant upfront investment.

Step 4: Prioritize Cash Flow and Reinvest Profits

Managing cash flow is crucial for any bootstrapped business. In the early stages, your focus should be on generating enough revenue to cover operational costs and reinvest back into the business. Instead of drawing profits right away, keep that money within the business to fund marketing, product development, or expand your team. Prioritizing cash flow ensures long-term sustainability and growth.

Step 5: Build a Strong Online Presence

building an online presence is essential for any business, especially when you’re bootstrapping. Leverage social media and content marketing to create awareness about your product or service without spending it on traditional advertising. Use platforms like Instagram, LinkedIn, and YouTube to engage with your target audience, build your brand, and generate leads.

Step 6: Seek Low-Cost or Free Resources

As a bootstrapped entrepreneur, you need to be resourceful. Look for free mentorship, business incubators, and accelerators that support women entrepreneurs. Join online communities, attend webinars, and use free online courses to continuously develop your skills. Networking with other women entrepreneurs can also provide valuable insights and support during the bootstrapping phase.

By following these practical startup tips and focusing on cost-effective strategies, you can successfully bootstrap your business. Keep your goals focused, remain adaptable, and reinvest in growth to create a thriving, self-sustaining startup.

Common Challenges Women Entrepreneurs Face and How to Overcome Them

Starting and growing a business comes with obstacles, but women entrepreneurs often encounter additional challenges. From access to capital to work-life balance, these hurdles can be frustrating but they are not insurmountable. Here’s a look at the most common challenges for women entrepreneurs and practical ways to overcome them.

Limited Access to Capital

Many women struggle to secure startup funding due to gender biases in investment and loan approvals. Studies show that women-led businesses receive less venture capital than those led by men.

How to Overcome It:

- Explore alternative funding sources like microloans, crowdfunding, and grants designed for women entrepreneurs.

- Build strong business credit and prepare a solid business plan to improve your chances of securing loans.

- Network with women-focused investor groups and angel investors who prioritize funding female-led startups.

Work-Life Balance Struggles

Juggling the demands of running a business while managing family responsibilities can be overwhelming. Many women feel pressured to “do it all”, leading to burnout.

How to Overcome It:

- Set clear boundaries between work and personal life to avoid exhaustion.

- Use time management tools like scheduling apps to stay organized.

- Delegate tasks whenever possible so you can focus on growth.

Societal Expectations and Gender Bias

Women entrepreneurs often face skepticism about their business capabilities. In male-dominated industries, securing clients, investors, or leadership roles can be harder due to outdated gender norms.

How to Overcome It:

- Build confidence in your expertise and assert your value in professional settings.

- Seek mentors and women entrepreneur networks for guidance and support.

- Focus on results and performance, letting your success speak for itself.

Lack of Networking Opportunities

Networking plays a crucial role in business success, yet women often have fewer opportunities to connect with influential decision-makers.

How to Overcome It:

- Join women-in-business organizations and attend industry events to expand your network.

- Leverage LinkedIn and social media to connect with mentors, investors, and clients.

- Create a supportive community of like-minded entrepreneurs for collaboration and partnerships.

Scaling Business with Limited Resources

Many women entrepreneurs bootstrap their businesses, making it challenging to scale quickly without external investment.

How to Overcome It:

- Focus on reinvesting profits into business expansion rather than relying on external funding.

- Use technology and automation to streamline operations and save costs.

- Consider strategic partnerships to access new markets and resources without high expenses.

While the road to entrepreneurship comes with unique obstacles, women in business have more resources and support than ever before. By tackling these challenges for women entrepreneurs head-on and implementing strategic solutions, you can overcome obstacles in business and build a successful, sustainable venture.

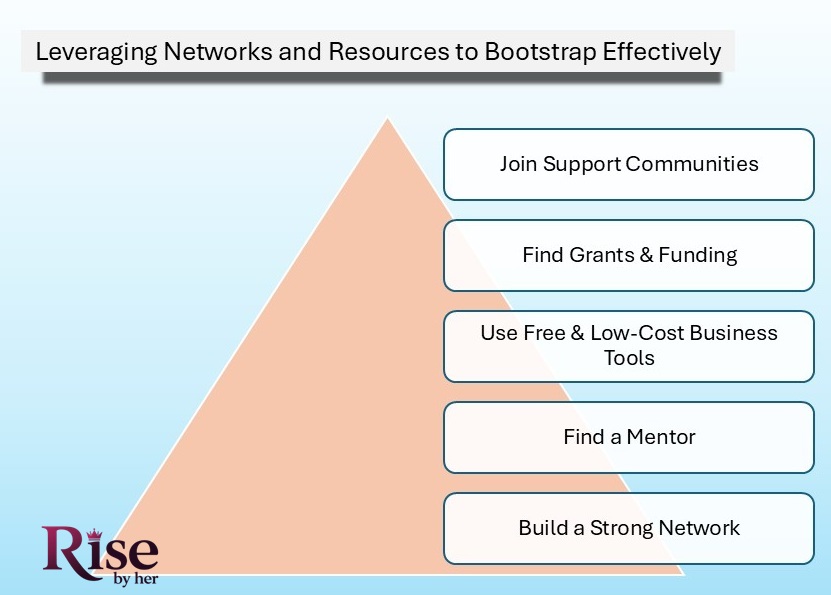

Leveraging Networks and Resources to Bootstrap Effectively

Bootstrapping doesn’t mean going alone. A strong network and the right resources can help you grow without significant investment. Here’s how to make the most of available opportunities.

Build a Strong Network

Networking opens doors to partnerships, funding, and industry insights.

- Join women entrepreneur groups like SheEO and Female Founders Collective.

- Attend startup events and webinars to expand connections.

- Use LinkedIn and Twitter to engage with industry leaders.

Find a Mentor

Mentors provide guidance and connections.

- SCORE for Women Entrepreneurs and Techstars offer mentorship programs.

- Connect with experienced founders on LinkedIn and in business incubators.

Use Free & Low-Cost Business Tools

- Accounting: Wave, QuickBooks Self-Employed

- Project Management: Trello, Asana

- Marketing: Canva, Mailchimp

Tap into Grants & Funding

Even bootstrapped businesses can benefit from non-equity grants.

- Amber Grant (monthly funding for women).

- Cartier Women’s Initiative (global support for female entrepreneurs).

- IFundWomen (crowdfunding & grants).

- See more on: Best Small Business Grants for Women Entrepreneurs

Join Support Communities

Engage with others for motivation and support.

- Facebook Groups: Women Helping Women Entrepreneurs

- Reddit: r/Entrepreneur, r/SmallBusiness

Financial Management Tips for Bootstrapped Startups

Managing finances wisely is crucial for bootstrapped startups, especially for women entrepreneurs looking to grow sustainably. Without external funding, every dollar counts. Here’s how to stay financially smart while scaling your business.

Create a Lean Budget

A well-planned budget helps control expenses and prioritize essential costs. How to Budget Effectively ?

- Separate personal and business finances with a dedicated business account.

- List fixed and variable expenses, cutting non-essential costs.

- Allocate a portion of revenue for reinvestment and future growth.

Track Every Expense

Knowing where your money goes helps prevent overspending. Best Tools for Expense Tracking?

- QuickBooks Self-Employed – Automates expense categorization.

- Wave – Free accounting software for small businesses.

- Excel or Google Sheets – Simple and customizable for tracking cash flow.

Prioritize Cash Flow Management

Positive cash flow keeps your business running smoothly. How to Improve Cash Flow?

- Offer early payment incentives to customers.

- Use subscription models or retainers for recurring revenue.

- Delay unnecessary expenses until revenue stabilizes.

Bootstrap Smart: Invest Where It Matters

Spend strategically on tools that bring the highest return. Where to Invest First?

- Marketing & Branding – Organic SEO, social media, and content marketing.

- Automation Tools – Save time on admin tasks with software.

- Essential Services – Website hosting, legal setup, and domain registration.

Plan for Long-Term Sustainability

Thinking ahead prevents financial pitfalls. How to Stay Sustainable?

- Build an emergency fund to handle unexpected costs.

- Set financial goals for 6 months, 1 year, and 3 years.

- Diversify income streams to reduce dependency on a single revenue source.

Conclusion

Bootstrapping isn’t just about starting a business with no funding—it’s about building a business on your own terms. For women entrepreneurs, this approach offers independence, financial control, and long-term sustainability.

By minimizing costs, leveraging networks, and managing finances wisely, bootstrapped startups can grow without relying on external investors. This means retaining full ownership, making strategic decisions without pressure, and scaling at a sustainable pace.

Key Takeaways:

- Financial Independence – No debts or investor obligations.

- Flexibility & Control – Grow at your own pace.

- Stronger Business Foundations – Learn essential skills in budgeting, networking, and scaling.

Bootstrapping requires patience and strategic planning, but the rewards are worth it. If you’re ready to take charge of your entrepreneurial journey, start today with the right mindset and resources; your success is in your hands!