Choosing the right business structure isn’t just a box to check when starting a company, it’s one of the most important legal and strategic decisions a woman entrepreneur can make. Your business structure determines how you’re taxed, how much personal liability you hold, the way you can raise capital, and even how investors and customers perceive your brand.

In 2026, as more women break barriers in entrepreneurship, understanding the importance of business structure becomes even more essential. Whether you’re launching a solo coaching practice, scaling an e-commerce brand, or building a tech startup with co-founders, your legal structure will shape your growth path.

For women-owned businesses, choosing the right legal foundation can also open doors to funding opportunities, tax benefits, and certifications designed to support female entrepreneurs. But making the wrong choice? That can lead to unnecessary taxes, legal vulnerability, and roadblocks to scaling.

In this guide, we’ll walk you through the best business structures for women entrepreneurs in 2026, including Sole Proprietorships, LLCs, Corporations, and Partnerships. You’ll learn how to align your business structure with your goals, what each option means for your day-to-day operations, and how to register your business step-by-step.

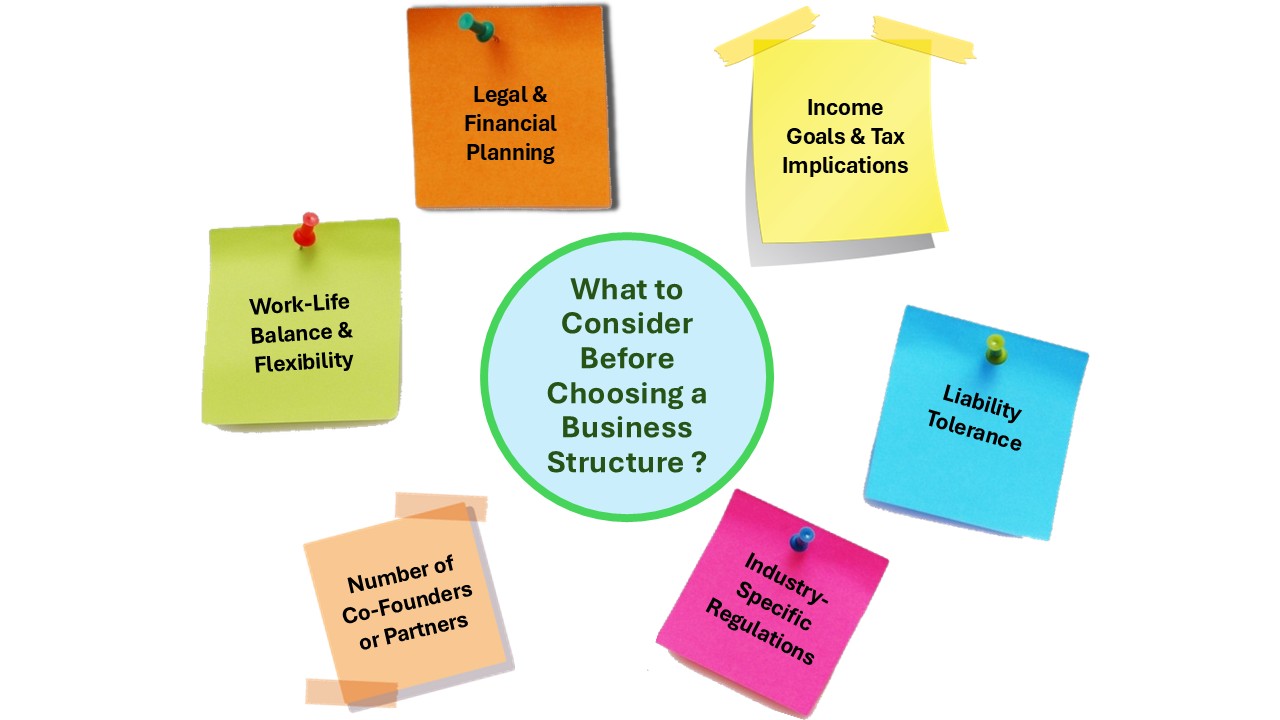

Key Factors to Evaluate Before Choosing a Business Structure

Before you decide on the right business structure, it’s essential to do a thorough business needs assessment. The structure you choose today will impact how you manage income, risk, operations, and future growth. For women entrepreneurs, choosing a business structure means balancing legal and financial protection with personal lifestyle and business ambitions.

Here are the key factors to consider before making your decision:

Income Goals & Tax Implications

One of the biggest considerations when choosing a business structure is how it will affect your taxes. If your income goals are modest and you want a simple setup, a sole proprietorship or single-member LLC may work well. But if you’re planning to grow quickly or attract investors, forming a corporation could offer tax advantages and make fundraising easier.

Quick Tip: LLCs offer tax flexibility, you can choose to be taxed as a sole proprietor, partnership, or corporation depending on your growth stage.

Liability Tolerance

How much personal risk are you willing to take on? Some business structures, like sole proprietorships and general partnerships, leave your personal assets exposed to business debts or lawsuits. Others, like LLCs and corporations, offer limited liability protection, which means your personal savings, home, or car are protected if the business runs into legal trouble.

For women entrepreneurs balancing business and personal responsibilities, liability protection provides peace of mind.

Industry-Specific Regulations

Certain industries; like healthcare, finance, legal services, or food, may have regulations that influence your choice of structure. For example, you might need a more formal setup like LLC or corporation to meet licensing requirements or secure insurance.

Do your research or consult a small business attorney to ensure your structure meets the regulatory standards in your field.

Number of Co-Founders or Partners

Are you building this business on your own, or with a partner or team? Solo entrepreneurs often find sole proprietorships or single-member LLCs more manageable. But if you have co-founders or plans to bring on partners or investors, consider forming a multi-member LLC or corporation that clearly defines roles, ownership shares, and decision-making rights.

A solid structure now can prevent future disputes and confusion.

Work-Life Balance & Flexibility

Many women entrepreneurs are drawn to entrepreneurship for work-life flexibility. If you value simplicity and minimal paperwork, a sole proprietorship or LLC may give you the control and ease you need. On the other hand, if you’re building a scalable startup with big ambitions, a corporate structure might require more administrative effort but offer greater rewards down the line.

The key is aligning your structure with your lifestyle and capacity.

Legal & Financial Planning

Think long-term. Your structure will affect your access to funding, how you file taxes, your legal obligations, and your ability to scale. For example, corporations can issue stocks, making it easier to raise venture capital. LLCs are often preferred by small business owners who want limited liability without the complexity of corporate formalities.

Don’t forget to plan for:

- How you’ll pay yourself

- Whether you’ll need outside investment

- What your exit strategy might be

Sole Proprietorship Explained: Pros, Cons, and Risk Factors

A sole proprietorship is the most straightforward business structure, perfect for women entrepreneurs just starting out, especially in service-based roles like coaches, consultants, freelancers, and solo creatives. If you’re testing your business idea or want to get up and run quickly with minimal costs and paperwork, this might be your starting point.

What Is Sole Proprietorship?

A sole proprietorship means you and your business are legally the same entity. There’s no formal registration (beyond local permits or a DBA, if needed), and all profits and losses are reported on your personal tax return. It’s a great structure for women launching side hustles, home-based businesses, or freelance services.

Pros of a Sole Proprietorship

- Easy Setup: No formal paperwork or fees (beyond a business license or fictitious name if needed).

- Full Control: You make all the decisions—no boards, no partners.

- Pass-Through Taxation: Profits are taxed only once as personal income—no corporate tax burden.

- Low Cost: No need for legal fees or ongoing compliance costs.

These perks make it an attractive first step for women-owned startups, especially in industries like life coaching, virtual assistance, writing, or digital marketing.

Cons of a Sole Proprietorship

- Unlimited Liability: You’re personally responsible for all debts, obligations, and legal issues. Your savings, home, and assets could be at risk.

- Limited Access to Funding: It’s harder to get loans or outside investment since there’s no legal distinction between you and your business.

- Lack of Business Credibility: Sole proprietorships can be seen as less “legit” than LLCs or corporations.

- No Continuity: The business ends if you retire, sell, or pass away—unless you restructure.

These risks become more significant as your income grows or if you offer higher-risk services.

Real-World Example: Starting Simple

Take Elena Davis, a wellness coach in Atlanta. She started her coaching business as a sole proprietor using just her name and a website. With minimal overhead, she built a loyal client base and quickly validated her services. After two years of growth, she transitioned to an LLC to protect her assets and expand.

Her journey is a perfect example of how women entrepreneurs can start simple and scale smart.

Limited Liability Company (LLC): Why It’s the Top Choice for Women Entrepreneurs

If there’s one business structure that consistently ranks as the go-to for women entrepreneurs in 2026, it’s the Limited Liability Company (LLC). It offers the best of both worlds: the simplicity of a sole proprietorship and the legal protection of a corporation—making it an ideal choice for women ready to grow confidently.

What Is an LLC?

A Limited Liability Company (LLC) is a formal business entity that separates your personal assets from your business liabilities. This means if your business is sued or falls into debt, your personal savings, home, or other assets are generally protected.

Whether you’re running a boutique marketing agency, launching a product line, or offering consulting services, an LLC can help you look more professional and stay legally protected.

Key LLC Benefits for Women-Owned Businesses

- Limited Liability Protection: This is the big one, you won’t be personally responsible for business debts or lawsuits (unlike a sole proprietorship).

- Flexible Tax Options: By default, profits pass through to your personal income taxes (like a sole prop), but you can also elect to be taxed as an S-corp for potential savings.

- Professional Credibility: Adding “LLC” to your business name instantly increases your business’s legitimacy in the eyes of clients, partners, and lenders.

- Flexible Ownership: You can form a single-member LLC (just you), or a multi-member LLC with co-founders or investors.

- Scalability: An LLC structure allows you to grow your team, bring on partners, or expand into new markets more easily.

Key LLC Benefits for Women-Owned Businesses

- Single-Member LLC: Great for solo founders who want liability protection without the complexity of a corporation. Perfect for coaches, designers, consultants, and other one-woman ventures.

- Multi-Member LLC: Best for startups with co-founders, collaborators, or investors. Ownership percentages and responsibilities are outlined in an operating agreement.

Real-World Example: Elevating with an LLC

Meet Jasmine Rivera, founder of a sustainable skincare brand in California. She began as a sole proprietor selling products on Etsy. Once her brand gained traction and wholesale orders started coming in, she transitioned to an LLC. Not only did she gain peace of mind from liability protection, but the LLC status also helped her qualify for a women-owned business grant and attract retail partnerships.

Corporation Structure: Best for High-Growth and Scalable Businesses

For women entrepreneurs building high-growth startups or seeking outside funding, forming a corporation, especially a C-Corp or S-Corp, offers structure and investor appeal.

What Is a corporation?

A corporation is a separate legal entity from its owners. It can:

- Own property

- Enter contracts

- Be sued (or sue)

- Raise capital by issuing stock

Because it’s an independent entity, a corporation offers the highest level of liability protection. However, it also comes with stricter compliance rules, formalities (like holding board meetings), and more paperwork than an LLC.

C-Corp vs. S-Corp: What’s the Difference?

| C-Corporation (C-Corp) | S-Corporation (S-Corp) |

| The default corporate structure in the U.S. Allows for unlimited shareholders (great for raising venture capital). Subject to double taxation: profits are taxed at the corporate level and again when distributed to shareholders. | Must meet IRS requirements (e.g., max 100 shareholders, U.S. citizens only). Avoids double taxation—profits pass through to shareholders’ personal tax returns. Good for small businesses wanting corporate benefits without the tax burden of a C-Corp. |

When Should Women Entrepreneurs Consider a corporation?

A corporation makes sense if you:

- Are building a venture-backed startup

- Plan to raise Angel Investment or Venture Capital investment

- Want to issue equity to employees (stock options)

- Are forming a nonprofit arm of your business

- Need international credibility for global partnerships

Pros & Cons of a Corporation

| Pros of a Corporation | Cons of a Corporation |

| Investor Appeal: Preferred by VC firms and angel investors. Strong Legal Protection: Owners are generally not personally liable. Stock Options: Attract top talent by offering equity. Perpetual Existence: The business can outlive its founders. | Double Taxation: Especially for C-Corps—profits taxed twice unless managed smartly. More Paperwork: Annual reports, board minutes, bylaws, and tax filings. Higher Costs: Incorporation fees, legal/accounting services, and state compliance. |

Real-World Example: A Tech Founder’s Choice

Tasha Grant, founder of a fintech platform empowering women with budgeting tools, opted for a Delaware C-Corp when she prepared for seed funding. Investors preferred the structure, and it made it easier for onboard advisors with stock options.

Partnership Businesses: What Co-Founders Need to Know

A partnership is a smart option when two or more people want to run a business together, whether it’s with a co-founder, spouse, or trusted colleague.

Types of Partnerships

- General Partnership (GP): All partners manage the business and share both profits and liabilities.

- Limited Partnership (LP): One or more partners contribute capital but have limited liability and no day-to-day control.

When Is It Good Fit?

- You’re starting with a co-founder or spouse.

- You want to combine expertise, networks, and capital.

- You’re okay with shared responsibilities and decision-making.

Pro Tip: Draft a Partnership Agreement

Avoid misunderstandings by creating a solid partnership agreement. This should include:

- Roles and responsibilities

- Profit/loss sharing

- Dispute resolution methods

- Exit strategies or buyout clauses

Tools like LegalZoom or Rocket Lawyer can help you get started or consult a small business attorney for customization.

Business Structure Comparison Chart

Choosing the right business structure can feel overwhelming, so here’s a side-by-side comparison table to help you decide quickly based on your goals, risk tolerance, and growth plans.

| Structure | Tax Treatment | Liability Protection | Setup Complexity | Scalability | Best For |

| Sole Proprietorship | Pass-through (personal tax) | No protection | Easiest | Low | Freelancers, coaches, solo founders |

| Partnership | Pass-through (personal tax) | No GPs LPs (for limited partners) | Easy | Medium | Co-founders, spouses, small joint ventures |

| LLC | Pass-through or elect corporate taxation | Yes | Moderate | Flexible | Service providers, consultants, small businesses |

| S-Corp | Pass-through with potential payroll tax savings | Yes | Moderate | Good | Growing businesses with steady profits |

| C-Corp | Double taxation (corporate + dividends) | Strong | Complex | Best for VC-backed growth | Tech startups, large-scale ventures |

Tax Responsibilities by Business Structure in 2026

Understanding how your business structure affects taxes is crucial for financial planning. Here’s a quick overview of the tax implications for each structure in 2026:

Sole Proprietorship: Simple Taxation

- Taxed: Income is reported on your personal tax return (Schedule C). Self-employment taxes (15.3%) apply.

- 2026 Update: No significant changes in taxes, but keep in mind self-employment taxes.

Partnership: Pass-Through Taxation

- Taxed: Income passes through to partners’ personal tax returns.

- 2026 Update: Partnerships qualify for the Qualified Business Income Deduction (QBI), reducing taxable income by up to 20%.

LLC: Flexible Tax Treatment

- Taxed: LLCs can choose to be taxed as a sole proprietorship, partnership, or corporation.

- 2026 Update: S-Corp election remains popular for tax savings. LLCs can take advantage of the QBI deduction.

S-Corp: Tax Advantages

- Taxed: Pass-through taxation but with payroll tax savings by paying yourself a reasonable salary.

- 2026 Update: Reasonable salary rules are strictly enforced. Profits are not subject to self-employment tax.

C-Corp: Double Taxation

- Taxed: Corporate income is taxed at 21%, and dividends are taxed again at the individual level.

- 2026 Update: The corporate tax rate remains at 21%, but double taxation is a disadvantage for small businesses.

Tax Benefits for Women-Owned Businesses in 2026

- WOSB Certification: Women entrepreneurs may qualify for tax credits or grants under the Women-Owned Small Business (WOSB) program.

- QBI Deduction: Up to 20% deduction for eligible businesses like partnerships or S-Corps.

- State Incentives: Some states offer tax benefits for women-owned businesses, including lower tax rates and credits for hiring diverse teams.

Step-by-Step Guide to Registering Your Business in 2026

Starting your business involves legal steps to ensure it is officially recognized and compliant. Here’s a step-by-step guide to registering your business:

Choose Your Business Structure

Before registering, decide on the structure that best suits your needs (Sole Proprietorship, LLC, Corporation, etc.). Your business type affects tax, liability, and legal requirements. Refer to the earlier sections for detailed insights into each structure.

Choose Your Business Name

- Ensure the name is unique and aligns with your brand.

- Check for trademarks using the United States Patent and Trademark Office (USPTO) database.

- Verify name availability with your state’s Secretary of State.

Register with State and Local Authorities

- Sole Proprietorship: Register your business name (if it’s different from your legal name) with your local county office or state agency.

- LLC or Corporation: File articles of incorporation or organization with your state’s Secretary of State office. You’ll need to include your business name, address, and type of structure.

- For LLC: Submit Articles of Organization.

- For Corporation: Submit Articles of Incorporation.

- Partnership: File a Partnership Agreement and may need to register with the state, depending on your location.

Apply for an Employer Identification Number (EIN)

- EIN: Required for most businesses except sole proprietorships without employees. Apply through the IRS website for free.

- For LLCs, Corporations, and Partnerships, EIN is mandatory for tax reporting, opening business bank accounts, and hiring employees.

Register for State Taxes

Depending on your location and business type, you may need to register for state-specific taxes such as:

- Sales tax (if you sell goods).

- Unemployment insurance tax (if you have employees).

- State income tax (if applicable).

Obtain Necessary Licenses & Permits

- General Business License: Check with your city or county for a business license to operate legally.

- Industry-Specific Licenses: Depending on your business (e.g., food, health, education), you may need additional permits.

- Example: A restaurant may need health department approval and a food handling license.

Comply with Zoning Laws

If you plan to operate from a physical location, check zoning laws to ensure your business can legally operate in the area.

Set Up Business Finances

- Open a separate business bank account to manage finances.

- Consider setting up accounting software (e.g., QuickBooks, Xero) to track expenses and income.

Familiarize Yourself with Compliance Requirements

- Stay on top of annual filing requirements, tax deadlines, and other ongoing legal obligations for your specific business structure.

- Corporations and LLCs may need to file annual reports and maintain registered agents.

Common Mistakes to Avoid

- Not Registering Properly: Failing to register your business correctly with local, state, or federal authorities could lead to penalties or legal issues.

- Neglecting Permits: Operating without the necessary permits can result in fines or business shutdown.

- Not Protecting Your Brand: Failing to trademark your business name or logo might leave you vulnerable to infringement.

- Ignoring Taxes: Not registering for the correct tax accounts can lead to penalties and interest in unpaid taxes.

How to Choose the Best Business Structure for Your Goals

Your business structure is not just a legal requirement, it’s the foundation upon which your entrepreneurial journey will thrive. Take the time to assess your needs, consult experts if necessary, and choose the structure that aligns with your goals. Remember, your business’s future success depends on the choices you make today.

Have questions about your business structure? Let’s discuss in the comments! Whether you’re just starting out or looking to pivot, I’m here to help you navigate the best options for your growth.

Explore more Guides on: