Introduction: The Importance of Financial Independence for Women

Looking for a trusted financial advisor who understands women’s unique financial needs? This 2026 guide highlights the best female financial advisors dedicated to empowering women to take control of their money; from budgeting to retirement planning and long-term wealth building. Whether you’re just starting out or looking to grow your assets, these advisors offer expert guidance tailored for women. Scroll down to discover their key strengths, specialties, and how to choose the right advisor for your goals.

Why Women Benefit from Working With Female Financial Advisors

Choosing the right financial advisor is a key step toward financial independence and for many women, working with a female financial advisor offers unique advantages. Female advisors often bring a deeper understanding of the financial challenges women face, such as career interruptions, pay gaps, and longer life expectancy.

What sets female financial advisors apart is their ability to relate through shared experiences. This often translates into a more personalized, empathetic approach to money management. Women may feel more comfortable discussing sensitive topics like budgeting, debt, or planning for single retirement with someone who truly gets it.

Female financial advisors can also serve as inspiring role models, empowering clients not only with financial knowledge but with confidence and support. Their guidance often extends beyond numbers, helping women align their financial decisions with personal values and life goals.

For women looking to take control of their finances, partnering with a female advisor can be a game-changer.

Top Female Financial Advisors to Follow in 2026

In 2026, numerous female financial advisors are making significant strides in the wealth management sector. Their expertise, leadership, and commitment to client success have earned them recognition on prestigious platforms like Forbes and SHOOK Research. Here are some standout professionals leading the way:

Dalal Salomon

Founder and CEO of Salomon & Ludwin, Dalal has been named among Forbes’ 2026 America’s Top Women Wealth Advisors. With decades of experience, she specializes in comprehensive wealth management, guiding clients through complex financial landscapes with personalized strategies.

Anh Tran, CFP

As a Managing Partner at SageMint Wealth, Anh has been recognized as one of Forbes’ Best-In-State Women Wealth Advisors. Her approach combines financial planning with a deep understanding of her clients’ unique goals, fostering long-term financial health.

Jessica Gibbs, CFP and Emily Harper, CFP

Both serving as advisors at Monument Wealth Management, Jessica and Emily have been ranked among Virginia’s 2026 Top Women Wealth Advisors by Forbes. Their collaborative approach emphasizes tailored financial solutions and client education.

Ami Aranha, CFP, JD

A Director of Wealth Management at Aspiriant, Ami has been honored in Forbes’ 2026 Top Women Wealth Advisors list. Her dual expertise in law and finance allows her to navigate complex financial situations with precision.

Sandi Bragar, CFP

As Chief Client Officer at Aspiriant, Sandi’s leadership and client-centric approach have earned her a spot among Forbes’ top advisors. She focuses on aligning financial strategies with clients’ personal values and life goals.

Lisa Colletti, CFP, JD

Managing Director in the Exclusive Family Office at Aspiriant, Lisa combines legal acumen with financial expertise to serve high-net-worth families, earning her recognition in Forbes’ 2025 rankings.

Helen Dietz, CFP

As a Managing Director in Total Wealth Management at Aspiriant, Helen’s commitment to personalized financial planning has placed her among the top advisors in Forbes’ 2025 list.

Theresa Donatelli

A distinguished advisor at Principal Wealth Partners, Theresa has been honored as a 2025 Forbes Top Women Wealth Advisor Best-In-State for the second consecutive year, reflecting her dedication to client success.

Mary Callahan Erdoes

As CEO of J.P. Morgan Asset & Wealth Management, Mary oversees over $4 trillion in client assets. Her leadership has solidified her reputation as one of the most powerful women in American finance.

Sallie Krawcheck

Formerly the head of Bank of America’s Global Wealth and Investment Management division, Sallie is now the CEO and co-founder of Ellevest, a digital financial advisor for women. Her mission is to close the gender investment gap and empower women financially. These accomplished women exemplify excellence in financial advising, offering personalized strategies and empathetic guidance to help clients achieve financial independence.

How to Choose the Right Financial Advisor as a Woman

Selecting a financial advisor is one of the most important steps toward achieving financial independence. But finding the right advisor, someone who truly understands your financial goals and life priorities, makes all the difference.

Here’s what to consider when choosing a female financial advisor:

- Experience and Credentials: Look for certified professionals (such as CFP®, CPA, or CFA) with a solid track record in financial planning, investments, or retirement strategies.

- Specialization: Choose an advisor who specializes in areas aligned with your goals, like debt reduction, wealth building, or retirement planning.

- Communication Style: A good advisor should make you feel heard, respected, and confident. Schedule an initial consultation to assess compatibility.

- Reputation and Reviews: Explore client testimonials, professional recognitions (like Forbes’ Top Women Wealth Advisors), or referrals from other women.

- Fee Structure: Understand how your advisor is compensated, flat fee, commission-based, or a percentage of assets so you know what you’re paying for.

Pro Tip: Don’t hesitate to interview more than one advisor. Finding someone you trust and connect with on a personal level is key to a successful long-term partnership.

How Female Financial Advisors Guide Women Toward Financial Independence

Financial independence is more than just having money in the bank, it’s about having control over your life and making decisions without financial stress. A skilled financial advisor can be your guide on this journey.

Here’s how financial advisors help women reach independence:

- Goal-Oriented Planning: Whether you’re saving for your child’s education, buying your first home, or planning early retirement, a financial advisor helps create a roadmap tailored to your goals.

- Budgeting and Cash Flow Management: Advisors assist in creating realistic budgets, tracking spending, and ensuring your income supports both short- and long-term objectives.

- Debt Strategy: From consolidating high-interest loans to paying off credit cards strategically, advisors help manage and eliminate debt efficiently.

- Investment Guidance: Financial advisors can recommend investment strategies based on your risk tolerance and timeline, helping your money grow over time.

- Tax Optimization: They help minimize tax liabilities through smart investment and savings strategies, leaving more money in your pocket.

With the right financial advisor, you don’t just save money, you grow it with purpose and direction.

Women’s Unique Financial Challenges and How Female Advisors Help Overcome Them

Women often face distinct financial challenges that can impact their ability to build wealth and plan for the future. Female financial advisors, having often navigated these same challenges themselves, are uniquely positioned to offer empathetic, effective solutions.

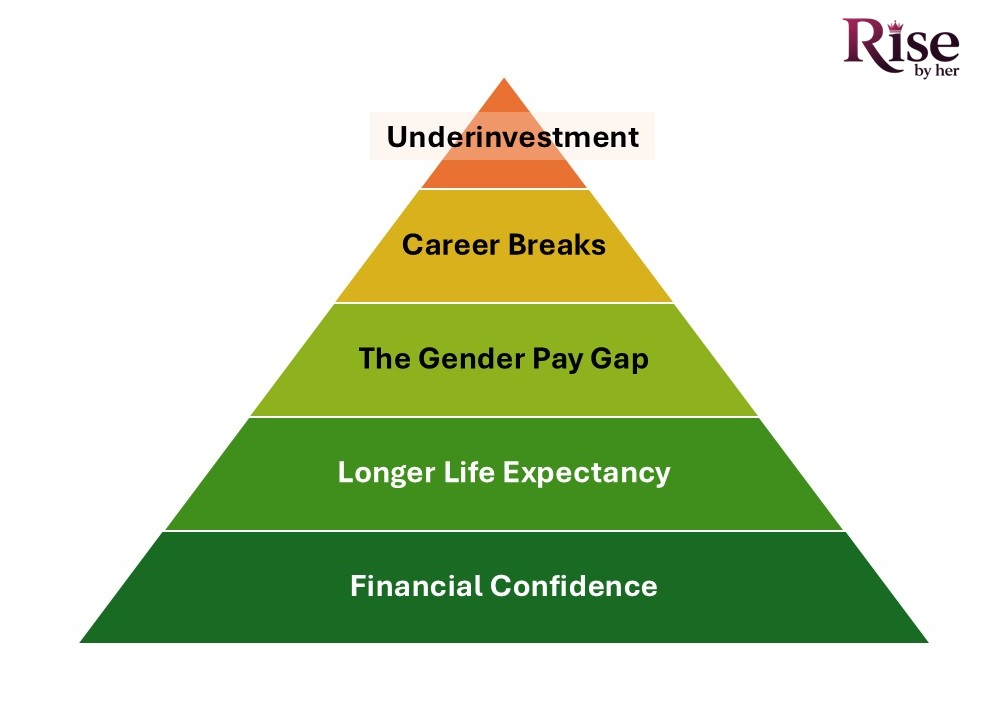

Here are a few common challenges and how advisors help address them:

- The Gender Pay Gap: Women still earn less on average than men, affecting their ability to save and invest. Advisors can create income-based saving plans and help optimize cash flow to maximize every dollar.

- Career Breaks: Many women take time off for caregiving, which can affect retirement savings and career progression. Advisors help plan these breaks and recover lost savings.

- Longer Life Expectancy: Women tend to live longer than men, which means needing more retirement funds. Advisors help structure long-term plans that ensure financial security into your 80s and beyond.

- Underinvestment: Studies show women are less likely to invest aggressively, often missing out on growth opportunities. A trusted advisor builds confidence through education and collaborative decision-making.

- Financial Confidence: Many women report feeling less confident about their financial knowledge. Female advisors can close this gap by breaking down complex topics in an approachable, empowering way.

A female financial advisor who understands these challenges firsthand can offer practical, relatable advice helping you build a plan that works for your unique life path.

The Future of Female Financial Advisors and Why Their Role Is Growing in 2026

The finance world is changing, and more women are stepping into leadership roles as financial advisors. This shift is helping to create a more inclusive and balanced industry that better serves all clients, especially women.

Why It Matters

Women often prefer working with advisors who understand their financial experiences. Female financial advisors bring empathy, clear communication, and a more personal approach to money management, which many clients value.

Key Trends to Watch

- Higher Demand for Women Advisors: More women are seeking advisors who understand their goals and challenges.

- Mentorship and Support Programs: Initiatives like Women in Wealth and the CFP Board’s WIN program are opening doors for women in finance.

- Work-Life Balance: Remote work and flexible schedules are making financial careers more accessible for women.

- Client Preferences Are Evolving: Clients are choosing advisors who offer transparency, emotional intelligence, and shared values.

- Diversity Initiatives: Financial firms are prioritizing inclusion and recruiting more women into the field.

Looking Ahead

With more educational opportunities and growing support, the future looks bright for female financial advisors. Encouraging more women to join the profession doesn’t just change the industry, it ensures that women everywhere have access to advice they can trust.

Our Mission: Empowering Women to Build Wealth and Achieve Financial Independence

Our mission is to make financial empowerment accessible to every woman, no matter her background, income level, or stage of life. Many women face financial challenges that are often overlooked, from wage gaps to caregiving responsibilities, and many still lack access to guidance they can truly trust. We are committed to breaking these barriers by connecting women to skilled female financial advisors who understand their goals, their concerns, and their long-term vision.

We aim to provide clear, practical information that helps women make confident financial decisions. By highlighting top female advisors, sharing expert insights, and offering resources that inspire action, we want every woman to feel equipped to take control of her financial life.

Financial independence is not just a destination. It is a mindset, a daily commitment, and a powerful step toward a secure and fulfilling future. Our mission is to support you at every step and help you build the financial freedom you deserve.

Conclusion: Taking the First Step Toward Financial Independence

Achieving financial independence starts with one small, intentional step. For many women, that step is finding a financial advisor who understands their goals, values, and unique challenges. Whether you are just beginning your financial journey or looking to build on what you have already accomplished, the right guidance can make all the difference.

Taking control of your finances means gaining the freedom to make choices that align with your dreams, whether that is starting a business, retiring comfortably, or building a legacy for your family.

Now is the time to take action.

Explore our recommended resources, book a free consultation, or dive into our financial literacy library to start building your future today. Your journey toward financial independence begins now.