Women entrepreneurs are on the rise, contributing significantly to the global economy. However, accessing funding remains a significant challenge. Studies show that women-led startups receive considerably less investment than male-led businesses. In this article, we will explore different funding options for women entrepreneurs, highlight real statistics on funding gaps, and provide actionable resources to help women secure financial support for their businesses.

The Gender Funding Gap: Real Numbers and Statistics

Despite making up a growing share of business owners, women entrepreneurs continue to face barriers in accessing capital. Here are some striking statistics:

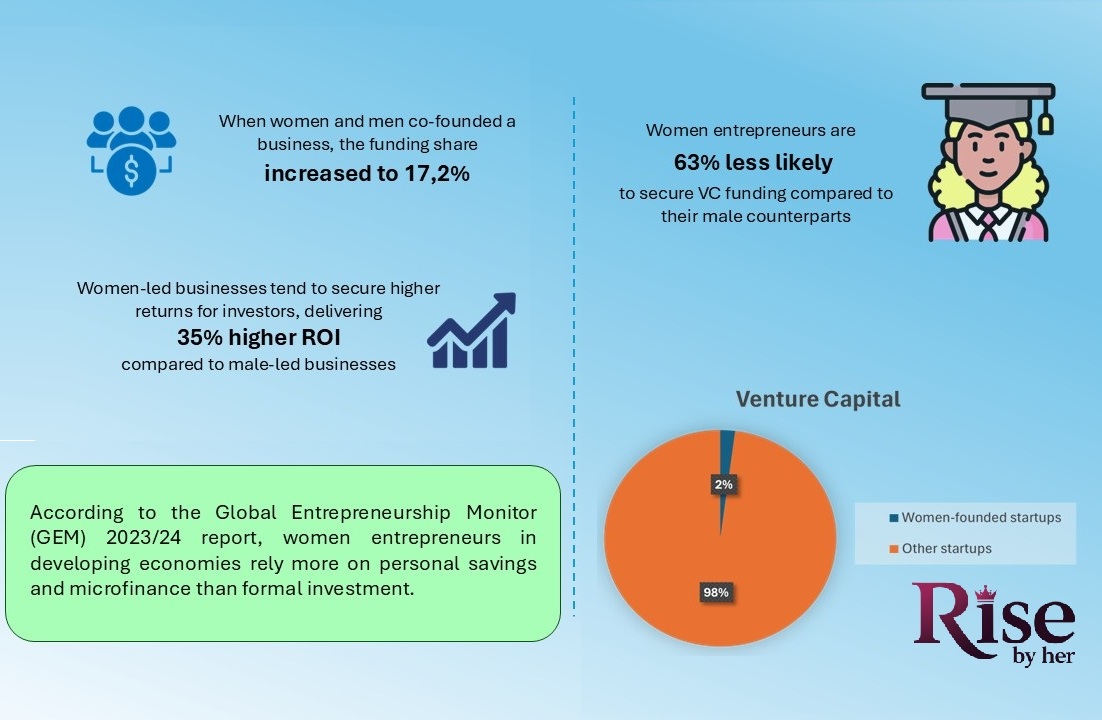

- Women-founded startups received just 2.1% of total venture capital (VC) funding in 2023 (WeForum, 2024).

- When women and men co-founded a business, the funding share increased to 17.2% (Pitch, 2023).

- Women entrepreneurs are 63% less likely to secure VC funding compared to their male counterparts (Heritage wealth, 2024).

- According to the Global Entrepreneurship Monitor (GEM) 2023/24 report, women entrepreneurs in developing economies rely more on personal savings and microfinance than formal investment.

- Women-led businesses tend to secure higher returns for investors, delivering 35% higher ROI compared to male-led businesses (Forbes, 2019).

These numbers highlight the systemic challenges women face in securing funding, emphasizing the need for targeted support and alternative financing options.

Funding Options for Women Entrepreneurs

1. Venture Capital and Angel Investors

While Venture Capital firms are a primary funding source for startups, they have historically overlooked women entrepreneurs. However, several female-focused VC firms and Angel Investor networks are addressing this gap, including:

- Female Founders Fund – Invests in women-led businesses in technology, healthcare, and consumer sectors.

- Golden Seeds – A national investment firm focused on female entrepreneurs.

- Astia Angels – A network of investors supporting women-led high-growth ventures.

- BBG Ventures – An early-stage fund investing in women-led startups.

- Pipeline Angels – A network of women investors funding female-led startups.

- Halogen Ventures – Focuses on early-stage, women-led consumer technology businesses.

- Portfolia – A venture capital firm investing in companies serving women’s markets.

2. Government Grants and Loans

When exploring ways to fund your business or personal projects, understanding government grants and loans for small businesses and entrepreneurs can open doors to financial support without the heavy burden of interest rates. These programs are designed to help women entrepreneurs, startups, and growing businesses access funding to expand operations, launch new initiatives, or cover essential expenses. Knowing the types of government grants and loans available for business growth can give you a strategic advantage, helping you make informed decisions and secure the resources you need to succeed.

- Small Business Administration (SBA) Women-Owned Business Federal Contracting Program (USA) – Helps women secure federal contracts.

- Innovate UK Women in Innovation Awards (UK) – Provides funding and mentoring for women entrepreneurs.

- IFC Banking on Women (Global) – Offers financial support to women-led enterprises in emerging markets.

- Canada’s Women Entrepreneurship Strategy (WES) – Invests $6 billion in women-owned businesses.

- European Investment Bank (EIB) SheInvest Initiative – Supports female entrepreneurs in Africa and Europe.

- Australia’s Boosting Female Founders Initiative – Provides grants to early-stage, women-led startups.

3. Crowfunding

Crowdfunding platforms allow entrepreneurs to raise money from a large number of investors or donors. Women tend to perform well on crowdfunding sites due to strong community engagement. Notable platforms include:

- Kickstarter – Great for creative and tech startups.

- Indiegogo – A platform supporting female entrepreneurs in multiple industries.

- IFundWomen – A crowdfunding and coaching platform specifically for women-led businesses.

- GoFundMe – A flexible crowdfunding platform suitable for businesses and personal ventures.

- Crowdfunder – Helps entrepreneurs connect with equity investors.

4. Microfinance and Peer-to-Peer Lending

For entrepreneurs and small business owners, microfinance and peer-to-peer lending for startups and small businesses offer flexible funding options beyond traditional banks. These platforms make it easier for women entrepreneurs and growing businesses to access small loans or crowdfunding opportunities to launch projects, manage cash flow, or scale operations. Understanding how microfinance programs and peer-to-peer lending platforms work can help you choose the best option to secure funding quickly and efficiently.

- Kiva – Offers 0% interest microloans for women entrepreneurs globally.

- Grameen America – Provides microloans to low-income women in the U.S.

- SheEO – A global community of women funding women-owned ventures.

- Accion – A nonprofit microfinance network that offers small business loans.

- LendHer Capital – A lending platform specifically for women entrepreneurs.

5. Corporate and Nonprofit Grants

Corporate and nonprofit grants for small businesses and women entrepreneurs provide valuable funding opportunities for projects, innovation, and community initiatives. Many companies and nonprofit organizations offer grants specifically designed to support startups, female-led businesses, and social impact ventures. Learning about the types of corporate and nonprofit grants available can help you identify funding sources that align with your goals and increase your chances of securing financial support.

- Cartier Women’s Initiative – Offers up to $100,000 in grants to women-led businesses.

- Visa’s She’s Next Grant Program – Provides funding and mentorship to female entrepreneurs.

- Tory Burch Foundation – Provides capital, mentorship, and networking opportunities.

- Amber Grant – Awards $10,000 monthly to female entrepreneurs in the U.S.

- The Women Founders Network Fast Pitch Competition – Provides funding and resources to women-led startups.

- The Eileen Fisher Women-Owned Business Grant – Grants for women-owned businesses focused on sustainability.

How to Improve Your Chances of Getting Funded

Knowing how to improve your chances of getting funded for small businesses and startups can make a significant difference in securing financial support. By learning strategies for women entrepreneurs and business owners to successfully apply for grants, loans, and alternative funding, you can increase your likelihood of approval. Understanding tips and best practices for funding applications ensures your business stands out and attracts the investment or support it needs to grow.

To secure funding successfully, women entrepreneurs should consider the following strategies:

- Build a Strong Business Plan – Investors look for a solid business model, revenue projections, and scalability.

- Network with Other Female Entrepreneurs – Join women-led business communities like Women’s Business Enterprise National Council (WBENC).

- Leverage Digital Platforms – Use LinkedIn, AngelList, and startup networking events to connect with potential investors.

- Prepare a Compelling Pitch – Storytelling and a well-prepared pitch deck can make a huge difference.

- Apply for Multiple Funding Sources – Diversify funding opportunities across grants, loans, and investment firms.

Useful Resources for Women Entrepreneurs

Here are some websites where women entrepreneurs can find funding opportunities and business support:

- IFundWomen – https://www.ifundwomen.com

- National Association of Women Business Owners (NAWBO) – https://www.nawbo.org

- Cartier Women’s Initiative – https://www.cartierwomensinitiative.com

- Small Business Administration (SBA) Women’s Business Centers – https://www.sba.gov

- Female Founders Fund – https://www.femalefoundersfund.com

- SheEO – https://sheeo.world

- Halogen Ventures – https://halogenvc.com

Conclusion: Take Action and Secure Your Funding Today!

Women entrepreneurs continue to break barriers, yet accessing funding remains a significant challenge. However, the landscape is evolving, with more venture capital firms, government initiatives, crowdfunding platforms, and microfinance programs designed to support women-led businesses. The key to success lies in strategic networking, leveraging the right funding opportunities, and mastering the art of a compelling business pitch.

Now it’s your turn!

- Have you faced challenges in securing funding? Share your experience in the comments!

- Looking for personalized funding opportunities? Stay tuned for more resources and expert advice on our blog.

- Don’t miss out—subscribe to our newsletter for the latest funding updates, success stories, and business growth strategies for women entrepreneurs.

Your journey to financial empowerment starts here. Let’s build and grow together!

References

- How to Write a Business Plan for Women Entrepreneurs That Gets Funded?

- Top Grants for Women in STEM Fields (How to Apply & Get Funded)

- How Women Entrepreneurs Can Get Funding: Top Strategies for Success

- Exclusive 2025 Scholarships & Grants for Women in STEM

- Forbes (2019). 10 Stats That Build The Case For Investing In Women-Led Startups. Retrieved from https://www.forbes.com/sites/allysonkapin/2019/01/28/10-stats-that-build-the-case-for-investing-in-women-led-startups/

- WeForum (2024). Women founders and venture capital – some 2023 snapshots. Retrieved from https://www.weforum.org/stories/2024/03/women-startups-vc-funding/

- Pitch (2023). How female founders can thrive in a funding downturn. Retrieved from https://pitch.com/blog/how-female-founders-can-thrive-in-a-funding-downturn

- Heritage wealth (2024). Top Challenges Women Entrepreneurs Face When Starting A Small Business. Retrieved from https://www.heritagewealth.net/blog/top-challenges-women-entrepreneurs-face-when-starting-a-small-business/