Why Angel Investors Are Key for Women-Led Startups

Struggling to fund your startup? Angel investors could be the game-changer you need.

Women-led startups often face more challenges securing capital compared to their male counterparts. According to Crunchbase, in 2023, startups founded solely by women received less than 3% of total venture capital funding, highlighting the urgent need for alternative financing options.

Why Angel Investment Matters for Women Entrepreneurs

Unlike traditional loans or venture capital, angel investors provide early-stage funding, mentorship, and industry connections—without requiring immediate repayment. This makes angel funding a powerful tool for women entrepreneurs looking to scale without giving up too much control.

Common Funding Challenges for Women Entrepreneurs

- Gender Bias in Funding: Many women founders struggle to gain the same financial trust as men.

- Limited Access to Investor Networks: Women often lack the same industry connections as male entrepreneurs.

- Risk Aversion in Pitching: Studies show women tend to ask for less funding than men, impacting their ability to secure larger investments.

Want to overcome these challenges and attract the right angel investor?

Let’s dive into the steps to help you secure funding in 2025!

Understanding Angel Investors: Who They Are & What They Look For

Wondering what angel investors look for in a startup? Here’s how to stand out and secure funding.

Who Are Angel Investors?

Angel investors are high-net-worth individuals who invest in early-stage startups in exchange for equity. Unlike venture capitalists (VCs), who manage pooled funds, angels use their own money and often provide mentorship, industry connections, and strategic advice.

How Angel Investors Differ from Venture Capitalists (VCs)

| Factor | Angel Investors | Venture Capitalists (VCs) |

| Funding Source | Personal wealth | Managed investment funds |

| Investment Stage | Early-stage startups | Growth-stage & scaling startups |

| Involvement | Hands-on mentorship | High-level strategic guidance |

| Risk Appetite | Higher risk, long-term returns | Moderate risk, scalable returns |

What Angel Investors Look for in Startups

- Market Potential: Is there strong demand and growth opportunity?

- Traction & Revenue Model: Are there early customers, sales, or proof of concept?

- Founder Credibility: Do you have the skills, experience, and vision to lead the business?

- Scalability: Can the business grow rapidly and generate high returns?

Successful Women-Led Startups Funded by Angel Investors

- Rent the Runway: Early-stage funding from angels helped scale the fashion rental platform.

- The Muse: A career platform founded by Kathryn Minshew, backed by angel investors.

- Glossier: Emily Weiss secured angel funding before growing into a beauty giant.

Want to attract the right angel investor? Let’s explore how to craft the perfect pitch!

Preparing Your Startup for Angel Investment

Want to attract angel investors? Here’s how to make your startup investment ready!

Build a Strong Business Model & Market Validation

Before approaching angel investors, ensure your startup has a solid foundation:

- Clear Value Proposition: What problem does your business solve?

- Market Validation: Do you have customer interest, pre-orders, or initial sales?

- Competitive Edge: How does your startup stand out in the market?

- Pro Tip: Conduct surveys, run pilot programs, and gather testimonials to showcase demand.

Have a Clear Revenue Strategy & Show Traction

Angel investors want to see how your startup will generate profit and grow sustainably:

- Revenue Model: Subscription, one-time sales, freemium-to-premium?

- Traction Metrics: Active users, sales growth, customer retention rates.

- Financial Projections: Where will your revenue be in 6-12 months?

- Use tools like Google Analytics, Stripe, and QuickBooks to track performance.

Ensure Legal Readiness & Financial Transparency

Investors need legal security before funding a startup:

- Business Registration: LLC, Corporation, or Sole Proprietorship?

- Equity Structure: Who owns what? Have a cap table ready.

- Financial Reports: Profit & Loss (P&L), balance sheets, cash flow statements.

- Pro Tip: Use legal platforms like LegalZoom, Clerky, or Stripe Atlas to formalize business structures.

With these foundations, you’re ready to pitch and impress angel investors! Next, let’s craft the perfect pitch.

Crafting a Winning Pitch for Angel Investors

Want to impress angel investors and secure funding? A compelling pitch is your key to success!

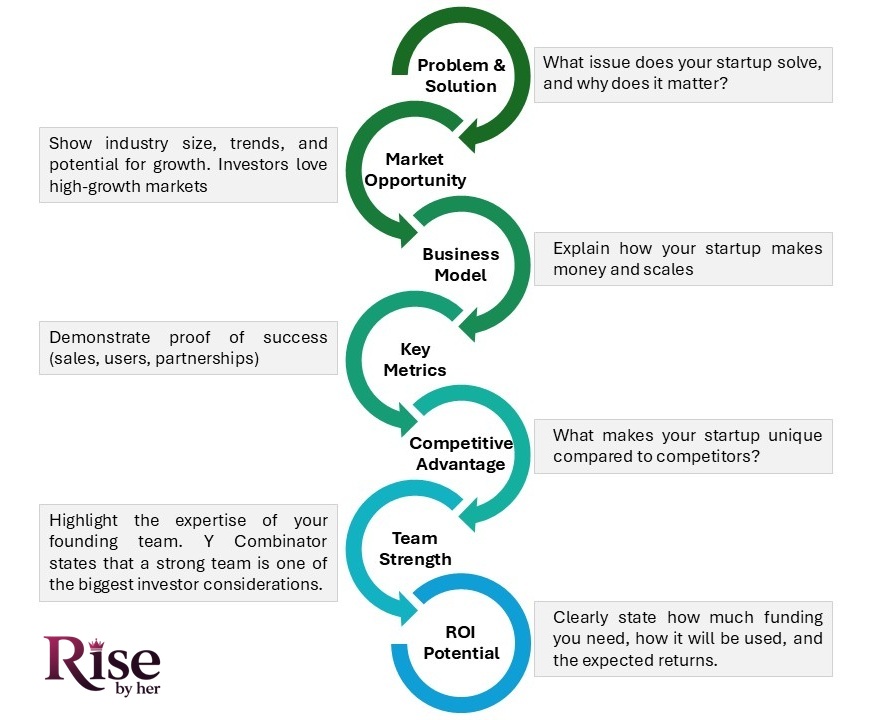

Essential Elements of a Strong Startup Pitch

Angel investors hear hundreds of pitches yours needs to stand out by being clear, data-driven, and opportunity-focused. Here’s what your pitch should include:

- Problem & Solution: What issue does your startup solve, and why does it matter?

- Market Opportunity: Show industry size, trends, and potential for growth. Investors love high-growth markets (CB Insights ranks this as a top reason investors fund startups).

- Business Model & Revenue Strategy: Explain how your startup makes money and scales.

- Traction & Key Metrics: Demonstrate proof of success (sales, users, partnerships).

- Competitive Advantage: What makes your startup unique compared to competitors?

- Team Strength: Highlight the expertise of your founding team. Y Combinator states that a strong team is one of the biggest investor considerations.

- Investment Ask & ROI Potential: Clearly state how much funding you need, how it will be used, and the expected returns.

Best Practices for Pitching to Angel Investors

- Keep It Concise: Your pitch should be 10-15 slides max (according to Sequoia Capital’s pitch deck guide).

- Tell a Story: Make an emotional connection by presenting a real-world problem and solution.

- Use Data, Not Just Hype: Investors want numbers: Market size, CAC (customer acquisition cost), LTV (lifetime value).

- Showcase Exit Strategy: Investors want to know how they’ll make a return (IPO, acquisition, etc.).

Free Tools to Design an Investor-Ready Pitch Deck

- Canva: User-friendly templates for professional pitch decks.

- Slidebean: AI-powered pitch deck generator with investor-friendly templates.

- Visme: Great for creating data-driven, visually appealing presentations.

With a well-crafted pitch, you’ll boost your chances of securing angel investment. Next, let’s explore where to find the right investors!

Where to Find Angel Investors for Women-Led Startups

Looking for angel investors to fund your startup? Here’s where to find the right investors who support women entrepreneurs.

Top Angel Investor Platforms for Women-Led Startups

These platforms connect startups with angel investors actively funding women entrepreneurs:

- AngelList: One of the largest platforms to find and pitch to angel investors globally.

- Golden Seeds: A premier investment network focused on women-led startups.

- 37 Angels: A network of female investors funding diverse, high-growth startups.

- Pipeline Angels: A network investing in women and non-binary entrepreneurs.

Industry-Specific Angel Networks

Certain angel networks specialize in funding startups in specific industries:

- Tech Startups → Tech Coast Angels

- Healthcare & Biotech → Life Science Angels

- Sustainability & Green Businesses → Elemental Excelerator

Networking Strategies to Connect with Angel Investors

- Attend Startup & Investment Events: TechCrunch Disrupt, Women’s Startup Lab, SheEO Summits.

- Leverage LinkedIn Outreach: Search for angel investors, engage with their content, and send personalized messages.

- Join Startup Incubators & Accelerators: Programs like Y Combinator, Seedcamp, and Female Founders Alliance provide investor connections.

Finding the right angel investors requires strategy, persistence, and leveraging the right platforms. Ready to approach investors? Next, let’s talk about negotiating a successful deal!

Navigating the Funding Process: From Interest to Investment

Got an angel investor interested in your startup? Here’s how to move from initial talks to securing funding.

Key Steps to Close an Angel Investment Deal

- Initial Meeting & Pitch: First impressions matter. Clearly present your business model, traction, and financials. Be prepared to answer tough questions.

- Due Diligence Process: Investors will assess your business viability. Expect a deep dive into financial statements, legal documents, market potential, and team background.

- Negotiation & Valuation: Be clear on your startup’s worth. Key negotiation points include equity stake, investor rights, and exit strategy. Pro Tip: Use valuation tools like Equidam or AngelList Valuation Calculator for fair estimates.

- Funding Agreement & Legal Documents: Secure the investment through a term sheet outlining ownership structure, voting rights, and investor expectations. Essential documents: SAFE (Simple Agreement for Future Equity), Convertible Notes, or Equity Agreements.

Common Red Flags That Scare Angel Investors

- Unclear Revenue Model: Investors want to see a clear path to profitability.

- Lack of Financial Transparency: Inaccurate or missing financial records can break a deal.

- Weak Founder Commitment: Investors look for full-time dedication and resilience.

How to Maintain Strong Investor Relationships

- Regular Updates: Keep investors informed with quarterly reports and milestone achievements.

- Leverage Their Expertise: Many angels are experienced entrepreneurs. Seek advice and mentorship.

- Align Long-Term Goals: Ensure you and your investor share the same vision for growth and exit strategies.

Successfully closing an angel investment deal is just the beginning. Next up, learn how to maximize investor support to scale your startup!

Grants & Alternative Funding Options for Women Entrepreneurs

Want funding without giving up equity? Explore grants and alternative financing options to fuel your startup growth.

Best Grants for Women-Owned Businesses

- Amber Grant: $10,000 monthly grants for women entrepreneurs, plus a $25,000 annual grant. (Apply at: ambergrantsforwomen.com)

- Cartier Women’s Initiative: Supports impact-driven women founders with funding and mentorship.

- Fearless Strivers Grant: Focuses on Black women-owned businesses, offering capital and resources.

- See more on this article: Best Small Business Grants for Women Entrepreneurs in 2025 (How to Apply)

Pro Tip: Check out Grants.gov for government-backed grants and funding programs.

Crowdfunding Platforms for Women Entrepreneurs

- IFundWomen: A top crowdfunding platform specifically for women-led startups. Offers coaching and grants alongside funding campaigns.

- Kiva: Provides 0% interest microloans up to $15,000 with community-backed lending.

- Kickstarter & Indiegogo: Best for product-based businesses looking for pre-sales funding.

- See more Crowdfunding Platforms: 10 Best Crowdfunding Platforms for Women Entrepreneurs in 2025

Success Tip: Create a compelling campaign with a strong story, clear goals, and engaging visuals to attract backers.

Government-Backed & Alternative Financing Options

- Small Business Administration (SBA) Loans: Low-interest loans available for women entrepreneurs in the U.S.

- Microloans & Peer Lending: Platforms like Accion Opportunity Fund and SheEO offer small business loans tailored for women.

- Corporate & Nonprofit Grants: Companies like FedEx and Visa run business grant competitions for female founders.

Combining angel investment with grants and crowdfunding can give your startup the financial boost it needs—without giving away ownership!

Conclusion: Take the First Step Toward Funding Success

Women entrepreneurs, the path to securing angel investment starts with action—take your first step today!

Recap Key Strategies for Funding Success:

- Refine Your Pitch: Craft a compelling, clear, and concise pitch that highlights your startup’s potential and ROI.

- Build a Strong Business Model: Ensure your business model is validated with market data and has a clear revenue strategy in place.

- Network and Outreach: Tap into angel investor networks like AngelList, Golden Seeds, and 37 Angels. Attend networking events and utilize LinkedIn to connect with investors.

- Explore Non-Equity Funding: Don’t forget about grants and crowdfunding platforms that can complement your angel investment efforts.

Encourage Action: “Start by refining your pitch and reaching out to investors today!”

Acting is the key to attracting angel investors. Keep refining your pitch, reach out to networks, and be persistent. Your next funding opportunity could be just a conversation away!

Have you tried securing angel investment for your women-led startup? Share your experience and tips with us in the comments below!