Struggling to manage your business finances effectively? You’re not alone. Many women entrepreneurs face challenges in budgeting, cash flow management, and securing funding, which can impact their business growth.

Effective financial management is the key to long-term success. It ensures stability, profitability, and scalability, allowing you to make strategic decisions without financial stress. Without a solid plan, even the most promising business ideas can struggle to survive.

Here are some common financial challenges for women entrepreneurs:

- Limited access to funding – Women receive less venture capital compared to men.

- Balancing personal & business finances – Many entrepreneurs mix finances, leading to confusion.

- Cash flow issues – Irregular income makes budgeting and reinvestment difficult.

- Lack of financial literacy – Understanding taxes, expenses, and profit margins can be overwhelming.

But don’t worry, smart financial management can help you overcome these hurdles!

Tip 1: Separate Personal and Business Finances for Women Entrepreneurs

One of the first financial steps every woman entrepreneur should take is separating personal and business finances. Keeping them mixed can lead to unclear cash flow, tax headaches, and difficulty in securing funding. A dedicated business account ensures better organization, legal protection, and financial clarity.

Why a Dedicated Business Account is Essential

- Clear Financial Tracking – Easily monitor revenue, expenses, and profit without confusion.

- Easier Tax Filing – Helps separate personal spending from business deductions, avoiding tax issues.

- Professionalism & Credibility – A business account makes you look serious to clients, suppliers, and investors.

- Simplifies Accounting – Streamlines bookkeeping and prevents errors in financial reporting.

Best Tools to Track Business Finances

- Wave – Free, beginner-friendly accounting software for small businesses.

- QuickBooks – Offers automated expense tracking, invoicing, and tax prep.

- FreshBooks – Best for freelancers and service-based businesses, with client invoicing features.

Pro Tip: When opening a business bank account, choose one that offers low fees, online banking, and easy integration with accounting software. Also, consider getting a business credit card to build credit and manage cash flow effectively.

Tip 2: How to Set a Realistic Business Budget and Stick to It

A solid budget is the backbone of any successful business. Without one, you risk overspending, running out of cash, or failing to reinvest in growth. For women entrepreneurs, creating a lean and strategic budget ensures financial stability while keeping costs under control.

How to Create a Lean Business Budget

- List All Expenses – Separate fixed costs (rent, subscriptions) from variable costs (marketing, supplies).

- Prioritize Essential Spending – Focus on must-have expenses and eliminate unnecessary ones.

- Set Revenue Goals – Align your budget with expected income to avoid cash flow issues.

- Monitor & Adjust Regularly – A budget should be flexible—track and tweak it as needed.

Best Tools for Budgeting & Expense Management

- Google Sheets – Simple, free, and customizable for tracking business expenses.

- YNAB (You Need a Budget) – Helps allocate every dollar effectively and stay on track.

- Mint – Great for automatic expense tracking and financial planning.

Pro Tip: Use the 50/30/20 rule for budgeting:

- 50% for essentials (rent, utilities, inventory)

- 30% for growth (marketing, networking, training)

- 20% for savings & emergencies (unexpected costs, reinvestment)

By setting and sticking to a budget, you’ll build a financially healthy business that thrives in 2025!

Tip 3: Track Every Business Expense to Avoid Overspending

Once you’ve set a realistic budget (Tip 2), the next step is to track every expense to ensure you stick to it. Untracked spending can quickly eat into profits, leading to cash flow issues and financial instability.

Why Expense Tracking is Crucial?

- Prevents Overspending – Helps you stay within budget and control unnecessary costs.

- Improves Cash Flow Management – Keeps a clear record of where your money is going.

- Simplifies Tax Preparation – Accurate tracking makes deductions and filing taxes easier.

- Identifies Cost-Cutting Opportunities – Highlights areas where you can save money.

Best Tools for Expense Tracking

- Expensify – Automatically scans and categorizes receipts for easy tracking.

- Zoho Expense – Great for managing business expenses and reimbursements.

- Xero – Ideal for small businesses, offering accounting, invoicing, and bank reconciliation.

Pro Tip: Review your expenses weekly to spot trends and adjust before they affect your cash flow. Combine expense tracking with your budget to maximize financial efficiency and keep your business profitable!

Tip 4: How to Keep Your Business Cash Flow Positive

Tracking expenses (Tip 3) is just one part of staying financially stable—the other is ensuring your cash flow remains positive. Many businesses fail not because they aren’t profitable, but because they run out of cash to cover daily operations.

Why Cash Flow Matters More Than Profits

- Ensures Business Survival – Cash flow covers operational costs like rent, salaries, and supplies.

- Provides Financial Stability – A steady inflow of cash prevents debt accumulation.

- Enables Growth & Flexibility – Extra cash allows reinvestment in marketing, inventory, or expansion.

Strategies to Maintain Positive Cash Flow

- Offer Early Payment Incentives – Give small discounts to encourage clients to pay faster.

- Use Subscription Models – Recurring revenue (e.g., memberships) ensures consistent cash flow.

- Reduce Unnecessary Expenses – Eliminate or downgrade tools and services you don’t actively use.

Pro Tip: Regularly review your cash flow statements and ensure you always have at least 3–6 months of operating expenses as a safety net. This keeps your business resilient and financially strong!

Tip 5: Reduce Business Costs Without Compromising Growth

As a woman entrepreneur, every dollar counts. Reducing unnecessary expenses can help you stretch your budget without sacrificing the growth potential of your business. The key is to find cost-effective solutions that don’t compromise quality or customer experience.

Why Reducing Costs is Crucial for Growth

- Maximize Profit Margins – Cutting costs increases your bottom line without the need to increase prices.

- Sustain Growth on a Budget – You can reinvest savings into marketing, product development, or expansion.

- Maintain Financial Flexibility – Freeing up cash allows you to pivot quickly or scale up when needed.

Effective Cost-Cutting Strategies

Use Free Tools – Take advantage of free business tools to handle tasks that usually require expensive software.

- Canva – Create professional designs for social media, marketing materials, and more.

- Mailchimp – Email marketing made easy and affordable, with a free plan for small businesses.

- Trello – Organize your projects, track tasks, and collaborate with teams, all for free.

Automate Repetitive Tasks – Tools like Zapier or Integromat can automate workflows, reducing manual labor and saving time.

Pro Tip: Look for open-source software and freemium tools that scale with your business. By cutting unnecessary costs, you can keep your business running lean and agile while focusing on sustainable growth!

Tip 6: Invest Wisely in Your Business: Prioritize High-ROI Areas

As a woman entrepreneur, making smart investments is essential to scaling your business. While it’s tempting to cut costs everywhere, certain high-ROI areas will fuel growth and enhance your business’s long-term success. Smart investments can help you optimize operations, attract customers, and establish a strong market presence.

Why Smart Investments Are Key to Business Growth?

- Maximize Returns – Focusing on high-ROI areas allows you to get the most value from every dollar spent.

- Enhance Efficiency – Strategic investments in tools and systems help you scale operations without increasing overhead.

- Set Up for Future Success – Investing early in your business foundation (like branding and automation) can lead to exponential returns as you grow.

Areas to Prioritize for Maximum ROI

- Marketing & Branding – Invest in online advertising, social media strategies, and building a strong brand identity to attract and retain customers. According to Forbes, a well-defined brand can increase customer loyalty and boost sales significantly.

- Automation Tools – Invest in tools like Zapier or HubSpot to automate repetitive tasks, saving time and reducing errors. Inc.com states that automation leads to greater operational efficiency and helps businesses scale faster.

- Essential Legal Structures – Secure your business’s legal foundation with the right legal entity (LLC, corporation, etc.) and proper contracts. This will protect you from future liability issues and help with funding opportunities.

- Outsource Smartly – Instead of hiring full-time employees, consider using freelancers for short-term needs. Platforms like Upwork or Fiverr allow you to hire experts in areas like content creation, design, and marketing without long-term commitments, as advised by Entrepreneur.com.

How to Make Smart Outsourcing Decisions?

- Hire Freelancers for Specific Tasks – Use freelancers for specialized tasks (e.g., graphic design, web development) that don’t require a permanent employee.

- Prioritize Full-Time Hires for Core Operations – For functions like customer service or product management, hiring full-time employees is essential for consistency and long-term growth.

Pro Tip: Always evaluate the ROI of any investment before committing. Focus on areas that directly impact revenue, customer retention, and operational efficiency to ensure long-term success and business scalability.

Tip 7: Build Multiple Income Streams to Strengthen Business Stability

As a woman entrepreneur, relying on a single income source can leave your business vulnerable to market fluctuations and unforeseen challenges. By building multiple income streams, you ensure financial stability and create opportunities for growth. Diversifying your revenue not only helps secure your business in uncertain times but also opens new avenues for profits.

Why Multiple Income Streams Are Essential

- Increase Financial Stability – Relying on several revenue sources reduces risk and helps you weather economic downturns.

- Maximize Earning Potential – Multiple streams can generate passive income, freeing up time for you to focus on growing your core business.

- Improve Cash Flow – More income sources lead to a steady cash flow, which is crucial for managing business expenses and reinvestment.

Income Streams Women Entrepreneurs Can Leverage

- Coaching & Consulting – Use your expertise to offer coaching services or become a consultant in your niche. According to Forbes, coaching is a lucrative field, with many women entrepreneurs earning substantial income through online platforms.

- Digital Products – Sell digital products such as eBooks, online courses, or templates. These products have minimal overhead and can generate passive income. Entrepreneur.com highlights that digital products can be automated, allowing you to earn while you sleep.

- Affiliate Marketing – Promote products or services and earn a commission on sales through affiliate programs. As Shopify points out, affiliate marketing is a great way to earn revenue without creating your own products.

- Freelancing – Offer your skills in areas like writing, graphic design, or social media management on platforms like Upwork or Fiverr. Small Business Trends emphasizes that freelancing allows flexibility while expanding your income sources.

How to Diversify Your Income Streams Effectively

- Focus on Your Strengths – Choose income streams that align with your skills and expertise.

- Start Small – Test each stream before committing significant time or resources.

- Automate and Scale – Once established, automate processes (like email marketing or product sales) to scale and generate passive income.

Pro Tip: Combining passive income sources like digital products with active income through freelancing or consulting can provide a balanced approach to diversifying revenue while maintaining control over your business’s growth.

Tip 8: Plan for Taxes and Avoid Financial Surprises

Effective tax planning is essential for the long-term financial health of your business. As a woman entrepreneur, managing taxes proactively ensures you’re not caught off guard during tax season and helps you avoid financial surprises that could derail your business. Proper planning also helps you take advantage of tax breaks and deductions that could save you money.

Why Tax Planning is Critical for Financial Stability

- Avoid Last-Minute Scrambles – Planning your taxes throughout the year helps you stay on top of your obligations, ensuring you don’t face penalties or interest charges.

- Maximize Tax Deductions – Tax planning allows you to identify deductible expenses like business supplies, home office costs, and travel, which can lower your tax burden. According to Inc.com, proactive tax planning can save entrepreneurs up to 20% in taxes each year.

- Maintain Cash Flow – Setting aside money for taxes helps you avoid financial stress when it’s time to pay your dues, keeping your cash flow steady and reliable.

Tools to Help You with Tax Planning and Tracking

- TurboTax – This software simplifies tax filing for small business owners, offering easy-to-understand guides and maximizing deductions. Forbes recommends TurboTax for its user-friendly interface and reliability.

- TaxJar – Automate tax calculations and track sales tax across multiple states, especially if you run an online business. Small Business Trends highlights TaxJar as a tool that saves time and reduces errors.

- Bench.co – A great option for tracking your business’s financials and taxes. Bench integrates bookkeeping and tax tracking into one seamless platform, helping entrepreneurs stay on top of their numbers. According to Business News Daily, Bench is one of the top-rated services for small business accounting.

Strategies for Effective Tax Planning

- Set Aside Tax Funds Monthly – Dedicate a percentage of your revenue each month to a tax savings account, making it easier to pay taxes when they are due.

- Consult with a Tax Professional – If your business is complex or you’re unsure about tax deductions, seeking help from a CPA or tax advisor can ensure you’re following the correct procedures and minimizing tax liabilities.

- Track Expenses – Keep a detailed record of business expenses and income throughout the year using tools like QuickBooks or Wave, so you’re always prepared for tax filing.

Pro Tip: Incorporating tax planning into your regular financial management strategy will not only help you stay compliant but also maximize your savings, allowing you to reinvest in your business and continue scaling confidently.

Tip 9: Secure Funding Options for Women Entrepreneurs to Grow Your Business

As a woman entrepreneur, securing the right funding is crucial for scaling your business and turning your ideas into reality. While traditional loans are often difficult to obtain, there are several alternative financing options specifically designed to support women in business. By exploring these funding sources, you can secure the necessary capital to grow and expand without sacrificing equity or taking on burdensome debt.

Why Securing Funding is Essential for Business Growth

- Fuel Your Growth – Whether you’re launching a new product, expanding your team, or scaling operations, funding can provide the capital you need to move forward.

- Avoid Personal Debt – Accessing business-specific funding allows you to separate personal finances from your business, protecting your personal financial security.

- Gain Access to Resources – Many funding programs for women also provide mentorship, networking opportunities, and business training, helping you succeed in the long run.

Alternative Financing Options for Women Entrepreneurs

- Grants for Women Entrepreneurs (Read more…)

- Amber Grant – Provides $10,000 in funding monthly, with a $25,000 yearly grant. They also offer mentorship and business resources tailored to women. Forbes recommends Amber Grant for its focus on helping underrepresented female entrepreneurs.

- Cartier Women’s Initiative – This global program offers financial support and business training to women-led ventures. Entrepreneur.com highlights it as one of the top grants for women entrepreneurs looking to make a global impact.

- Crowdfunding

- IFundWomen – A crowdfunding platform specifically designed to help women entrepreneurs raise capital from supporters. It’s a popular resource for women-led businesses, offering a combination of grants and loans. TechCrunch suggests IFundWomen for its strong community of female investors and business mentors.

- Kickstarter – If you have an innovative product, Kickstarter is an excellent platform to crowdfund your idea, building a customer base before your official launch. According to Small Business Trends, crowdfunding can help test market demand and create buzz.

- Microloans & Peer Lending

- Kiva – Offers interest-free microloans to women entrepreneurs, especially those in developing countries. Business News Daily praises Kiva for providing accessible funding for underserved entrepreneurs worldwide.

- Accion – This global non-profit offers microloans and financial services tailored to small business owners, particularly women in emerging markets. Inc.com highlights Accion for its affordable loans and business resources.

How to Choose the Right Funding Option for Your Business

- Evaluate Your Needs – Are you looking for a small loan, seed funding, or a grant to support your vision? Knowing what you need will help you narrow down the best options.

- Consider Repayment Terms – Look for funding options that offer flexibility and reasonable terms. Avoid funding options that may strain your cash flow.

- Leverage Multiple Sources – Don’t be afraid to combine several funding sources, such as grants, crowdfunding, and loans, to achieve your business goals.

Pro Tip: Securing the right funding early can accelerate your growth and provide the financial stability needed to take calculated risks and expand your operations. By leveraging programs designed specifically for women, you can unlock valuable opportunities for both capital and mentorship.

Tip 10: Improve Financial Literacy and Stay Updated on Business Finance Trends

For women entrepreneurs, mastering financial literacy is essential for business success. Understanding your finances helps you make informed decisions, avoid common pitfalls, and plan for long-term growth. Staying updated on financial trends ensures you’re always ahead of the curve.

Why Financial Literacy Matters

- Informed Decisions – With financial knowledge, you can confidently make investment and budgeting choices.

- Avoid Mistakes – Understanding your finances helps you prevent costly errors.

- Business Growth – Financial literacy empowers you to optimize resources and scale your business effectively.

Recommended Books & Courses

- Profit First by Mike Michalowicz – A practical guide on managing business finances and prioritizing profit.

- Finance for Non-Financial Managers (Coursera) – Learn the basics of financial management in this course for entrepreneurs.

Follow Financial Experts

- YouTube

- Podcasts

- Blogs

Pro Tip: Continuous learning and staying updated on financial trends is key to managing and growing your business effectively.

Conclusion: Take Control of Your Business Finances Today

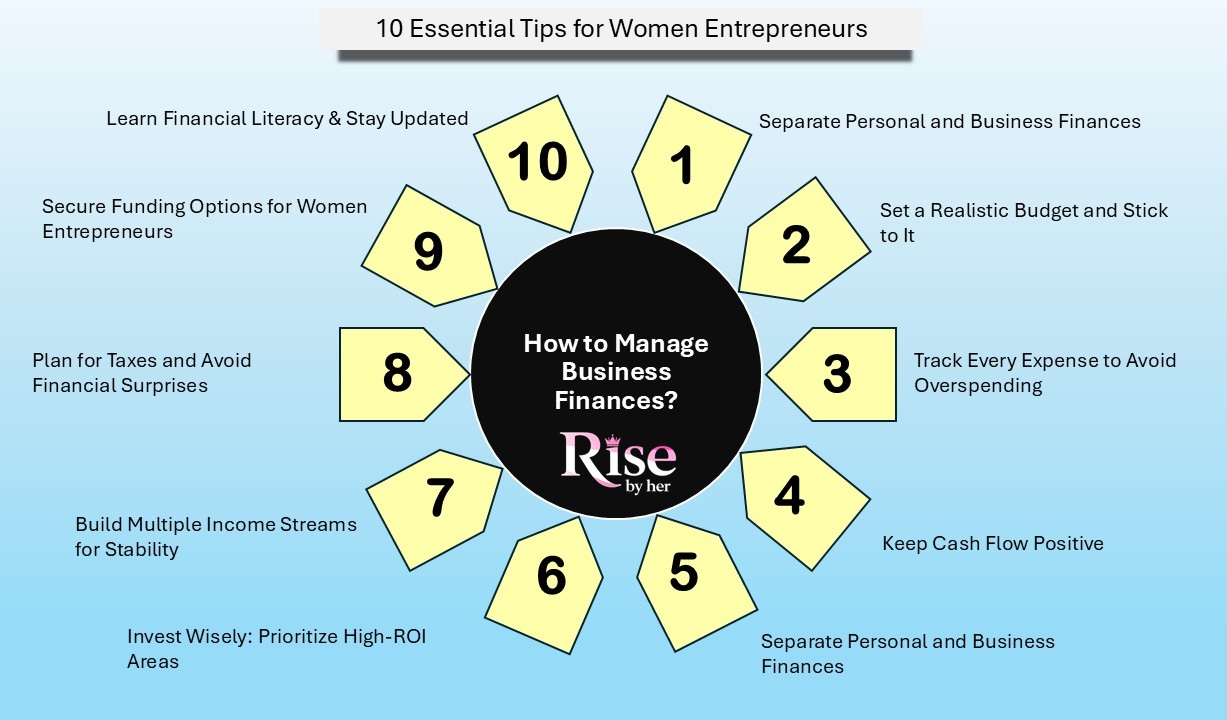

Managing your business finances effectively is crucial for long-term success. By implementing the 10 essential tips we’ve covered, you can make smarter financial decisions, stay on top of cash flow, and grow your business sustainably.

Key Takeaways:

- Separate personal and business finances to keep things organized.

- Set a realistic budget and track your expenses consistently.

- Focus on cash flow management and prioritize financial stability.

- Invest wisely in areas with high ROI and explore additional revenue streams for greater security.

- Plan for taxes and secure the right funding options for growth.

By taking charge of your finances today, you’re laying the groundwork for a successful future.

What financial tip helped you the most? Let me know in the comments below! Ready to take control of your business finances? Start implementing these strategies today!