Understanding your finances is one of the most powerful steps you can take toward independence and confidence. Yet many women are expected to navigate money matters without guidance, often while dealing with pay gaps, career breaks, or other unique challenges.

This beginner’s guide is here to change that. Designed specifically for women, it covers the essentials: budgeting, saving, managing debt, building credit, and starting to invest. You’ll also find tips and tools tailored to real-life situations women face every day.

Financial literacy isn’t about perfection. It’s about making informed choices and building confidence over time. No matter where you’re starting from, this guide will help you take control of your money and your future. Let’s begin.

What Financial Literacy Means for Women Beginners

Financial literacy means understanding how money works and how to manage it effectively. It includes everyday skills such as budgeting, saving, using credit responsibly, managing debt, and preparing for long-term goals like retirement or investing. Being financially literate gives you the ability to make informed decisions about your money rather than relying on guesswork or outside advice that may not serve your best interests.

Why Financial Education Is Especially Important for Women

While financial knowledge is essential for everyone, it holds special value for women. Several factors contribute to this:

- Pay inequality: Women still earn less on average than men. According to FasterCapital, the gender pay gap remains a significant barrier to building wealth and financial security.

- Career interruptions: Many women take breaks from work for caregiving or family responsibilities, which can reduce lifetime earnings and retirement savings.

- Longer life expectancy: Women typically live longer than men, which means they need more money saved for retirement and are more likely to manage finances alone later in life.

These challenges make it even more important for women to build a strong financial foundation early and continue developing it over time.

The Role of Financial Literacy in Building Confidence

Understanding personal finance gives women the tools to:

- Take control of everyday spending and saving decisions

- Plan ahead with clarity and purpose

- Avoid debt traps and unnecessary financial stress

- Set and achieve meaningful financial goals

As highlighted by Voya Financial, women who actively engage with their finances report feeling more secure and better prepared for unexpected life events. Financial literacy is not just about numbers; it is about having the confidence to make decisions that align with your values and future.

How to Budget and Manage Expenses Effectively

Creating and maintaining a budget is one of the most important steps in taking control of your finances. It helps you understand where your money is going, reduce unnecessary spending, and plan for future goals. For women, budgeting can also serve as a key tool for gaining financial independence, especially when managing multiple roles or variable income.

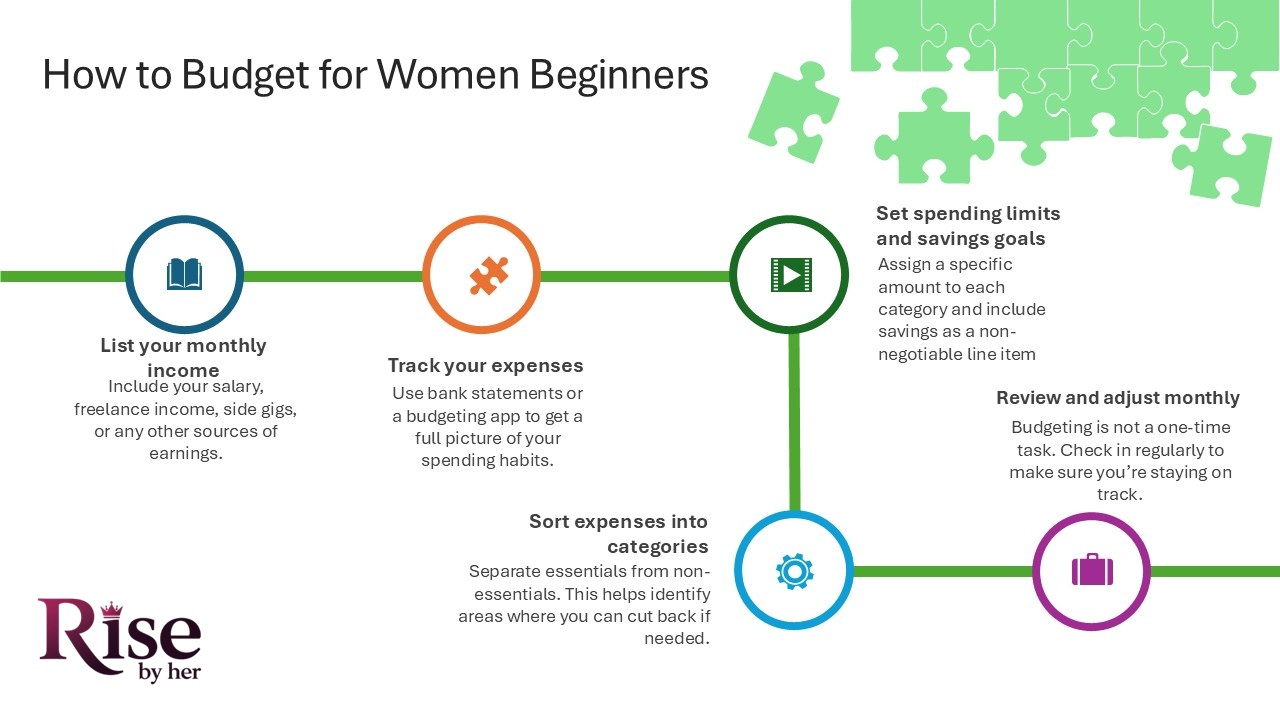

How to Budget for Women Beginners

Getting started with budgeting doesn’t have to be complicated. Here are a few simple steps to create a budget that works for your lifestyle:

- List your monthly income: Include your salary, freelance income, side gigs, or any other sources of earnings.

- Track your expenses: Start by recording all your spending for 30 days. Use bank statements or a budgeting app to get a full picture of your spending habits.

- Sort expenses into categories: Separate essentials (like rent, groceries, and utilities) from non-essentials (like dining out or subscriptions). This helps identify areas where you can cut back if needed.

- Set spending limits and savings goals: Assign a specific amount to each category and include savings as a non-negotiable line item.

- Review and adjust monthly: Budgeting is not a one-time task. Check in regularly to make sure you’re staying on track.

Expense Tracking Tips for Women

- Use budgeting apps designed with women in mind, like Savvy Ladies, BolderMoney, or Mint.

- Try a physical planner or printable templates if you prefer writing things down.

- Involve a friend or partner to keep yourself accountable.

Case studies from Liberty Group and Investopedia show that women who actively track their spending are more likely to reach savings goals and avoid debt.

Learning how to budget is a powerful first step toward financial clarity. With the right tools and consistent tracking, you can create a spending plan that supports your values and future goals. Budgeting helps you spend with purpose and save with confidence.

Saving Strategies and Building an Emergency Fund

Building savings is a crucial part of financial security, especially for women who often face unique financial challenges. Having a solid savings plan and an emergency fund can provide peace of mind and a safety net for unexpected expenses.

Why an Emergency Fund Matters

An emergency fund acts as a financial cushion to cover unexpected costs like medical bills, car repairs, or sudden job loss. Experts recommend saving enough to cover three to six months’ worth of living expenses. For women, this fund is particularly important given factors such as career breaks or fluctuating income.

Saving Money Strategies for Female Beginners

Getting started with saving may seem overwhelming, but breaking it down into manageable steps can help:

- Set realistic goals: Start small if needed, such as saving $500 initially, then gradually increase your target.

- Automate your savings: Set up automatic transfers to your savings account right after each paycheck arrives. This “pay yourself first” method builds your savings without extra effort.

- Choose the right account: Look for savings accounts with no fees and competitive interest rates. High-yield savings accounts or credit unions often offer better returns than standard accounts.

How Women Can Build Savings Effectively

- Use savings calculators to plan your goals and track progress.

- Learn from real women’s stories: Interviews with women who successfully built emergency funds show that consistency and discipline are key.

- Avoid dipping into savings unless it’s a true emergency to keep your fund growing steadily.

Developing smart saving habits is one of the best ways women can secure their financial future. By prioritizing an emergency fund and setting clear, achievable goals, you’ll build confidence and resilience to face life’s uncertainties. Remember, every small deposit adds up over time.

Managing Debt and Improving Your Credit Score

Managing debt and building a strong credit history are essential skills for financial health. For women, understanding how to reduce debt and improve credit can open doors to better loans, housing, and financial opportunities.

Understanding Different Types of Debt

Debt comes in many forms, including:

- Credit card debt

- Student loans

- Auto loans

- Mortgages

Each type has different interest rates and repayment terms. Knowing what kind of debt you have is the first step toward effective management.

Debt Reduction Strategies for Women

Here are some proven strategies to pay off debt efficiently:

- Create a debt payoff plan: List your debts from smallest to largest or by interest rate. Focus on paying extra toward one while making minimum payments on others.

- Consolidate or refinance loans: Combining high-interest debts into a single loan with a lower rate can reduce monthly payments.

- Avoid accumulating new debt: While paying off existing debt, try to limit new borrowing.

How to Improve Credit Score for Female Beginners

A good credit score is vital for financial flexibility. Here’s how to boost yours:

- Pay bills on time, every time.

- Keep credit card balances low relative to limits.

- Avoid opening too many new credit accounts in a short time.

- Regularly check your credit report for errors or fraud.

Managing Student Loans as a Woman

Student debt is common and can feel overwhelming. Explore repayment plans based on income and consider loan forgiveness options if available. Staying informed and proactive will help you manage loans without sacrificing other financial goals.

Helpful Tools and Resources

- Use debt payoff planners to visualize your progress and stay motivated.

- Monitor your credit with free tools like Credit Karma or Experian to track improvements.

Beginner’s Guide to Investing for Women

Investing is one of the most effective ways to build long-term wealth, but it can feel intimidating; especially for women who are just starting out. Understanding the basics and developing a clear strategy can help you grow your money confidently and securely.

Investing Basics for Women Beginners

Investing means putting your money into assets like stocks, bonds, mutual funds, or real estate with the goal of generating returns over time. Common investment vehicles include:

- Stocks: Ownership shares in a company with potential for growth and dividends.

- Bonds: Loans to governments or corporations that pay fixed interest.

- Mutual funds and ETFs: Pooled investments that spread risk across many assets.

- Retirement accounts: Such as IRAs or 401(k)s, offering tax advantages.

Starting with simple, low-cost options like index funds can help minimize risk while learning the ropes.

Assessing Risk Tolerance and Strategy

Before investing, it’s important to assess your comfort with risk. Younger investors might choose more aggressive growth strategies, while those closer to retirement may prefer conservative options. Diversification (spreading investments across different types of assets) also helps manage risk.

How to Start Investing as a Woman

- Begin by setting clear financial goals, such as saving for a home or retirement.

- Use beginner-friendly platforms like Robinhood, Acorns, or Betterment.

- Consider working with a financial advisor experienced in women’s financial planning.

Resources and Inspiration

Many women have successfully navigated investing and can serve as role models. Reading profiles of female investors and using educational infographics can boost your confidence.

Retirement Planning Essentials for Women

Planning for retirement is one of the most important financial steps women can take to ensure security and independence in later years. Because women often face unique challenges, early and strategic planning is essential.

Understanding Retirement Accounts

Key retirement accounts include:

- 401(k): Employer-sponsored plans that often include matching contributions.

- Individual Retirement Accounts (IRA): Personal accounts with tax benefits, including Traditional and Roth IRAs.

Knowing how these accounts work helps you maximize savings and benefits.

Calculating Retirement Needs for Women

Women generally live longer than men, meaning retirement savings need to stretch further. To estimate your retirement needs, consider:

- Expected living expenses

- Healthcare costs

- Inflation over time

- The impact of career breaks or part-time work

Using online retirement calculators can provide personalized projections and help set realistic savings goals.

Overcoming Common Challenges

Women face specific hurdles in retirement planning, such as:

- Career breaks: Time off for caregiving can reduce contributions and compound growth.

- Lower lifetime earnings: The gender pay gap means less money saved overall.

To overcome these, focus on maximizing contributions when you can and taking advantage of employer matching programs.

Retirement Planning Tips for Women

- Start saving as early as possible, even small amounts add up over time.

- Diversify investments within your retirement accounts for balanced growth.

- Review your retirement strategy regularly and adjust for life changes.

Using Financial Tools and Resources to Stay on Track

Navigating your financial journey becomes easier with the right tools and resources. Women especially benefit from apps, educational content, and supportive communities designed to meet their unique needs.

Best Financial Tools for Women

Several budgeting and investment apps cater specifically to women’s preferences and financial goals. Some popular options include:

- YNAB (You Need A Budget): Helps you create a personalized budget and track spending.

- Ellevest: An investment platform designed for women, focusing on gender-specific financial realities.

- Honeydue: A budgeting app for couples, great for managing shared expenses.

These tools simplify money management and empower you to make smarter decisions.

Educational Resources for Women Beginners

Learning is key to financial confidence. Consider these highly recommended resources:

- Books: “Smart Women Finish Rich” by David Bach and “Women & Money” by Suze Orman.

- Podcasts: “HerMoney” by Jean Chatzky and “Financial Feminist” by Talaat McNeely.

- Online Courses: Platforms like Coursera and Udemy offer personal finance courses tailored for women.

These resources provide knowledge and inspiration to help you stay motivated.

Community Groups and Forums

Joining financial communities can boost your learning and accountability. Some places to check out include:

- Ellevate Network: A global community of professional women supporting financial growth.

- Reddit’s r/personalfinance: A diverse forum with practical advice and support.

- Facebook groups focused on women’s finance and entrepreneurship.

Being part of a community helps you share experiences, ask questions, and grow your financial skills.

Build Financial Confidence and Overcome Common Barriers

Many women face unique psychological and societal challenges when it comes to managing money. Addressing these barriers is a crucial step toward financial empowerment and long-term success.

Common Financial Myths and Misconceptions

Some beliefs can hold women back from taking control of their finances, such as:

- “I’m not good with money.”

- “Investing is too risky or complicated.”

- “I don’t earn enough to save or invest.”

Recognizing and challenging these myths helps overcome financial anxiety for women and encourages proactive money management.

Building Money Confidence as a Female Beginner

Confidence comes with knowledge and experience. To build yours:

- Start with small, manageable financial decisions to gain momentum.

- Celebrate progress, no matter how minor it seems.

- Educate yourself using trustworthy resources and ask questions without hesitation.

Financial Empowerment Tips for Women

- Seek mentorship: Find a trusted financial advisor or mentor who understands your goals and challenges.

- Join supportive communities: Engage with groups focused on women’s financial growth.

- Practice self-compassion: Financial mistakes are learning opportunities, not failures.

Personal stories of women who overcame money fears can inspire and guide you on your own journey.

Building financial confidence requires both practical knowledge and emotional support. By confronting myths, seeking guidance, and celebrating your progress, you can overcome barriers and take charge of your financial future with confidence.

Read more related article on: Women Financial Independence