Want to make money while you sleep? You’re not alone. More women than ever are exploring passive income as a powerful path to financial independence. Whether you’re a stay-at-home mom, a full-time professional, or building your own business, earning extra money without clocking more hours is not just a dream: it’s a smart strategy.

Passive income allows you to generate revenue with minimal ongoing effort after the initial setup. From investing in dividend stocks to selling digital products or renting out assets, there are dozens of creative and accessible ways to build long-term wealth. And the best part? Many of these income streams can be started with little capital or technical skills.

In this guide, we’ll share 15 of the best passive income ideas for women in 2026, ideas that are beginner-friendly, proven, and designed to help you create more freedom and security in your life. Whether your goal is to make an extra $1,000 a month, save for early retirement, or simply stop trading time for money, this list has something for you.

Let’s dive into the world of smart, sustainable, and empowering income strategies, designed with women’s goals in mind.

Why Passive Income Matters for Women in 2026

Passive income is more than just a buzzword, it’s becoming a key strategy for women who want to take control of their finances and design a life on their terms.

So, what is passive income exactly? Simply put, it’s money you earn with minimal daily effort. Unlike a traditional 9-to-5 job, where you trade time for money, passive income allows you to generate earnings even while you sleep, travel, or spend time with loved ones. It’s about creating financial systems that work for you, long after the upfront work is done.

This income stream is especially empowering for women. Whether you’re balancing a full-time career, raising children, managing a household, or all the above, passive income offers flexibility, freedom, and long-term stability. It helps reduce reliance on a single paycheck, opens the door to early retirement, and supports goals like starting a business, paying off debt, or simply having more breathing room in your budget.

More women than ever are embracing financial literacy and wealth-building. From investing in dividend stocks to launching digital products or side hustles, the interest in passive income is growing fast. And the best part? You don’t need to be rich or a finance expert to get started.

In a world that’s shifting toward independence and flexibility, passive income is a powerful tool for women to achieve lasting financial empowerment.

15 Best Passive Income Ideas for Women in 2026

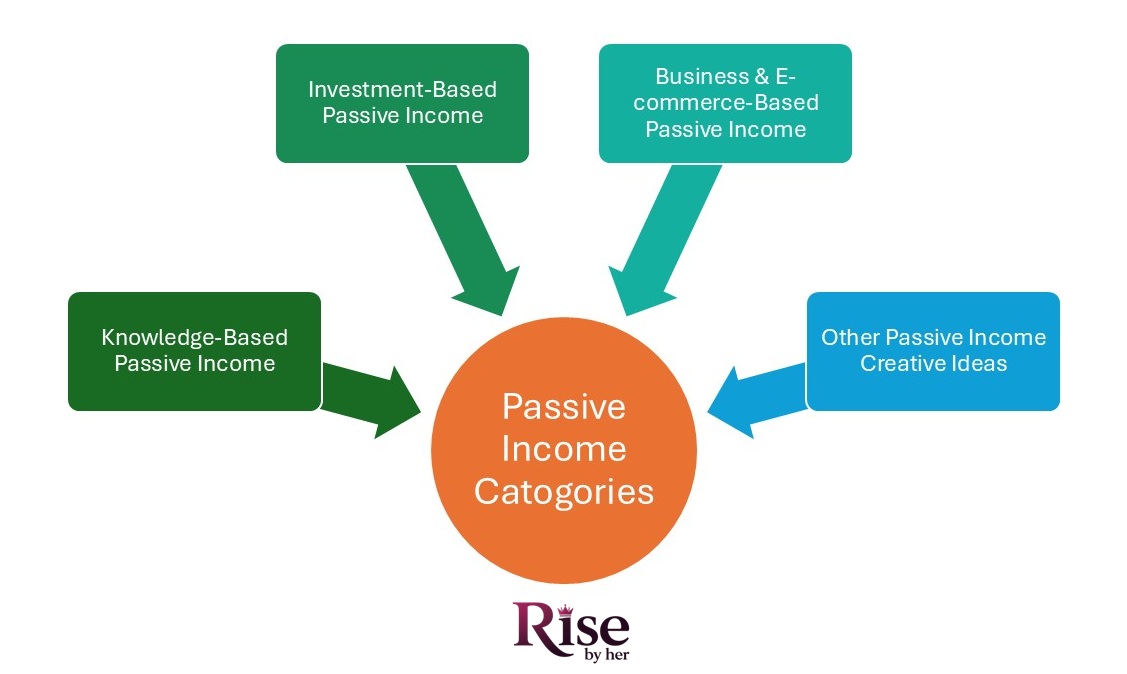

Looking to build wealth without burning out? These 15 powerful passive income ideas are ideal for women who want to earn extra money, gain financial independence, and enjoy more freedom, whether you’re raising a family, growing your career, or running your own business. We’ve grouped them into knowledge-based, investment-based, and business-focused categories so you can find what fits your lifestyle and skills best.

Category A: Knowledge-Based Passive Income

These ideas turn your skills and knowledge into cash, perfect for educators, creatives, and professionals.

1. Create an Online Course or E-book

- Pros: Scalable, low overhead can sell 24/7.

- Cons: Requires upfront time and marketing.

- Tip: Use platforms like Teachable or Gumroad to launch quickly.

2. Launch a Niche Blog with Affiliate Marketing

- Pros: Long-term SEO value, recurring income.

- Cons: Takes time to grow traffic.

- Tip: Focus on a niche you’re passionate about—like beauty, parenting, or finance—and use affiliate networks like Amazon Associates.

3. Start a YouTube Channel or Podcast

- Pros: Monetize with ads, sponsorships, and merch.

- Cons: Takes consistency and time to build an audience.

- Tip: Choose topics you can talk about endlessly—storytelling and authenticity are key.

4. Sell Digital Downloads (Printables, Templates)

- Pros: Low cost to create, instant delivery.

- Cons: Must stand out in a crowded market.

- Tip: Use Etsy or your own Shopify site to sell planners, resume templates, or journals.

Category B: Investment-Based Passive Income

These strategies help your money make more money. They’re perfect for women looking to build wealth steadily over time.

5. Dividend-Paying Stocks

- Pros: Earn regular income without selling your investments.

- Cons: Market risk; research requires.

- Tip: Look for stable, blue-chip companies with a strong dividend history.

6. Real Estate Investing (Including REITs or Airbnb)

- Pros: Generates rental income and builds equity.

- Cons: Property management can be hands-on.

- Tip: Start with REITs or fractional ownership platforms if you don’t want to manage property.

7. High-Yield Savings Accounts or CDs

- Pros: Safe and stable with guaranteed returns.

- Cons: Lower returns compared to stocks or real estate.

- Tip: Shop around for online banks offering rates above inflation.

8. Peer-to-Peer Lending Platforms

- Pros: Higher returns than traditional banks.

- Cons: Risk of borrower default.

- Tip: Use reputable platforms and diversify your loans.

9. Buy & Hold Crypto for Passive Yield (With Caution)

- Pros: Potential for high yield via staking or DeFi.

- Cons: Highly volatile; risky for beginners.

- Tip: Only invest what you can afford to lose and use platforms like Coinbase or Binance for yield staking.

Category C: Business & E-commerce-Based Passive Income

Create automated income streams with products, services, or tech, perfect for entrepreneurial women.

10. Print-on-Demand Products

- Pros: No inventory, great for creative minds.

- Cons: Lower profit margins.

- Tip: Use sites like Printful or Redbubble to design mugs, shirts, or tote bags.

11. Dropshipping Store

- Pros: No need to stock or ship products.

- Cons: Requires good marketing skills and niche research.

- Tip: Start with Shopify and Oberlo to build your store.

12. Mobile App with Monetization

- Pros: Scalable and global reach.

- Cons: Requires upfront tech development.

- Tip: Partner with a developer or use no-code platforms if you’re non-technical.

13. Amazon KDP (Self-Publishing)

- Pros: Passive royalties, global market.

- Cons: Competitive space.

- Tip: Publish low-content books like journals or planners to start.

Bonus Passive Income Ideas

14. License Your Photography or Art

- Pros: Make money from your creative work.

- Cons: Requires high-quality content and exposure.

- Tip: Upload to platforms like Shutterstock, Adobe Stock, or Creative Market.

15. Rent Assets (Car, Equipment, Storage Space)

- Pros: Easy, local income stream.

- Cons: Wear and tear on property.

- Tip: Use apps like Turo (for cars) or Neighbor (for storage) to get started.

How Much Can Women Earn from Passive Income in 2026?

Let’s be real: passive income isn’t a get-rich-quick scheme, but it can become a powerful source of financial freedom over time. Whether you’re looking to supplement your day job or eventually replace it, the key is consistency, patience, and smart strategy.

Set Realistic Expectations First

Passive income streams often start small, especially if you’re building from scratch. Think $50–$200/month in the first few months. But with time and reinvestment, many women have scaled these earnings to $1,000/month or more, some even turning side hustles into full-time businesses.

Example Income Ranges (Per Month)

| Passive Income Idea | Beginner Range | Growth Potential |

| Blogging with Affiliate Links | $50–$300 | $1,000+ |

| Selling E-books or Courses | $100–$500 | $5,000+ |

| Dividend-Paying Stocks | $20–$200 | $500+ |

| Print-on-Demand Products | $50–$250 | $1,000+ |

| YouTube or Podcast Monetization | $10–$100 | $1,000+ |

| Real Estate (REITs or Rentals) | $50–$400 | $1,500+ |

| Peer-to-Peer Lending | $20–$150 | $300+ |

| High-Yield Savings/CDs | $10–$100 | Stable |

| Amazon KDP (Self-Publishing) | $50–$300 | $2,000+ |

| App Monetization (Ad Revenue/Subs) | $0–$200 | $5,000+ |

Note: Results vary by effort, niche, platform, and market conditions.

Use the Right Tools to Scale

- DRIP (Dividend Reinvestment Plans): Helps compound your stock earnings automatically.

- Affiliate Dashboards: Platforms like Amazon Associates or ShareASale let you track clicks, sales, and payouts.

- Course Platforms: Sites like Teachable or Kajabi automate delivery and payments.

- Print-on-Demand Stores: Tools like Printful sync with Shopify for hands-off sale.

- Content Monetization Tools: YouTube Studio, Spotify for Podcasters, and Anchor track earnings and audience growth.

By setting realistic goals and leveraging smart tools, women can unlock serious income potential. Whether your goal is an extra $200/month to cover groceries or $2,000/month for early retirement, passive income can be a game-changer.

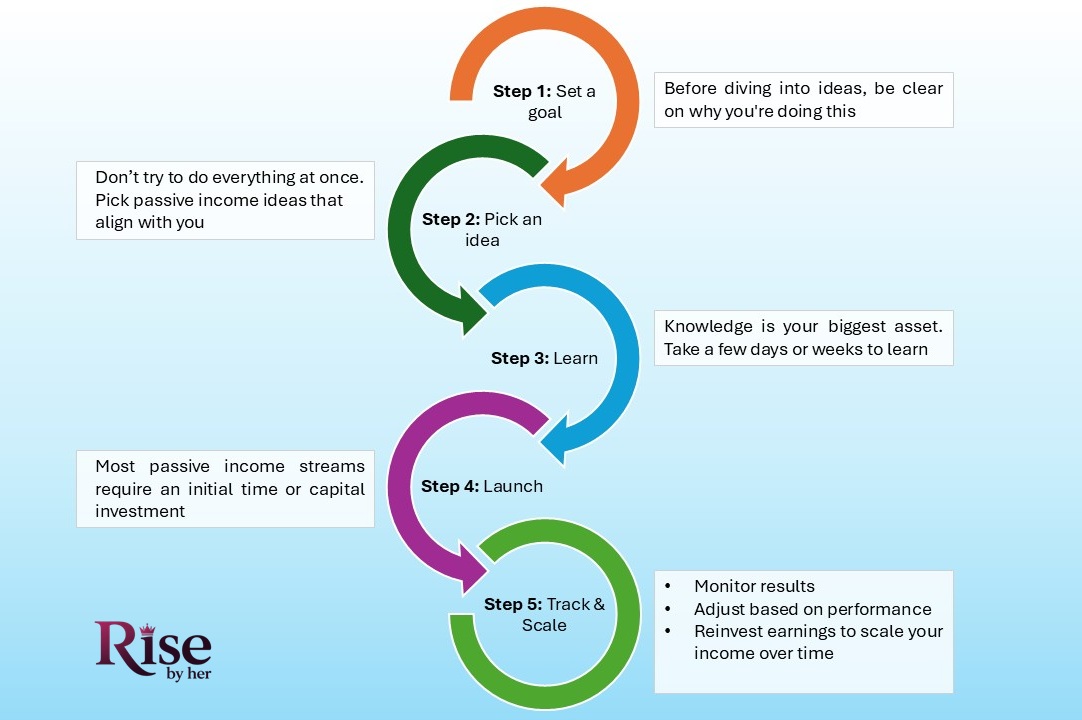

Getting Started with Passive Income: A Step-by-Step Roadmap for Women

Starting your passive income journey might feel overwhelming, but it doesn’t have to be. With the right steps and a clear plan, you can go from zero to earn your first $500 or $1,000 a month, even with a busy schedule. Whether you’re a stay-at-home mom, a full-time professional, or building a business, this roadmap will help you start strong.

Step 1: Define Your Financial Goal

Before diving into ideas, be clear on why you’re doing this. Do you want:

- An extra $200–$500/month to ease monthly bills?

- $1,000/month to fund travel or savings?

- Long-term financial independence?

Your income goal will shape which ideas are worth pursuing and how much time or money to invest.

Step 2: Choose 1–2 Ideas That Match You

Don’t try to do everything at once. Pick passive income ideas that align with your:

- Skills (e.g., writing, designing, investing)

- Interests (e.g., wellness, finance, fashion)

- Time availability and comfort level with tech

Example: Love writing? Try Amazon KDP or blogging. More into numbers? Consider dividend investing.

Step 3: Learn the Basics

Knowledge is your biggest asset. Take a few days or weeks to:

- Watch YouTube tutorials

- Join beginner-friendly communities (e.g., Facebook groups, Reddit forums)

- Take affordable online courses on platforms like Skillshare, Udemy, or Coursera

Step 4: Invest Time (or Money) Upfront

Most passive income streams require an initial time or capital investment:

- Time = creating content, building a blog, filming videos

- Money = buying dividend stocks, launching a Shopify store, running ads

- Start with what’s feasible for you and grow from there.

Step 5: Track, Tweak & Scale

Once your setup is live:

- Monitor results (site traffic, stock returns, affiliate clicks)

- Adjust based on performance

- Reinvest earnings to scale your income over time

Common Passive Income Mistakes Women Should Avoid

Creating a stream of passive income is exciting, but it’s easy to fall into common traps, especially with so much flashy advice online. If you want to build sustainable, long-term income that supports your lifestyle and financial goals, it’s important to avoid these common mistakes many beginners make.

Chasing “Get Rich Quick” Schemes

If it sounds too good to be true, it probably is. Many passive income scams promise overnight success with little effort, whether it’s a sketchy crypto scheme or “automated” dropshipping. Real passive income takes time to build. Focus on legitimate, proven strategies like dividend investing, content creation, or digital products that grow over time.

Women looking for “legit passive income ideas” or “safe side hustles” are often trying to avoid these traps, so build trust by showing what’s real.

Not Doing Enough Research

Jumping into an income stream without understanding the basics can lead to wasting time and money. Whether you’re launching a blog or buying a rental property, take time to research:

- Profit potential

- Start-up costs

- Learning curves

- Risk levels

Use free tools like YouTube, financial blogs, and online forums to educate yourself before committing.

Failing to Diversify Income Streams

Putting all your eggs in one basket can be risky. If your YouTube channel gets demonetized or your affiliate links stop performing, your income could vanish. Instead, build multiple income streams over time. For example, pair a blog with digital products or combine real estate investing with dividend stocks.

Giving Up Too Early

The truth is passive income is rarely instant. It might take a few months (or even a year) to see meaningful results. Many women give up just before their efforts start to pay off. Stay consistent, keep learning, and adjust as you go.

How Women Are Winning with Passive Income in 2026 (Real Stories & Stats)

The rise of passive income is more than just a trend, it’s a quiet revolution, and women are leading the charge. From earning through content creation to building investment portfolios, women across the globe are redefining what financial independence looks like.

Real Women, Real Wins

- Jannese Torres, a former engineer, started a food blog called Delish D’Lites in 2013. After being laid off, she focused on her blog and later launched the Yo Quiero Dinero podcast to share financial advice. By 2022, she had developed ten income streams, including blog and podcast ads, affiliate marketing, digital course sales, and brand partnerships, earning an average of $35,000 per month, with $10,000 being passive income.

- Becca Luna dropped out of high school and began working as a virtual assistant, focusing on website design. In 2019, she launched Bold x Boho, offering website templates and design services. Her business quickly gained traction, surpassing $1 million in sales by 2021. A significant portion of her income comes from passive sources like selling digital templates and educational courses.

- Amy Landino left college in 2007 and pursued her passion for video creation. She started a YouTube channel, which evolved into a successful business. By 2024, she was earning approximately $18,000 per month in passive income through her online content, working only four hours a day.

- Kerri Gibson, a former CPA from Quebec, transitioned into real estate by flipping houses with her partner. They established Chalets Hygge, a short-term rental business, expanding to six properties. While managing these rentals requires about 50 hours of work per week, the business provides a steady income, allowing them to live off their earnings

- Jasmine McCall, a former Amazon resource manager, began sharing her credit repair journey on YouTube in 2021. She created the Credit Repair Kit, a digital product that gained popularity. By 2023, she was generating $105,000 per month in passive income from her digital products, working only two hours a day.

Passive Income Trends Among Women (2025)

- According to a recent report by CNBC Make It, over 38% of women in the U.S. have a side hustle, and passive income is one of the fastest-growing categories.

- Fidelity Investments reported a 42% increase in female investors between 2020 and 2023, many of whom cite passive income as a top goal.

- A Shopify 2024 survey revealed that 56% of new digital product sellers are women, driven by platforms like Etsy, Gumroad, and Amazon KDP.

Building a Movement, Not Just a Side Hustle

This isn’t just about making money, it’s about empowerment. Women are using passive income to:

- Gain freedom from 9-to-5 jobs

- Travel and work remotely

- Fund their dreams without debt

- Build long-term wealth and generational security

These stories prove that passive income isn’t reserved for tech bros or finance pros, it’s for any woman ready to take control of her time, money, and future.

Best Tools, Resources & Communities for Women Building Passive Income

Building passive income as a woman in 2026 isn’t just about having the right idea, it’s about having the right tools, knowledge, and support system to bring it to life. Whether you’re creating digital products, investing in the stock market, or launching a print-on-demand store, these resources are designed to help you succeed with confidence and clarity.

Top Platforms to Launch & Grow Your Passive Income Streams

- Udemy: Learn everything from blogging to investing with affordable online courses.

- Teachable: Create and sell your own online course with zero tech overwhelm.

- Canva: Design digital products, templates, and marketing assets with ease — no graphic design degree needed.

- Shopify: Build an e-commerce store for your dropshipping or print-on-demand business.

- Robinhood: Start investing in dividend stocks and ETFs with zero commission fees.

- Vanguard / Fidelity: Great for long-term investors who prefer reputable platforms with DRIP (dividend reinvestment) options.

- Amazon KDP: Self-publish eBooks or low-content books and earn passive income on autopilot.

Best Podcasts & Blogs for Women in Finance

- HerMoney with Jean Chatzky: Practical money talk for women, from budgeting to investing.

- Smart Passive Income by Pat Flynn: Great tips for creating income streams from scratch.

- Yo Quiero Dinero Podcast by Jannese Torres: Focused on financial freedom and entrepreneurship for Latinas and women of color.

- Clever Girl Finance: A blog and podcast with real advice on growing wealth and mastering your money.

Supportive Communities for Women Building Wealth

- Ellevest: An investing platform built by women, for women — with resources and coaching.

- HerMoney Private Facebook Group: A safe, empowering space to discuss money, goals, and strategies.

- Reddit r/FemaleFinancialIndependence: A growing, supportive community of women focused on FIRE and passive income.

- Boss Women Collective: A networking hub for ambitious women building businesses and brands.

- Ladies Get Paid: A powerful movement and community helping women get paid what they’re worth.

Takeaway: You don’t have to build your passive income empire alone. With the right tools, the right people, and the right mindset, success is absolutely within reach. Start small, stay consistent, and lean into communities that lift you up.

Conclusion

Here’s the truth: you don’t need to be a financial expert or have thousands in the bank to start building a passive income. What you need is one idea, one small step, and the courage to begin. Whether it’s writing an eBook, investing in dividend stocks, or launching a simple dropshipping store, the path to financial independence is more accessible than ever for women in 2026.

Passive income isn’t just about extra cash. It’s about freedom, the freedom to spend more time with your family, travel the world, leave a toxic job, or build something of your own. And no matter where you’re starting from, you can create a life of financial security and independence.

So, here’s your action step: Pick just one idea from this list that aligns with your passion or lifestyle. Learn about it, take the first step, and give yourself the grace to grow.

Your future self will thank you.

If this article inspired you, share it with a fellow woman looking to grow her income.

Want more step-by-step tips, real stories, and money-making ideas delivered weekly? Join my newsletter and become part of a community of women building wealth on their terms.

Let’s rise, earn, and thrive together.