Are you a woman entrepreneur looking for funding to start or grow your business but struggling to meet traditional bank requirements? Microloans could be the game-changer you need. These small, short-term loans—ranging from $500 to $50,000—offer flexible repayment terms and lower interest rates, making them accessible even if you have limited credit history or no collateral. For many women, especially those in underserved communities, microloans open the door to opportunities that might otherwise feel out of reach.

Microloans don’t just provide capital—they empower women to take control of their financial future. You can use the funds to invest in inventory, equipment, marketing, or day-to-day operations, helping your business grow and thrive. Many programs also include mentorship, financial education, and networking support, giving you the tools to succeed beyond just funding. By breaking financial barriers, microloans help women gain independence, create jobs, and contribute to economic growth, making them a vital resource in today’s entrepreneurial landscape.

Whether you’re launching a startup or scaling an existing business, understanding and leveraging microloans can be a crucial step toward long-term success and self-sufficiency.

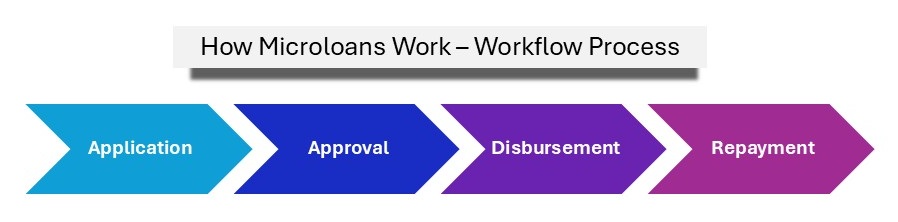

How Microloans Work

Microloans provide women entrepreneurs with accessible funding to start or expand their businesses. The process typically involves three key steps: application, approval, and disbursement.

- Application: Borrowers submit a loan application detailing their business plan, financial needs, and repayment strategy. Some lenders may require proof of income, references, or business registration.

- Approval: Lenders assess the applicant’s creditworthiness, business viability, and repayment capacity. Unlike traditional loans, microloans often have more flexible requirements, making them accessible to women with limited credit history.

- Disbursement: Once approved, funds are disbursed either as a lump sum or in stages. Borrowers then repay the loan in fixed installments over an agreed period.

Types of Microloan Lenders

Microloans come from various sources, each with distinct benefits:

- Banks: Offer structured microloan programs with competitive rates.

- Microfinance Institutions (MFIs): Specialize in small loans for underserved entrepreneurs, often with educational support.

- Government Programs: Provide subsidized microloans to support women’s economic empowerment.

- Non-Profit Organizations: Focus on social impact, offering low-interest or zero-interest loans.

Eligibility for Microloans for Women Entrepreneurs

Microloans are designed to be more accessible than traditional bank loans, but they still have specific eligibility criteria. Women entrepreneurs must meet certain requirements to qualify, which may vary based on the lender.

General Eligibility Requirements

Most microloan providers consider the following:

- Business Purpose: The loan must be used for business-related expenses, such as inventory, equipment, or working capital.

- Credit History: While credit checks are often more flexible, some lenders assess past financial behavior.

- Business Plan: A clear, viable business plan improves approval chances.

- Income & Repayment Ability: Applicants must show they can repay the loan, often through income statements or revenue projections.

Special Considerations for Women in Developing Countries

In many developing regions, women entrepreneurs face additional barriers, such as:

- Lack of Collateral: Many women lack property or assets for loan security, leading to alternative collateral options like group lending.

- Limited Banking Access: Some microfinance institutions (MFIs) provide loans without requiring a formal bank account.

- Support Programs: Many organizations offer business training alongside financial support.

Key Factors Influencing Loan Approval

- Business Viability: Lenders assess industry trends, profitability, and scalability.

- Debt-to-Income Ratio: A lower ratio improves approval chances.

- Lender Type: Banks may have stricter requirements, while MFIs and NGOs are more flexible.

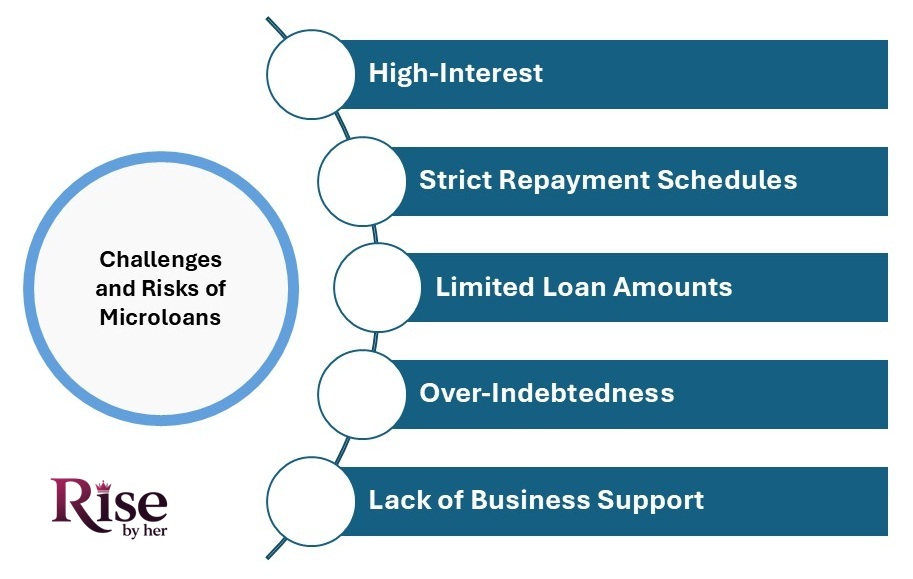

Challenges and Risks of Microloans

While microloans offer financial empowerment, they also come with challenges that women entrepreneurs must navigate. Understanding these risks helps borrowers make informed decisions and maximize their chances of success.

High-Interest Rates from Certain Lenders

Although many microloan programs offer lower rates than traditional banks, some private lenders and alternative financing sources impose high-interest microloans for women entrepreneurs. It’s crucial to compare rates and choose reputable lenders to avoid excessive repayment burdens.

Strict Repayment Schedules

Microloans often have fixed repayment schedules for small business owners, which can be challenging if a business experiences inconsistent cash flow. Women entrepreneurs should explore lenders offering flexible repayment microloan options based on income fluctuations.

Limited Loan Amounts May Not Cover Full Business Needs

Many microloans range between $500 and $50,000, which may not be enough for larger-scale businesses. Women seeking higher funding might need to combine microloans with alternative business financing for female entrepreneurs, such as grants or crowdfunding.

Risk of Over-Indebtedness

Taking multiple microloans without proper financial planning can lead to high debt burdens for women-owned businesses. Entrepreneurs should assess their repayment capacity and avoid excessive borrowing.

Lack of Business Support from Some Lenders

While some microfinance institutions provide mentorship, others only offer capital. Women should prioritize microloans with business coaching for female entrepreneurs to gain essential skills and networking opportunities.

By carefully evaluating loan terms and selecting trusted microloan providers for women-owned startups, entrepreneurs can mitigate risks and ensure financial sustainability.

Top Microloan Programs for Women Entrepreneurs

Microloans help women entrepreneurs access capital, grow businesses, and achieve financial independence. Here are 10 top programs:

- Grameen America – Offers microloans ($500–$2,500+), financial training, and support for low-income women in the U.S.

- Kiva – Crowdfunded loans (0% interest, up to $15,000) for women worldwide.

- SBA Microloan Program – U.S. government-backed loans (up to $50,000) via nonprofit intermediaries.

- Accion Opportunity Fund – Microloans ($5,000–$100,000) plus business coaching for underserved entrepreneurs.

- Mahila Money – Microloans (₹10,000–₹200,000) for Indian women entrepreneurs.

- Count Me In – Loans, coaching, and consulting for women-owned businesses.

- Women’s World Banking – Partners with banks globally to offer financial services for women.

- Heifer International – Microloans for African women, focusing on sustainable development.

- Opportunity International – Loans, savings, and training for women in developing countries.

- FINCA International – Microfinance services for low-income female entrepreneurs worldwide.

These programs provide funding, mentorship, and resources to empower women in business.

Success Stories of Women Entrepreneurs Who Benefited from Microloans

Microloans have been instrumental in empowering women entrepreneurs worldwide, enabling them to start or expand businesses, achieve financial independence, and contribute to their communities. Here are some inspiring success stories:

Story 1: Jacqueline Mukacyemayire – Rwanda

Jacqueline, a mother of five from Rwanda, transformed her life through microloans. Initially struggling to make ends meet, she received a microloan from World Vision, which she used to purchase a sewing machine. This investment allowed her to start a tailoring business that grew overtime, enabling her to employ 15 people. Her journey from poverty to becoming a successful entrepreneur showcases the profound impact of microfinance.

Source: World Vision

Story 2: Tran Thi Thanh – Vietnam

In Vietnam, Tran Thi Thanh faced financial instability, relying on collecting bamboo shoots and manual labor. Through microfinance loans, she ventured into animal husbandry and sugar cane cultivation. Her business not only provided a stable income for her family but also created seasonal jobs in her community. Her entrepreneurial spirit was recognized at the 2018 Citi Micro-entrepreneurship Awards.

Source: https://visionfund.org

Story 3: Dadirai – Zimbabwe

Dadirai’s life in Zimbabwe was marred by an abusive relationship, leaving her isolated with three children. Joining the MicroLoan Foundation provided her with training in budgeting, business planning, and market research. With this support, she started a business that now sustains her family and restores her dignity and confidence.

Source: MicroLoan Foundation

Lessons Learned

- Financial Independence: Access to microloans enables women to start or expand businesses, leading to self-sufficiency.

- Community Impact: Successful women entrepreneurs often create employment opportunities, fostering community development.

- Empowerment: Beyond economic benefits, microloans boost confidence and social standing, empowering women to take active roles in their societies.

These stories highlight the transformative power of microloans in empowering women, promoting entrepreneurship, and driving socio-economic growth.

How to Apply for a Microloan as a Woman Entrepreneur

Applying for a microloan can be a game-changer for women entrepreneurs seeking to start or expand their businesses. Follow this step-by-step guide to successfully secure funding:

Step 1: Research Available Microloan Programs

Start by identifying microloan providers that cater to women entrepreneurs. Some top options include:

- Grameen America (grameenamerica.org)

- Kiva (kiva.org/borrow)

- SBA Microloan Program (sba.gov)

Step 2: Check Eligibility Requirements

Most microloan programs require applicants to:

- Own or plan to start a small business

- Demonstrate financial need

- Have a business plan or proof of revenue (for existing businesses)

- Provide collateral or a guarantor (in some cases)

Step 3: Prepare Your Application

- Business Plan: Clearly outline your business model, target market, and financial projections.

- Financial Statements: Include income statements, tax returns, and bank statements.

- Personal Identification & Credit History: Some lenders check credit scores, while others prioritize business viability.

Step 4: Submit Your Application & Attend an Interview

- Apply online or in person, depending on the lender.

- Be prepared for an interview where lenders assess your business knowledge and repayment ability.

Step 5: Loan Approval & Disbursement

Once approved, funds are transferred to your business account. Some programs also offer financial literacy training.

Alternatives to Microloans for Women Entrepreneurs

While microloans are a popular option, there are other funding alternatives that women entrepreneurs can consider. Each has its own benefits, depending on the stage and nature of the business. Here are some key alternatives:

- Crowdfunding: Platforms like Kickstarter and GoFundMe allow entrepreneurs to raise small amounts from a large crowd. This is great for businesses with strong community support and innovative ideas. No repayment required builds brand awareness.

- Angel Investors: Angel investors offer personal funds in exchange for equity. They focus on early-stage businesses with growth potential. Larger funding, mentorship, long-term growth.

- Venture Capital (VC): VC firms invest in high-growth startups, typically in tech or healthcare. In exchange for funding, they take equity and provide strategic guidance. Significant funding, scalability, business development support.

- Government Grants: Grants from government programs support women-led businesses, especially those with social or economic impact. No repayment required, often targeted for specific sectors.

- Business Competitions: Entrepreneurs can win funding and exposure through pitch competitions like Cartier Women’s Initiative and SheEO. Funding, visibility, networking.

Choose the funding option that best suits your business stage and goals.

Conclusion

Microloans offer a valuable pathway for women entrepreneurs to access the capital needed to start or grow their businesses. By providing accessible funding and support, these loans empower women to achieve financial independence and contribute to their communities. However, it’s important to explore other funding options, such as crowdfunding, angel investors, and venture capital, to find the best fit for your business needs. With the right resources and determination, women entrepreneurs can overcome financial barriers and build successful, sustainable businesses. Whether you choose a microloan or explore alternatives, the key is to keep pushing forward with confidence, supported by the opportunities available.