Women entrepreneurs are increasingly becoming a formidable force in reshaping industries worldwide. Their innovative approaches, resilience, and unique perspectives have not only led to the creation of successful businesses but have also driven significant economic growth. However, despite their remarkable contributions, women entrepreneurs continue to face substantial challenges, particularly in securing funding. This article delves into the impact of women entrepreneurs, the funding disparities they encounter, and resources available to support their ventures.

The Rise of Women Entrepreneurs and Their Global Impact

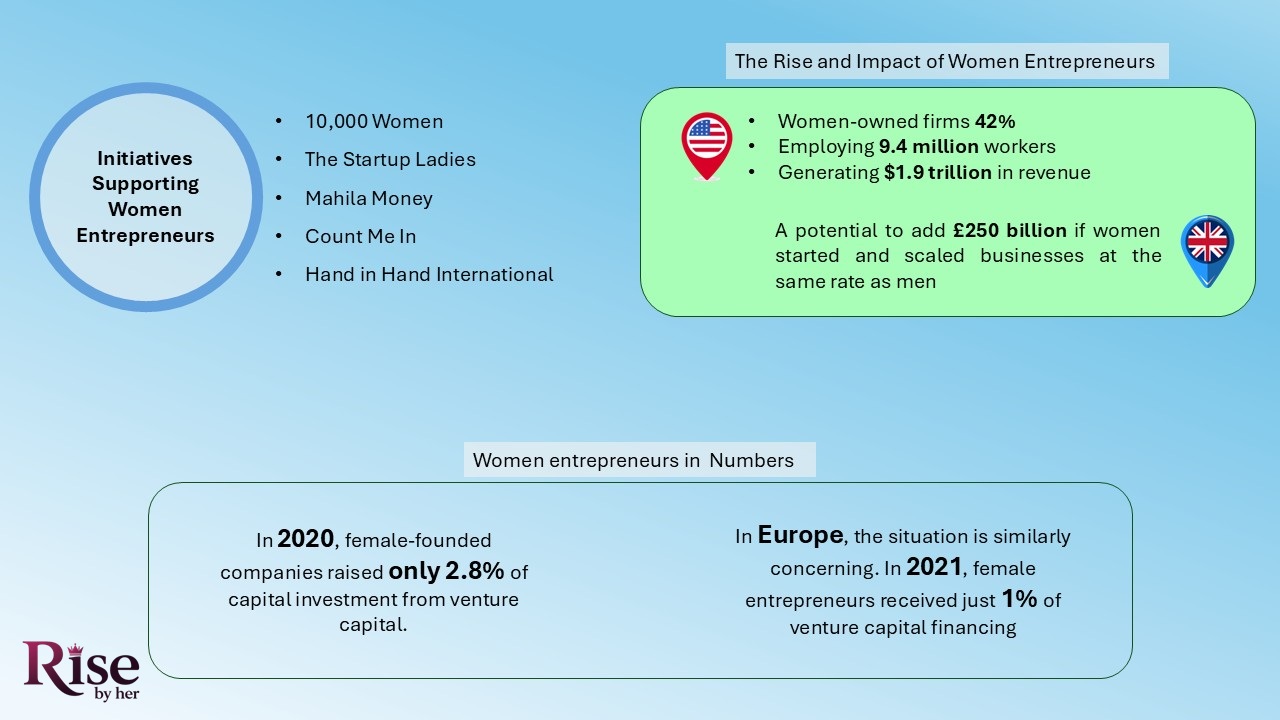

Over the past few decades, the number of women-owned businesses has surged globally. In the United States, for instance, women-owned firms represent 42% of all businesses, employing 9.4 million workers and generating $1.9 trillion in revenue. Similarly, in the United Kingdom, women-led businesses contribute significantly to the economy, with the potential to add £250 billion if women started and scaled businesses at the same rate as men. (The Scottish Sun, 2025)

Beyond numbers, female entrepreneurs bring diverse perspectives that lead to innovative solutions and services. For example, sectors like women’s health and caregiving, historically underfunded, have seen new opportunities identified and addressed by women-led ventures. (Financial times, 2025)

The Funding Gap Women Entrepreneurs Still Face

Despite the growing presence and proven capabilities of women entrepreneurs, significant disparities persist in securing funding. These disparities are evident across various regions and stages of business development, underscoring systemic challenges that hinder the full potential of female-led enterprises.

Global Funding Disparities

In 2020, female-founded companies raised only 2.8% of capital investment from venture capital, marking the highest amount recorded to date. Despite this modest increase, the vast majority of venture capital funding continues to flow to male-led ventures. (Wikipedia, Venture capital)

In Europe, the situation is similarly concerning. In 2021, female entrepreneurs received just 1% of venture capital financing, highlighting a significant gender gap in funding allocation. (Wikipedia, Women in Europe)

These statistics highlight a persistent and global issue: female entrepreneurs face substantial barriers in accessing the capital necessary to start and grow their businesses.

Contributing Factors to Funding Disparities

Several factors contribute to the funding disparities experienced by women entrepreneurs:

- Homophily in Investment Decisions: The tendency of individuals to associate with others who are like themselves, known as homophily, plays a significant role in venture capital funding. With men comprising most venture capitalists, there is a propensity to fund male entrepreneurs, perpetuating the cycle of underrepresentation for women. (Wikipedia, Female entrepreneurs)

- Gender Stereotyping: Investors often hold unconscious biases that align entrepreneurial success with traditionally masculine traits. This bias leads to women entrepreneurs being evaluated more critically and facing higher standards to prove their credibility and potential. (Wikipedia, Female entrepreneurs)

- Differential Questioning by Investors: Research indicates that during pitch sessions, women entrepreneurs are more likely to be asked prevention-focused questions (e.g., addressing potential risks), while men are asked promotion-focused questions (e.g., highlighting potential gains). This discrepancy can influence the perception of the venture’s potential and affect funding outcomes. (Wikipedia, Female entrepreneurs)

Impact of Funding Disparities

The funding gap not only limits the growth of women-led businesses but also has broader economic implications:

- Economic Growth: Addressing the gender gap in entrepreneurship could significantly boost economies. For instance, in the UK, it is estimated that £250 billion could be added to the economy if women started businesses at the same rate as men. (The Scottish Sun, 2025)

- Innovation and Diversity: Women entrepreneurs often venture into underrepresented sectors, bringing unique perspectives and solutions. Their underfunding means missed opportunities for innovation and addressing diverse market needs.

- Business Performance: Studies have shown that female-led firms often outperform their male counterparts. For example, female-founded firms backed by venture capital firm First Round Capital performed 63% better than those led by men. (The Times, 2025)

Addressing the Funding Disparities

To mitigate these disparities, several strategies can be implemented:

- Increasing Diversity Among Investors: Encouraging more women to take on roles as venture capitalists and angel investors can help balance the funding landscape. Diverse investment teams are more likely to recognize and invest in a broader range of opportunities.

- Bias Training for Investors: Implementing training programs to address unconscious biases can lead to more equitable evaluation processes. For instance, some firms have adopted blind and camera-off presentations to focus solely on business potential, reducing bias. (The Times, 2025)

- Supportive Networks and Mentorship: Establishing networks and mentorship programs tailored for women entrepreneurs can provide the support, guidance, and resources necessary to navigate the funding landscape.

By acknowledging and addressing these disparities, the entrepreneurial ecosystem can move towards a more inclusive and equitable environment, unlocking the full potential of women entrepreneurs and driving economic growth.

Programs and Initiatives Empowering Women Entrepreneurs

Recognizing these challenges, several organizations and programs have emerged to support women entrepreneurs:

- 10,000 Women: Launched by Goldman Sachs and the Goldman Sachs Foundation, this initiative aims to foster economic growth by providing business education, mentoring, networking, and access to capital for underserved women entrepreneurs globally. (Wikipedia, 10,000 women)

- Count Me In: This charitable organization offers financial assistance, business coaching, and consulting services to women-owned businesses, helping them scale and achieve economic independence. (Wikipedia, Count Me In)

- The Startup Ladies: A for-profit organization providing resources, educational programs, and networking opportunities for women entrepreneurs, investors, and corporate executives, aiming to address funding and support gaps. (Wikipedia, The Startup Ladies)

- Hand in Hand International: Focused on fighting poverty through job and business creation, this non-profit organization supports women entrepreneurs by offering training and resources to start and sustain small enterprises. (Wikipedia, Hand in Hand International)

- Mahila Money: An Indian financial services platform that provides micro-loans to women entrepreneurs, aiding in business setup, growth, and employment opportunities. (Wikipedia, Mahila Money)

Inspiring Success Stories of Women Entrepreneurs Changing Business

Despite the challenges, numerous women entrepreneurs have broken barriers and achieved remarkable success:

- Farah Kabir: A former Goldman Sachs employee, Kabir co-founded Hanx, a sexual wellness start-up. Despite facing blatant sexism when seeking funding, her company has thrived, highlighting the resilience of women entrepreneurs. (The Times, 2025)

- Annie Rogers: At just 16, Rogers manages two businesses while attending high school. She founded My Voice Communications, offering an innovative communication device for non-verbal individuals, inspired by her friend with cerebral palsy. Her invention has garnered national recognition, showcasing the impact of young female entrepreneurs. (The Courier Mail, 2024)

Funding and Growth Resources for Women Entrepreneurs

In addition to the previously mentioned resources, several other organizations and initiatives offer valuable support to women entrepreneurs seeking funding:

- Women’s World Banking (WWB): Led by Mary Ellen Iskenderian, WWB provides nearly one billion unbanked women with financial services. The organization emphasizes practical solutions such as government-backed loan guarantees and adjustments to collateral requirements to overcome financial barriers. (Reuters, 2024)

- Visa Foundation’s CatalyseHer Programme: This initiative supports women-owned start-ups by offering training, micro-grants, and networking opportunities, aiming to address the challenges women face in starting and scaling businesses. (The Scottish Sun, 2025)

- Astia: A venture capital firm that employs unbiased approaches, such as blind and camera-off presentations, to reduce failure rates and support women-led startups. (Financial times, 2025)

- Small Business Britain’s Campaign with Starling Bank: Aiming to increase the number of female small business owners to 30% by 2030, this campaign offers support, resources, and guidance to aspiring women entrepreneurs. (The Scottish Sun, 2025)

These resources, alongside the previously mentioned initiatives, provide comprehensive support to women entrepreneurs, addressing funding challenges and promoting business growth.

Conclusion

Women entrepreneurs are undeniably reshaping industries and driving economic growth. However, to fully harness their potential, it’s imperative to address the funding disparities they face. By supporting initiatives that promote financial inclusion, offering targeted resources, and challenging systemic biases, we can create an environment where women-led businesses thrive, benefiting economies and societies at large.

References

- The Scottish Sun, 2025. Women struggle to start businesses – but fixing it could deliver £250bn economy boost

- Financial Times, 2025. Wanted: more female voices in venture finance

- Wikipedia, Venture capital. Retrieved from https://en.wikipedia.org/wiki/Venture_capital

- Wikipedia, Women in Europe. Retrieved from https://en.wikipedia.org/wiki/Women_in_Europe

- Wikipedia, Female entrepreneurs. Retrieved from https://en.wikipedia.org/wiki/Female_entrepreneurs

- The Times, 2025. Female-led firms outperform rivals. So why is raising cash so hard?

- Wikipedia, 10,000 women. Retrieved from https://en.wikipedia.org/wiki/10%2C000_Women

- Wikipedia, Count me in. Retrieved from https://en.wikipedia.org/wiki/Count_Me_In_%28charity%29

- Wikipedia, The Startup Ladies. Retrieved from https://en.wikipedia.org/wiki/The_Startup_Ladies

- Wikipedia, Hand in Hand International. Retrieved from https://en.wikipedia.org/wiki/Hand_in_Hand_International

- Wikipedia, Mahila Money. Retrieved from https://en.wikipedia.org/wiki/Mahila_Money

- The Courier Mail, 2024. Retrieved from https://www.couriermail.com.au/lifestyle/qweekend/meet-queenslands-young-entrepreneur-of-the-year/news-story/5a1f676801a88a47075e335f39132a74?utm_source=chatgpt.com

- Reuters, 2024. Mary Ellen Iskenderian’s mission to ensure one billion women have bank accounts

Read more articles and insights here: Women in Business and Entrepreneurship