Introduction

Women entrepreneurs are driving innovation across industries, yet securing funding remains a challenge. Studies show that women-led startups receive less venture capital despite strong financial performance. A well-structured business plan is essential for overcoming these barriers, serving as a roadmap for growth while building credibility with investors and lenders.

Why Women Entrepreneurs Need a Solid Business Plan

A strong business plan is crucial for women entrepreneurs facing funding challenges, gender biases, and limited networks. It helps by:

- Demonstrating financial viability to investors and lenders.

- Providing strategic direction for business growth.

- Strengthening applications for grants and competitions.

The Role of a Business Plan in Securing Funding

Investors fund strategies, not just ideas. A well-prepared business plan:

- Clearly defines the business vision and value proposition.

- Provides market analysis to showcase demand and growth potential.

- Details financial projections and funding requirements.

- Establishes credibility and proves the entrepreneur’s ability to execute.

Trends in Female Entrepreneurship in 2025

Women-led businesses are thriving, with key trends shaping the landscape:

- Growth in women-owned startups, especially in tech and e-commerce.

- More impact-driven businesses focused on sustainability and social change.

- Expansion of women-focused funding sources such as Venture Capital firms and grants.

- Rise of digital and AI-powered business models.

- Increased access to mentorship and networking opportunities.

Understanding the Basics of a Business Plan

A business plan is a structured document outlining a company’s goals, strategies, and financial projections. It serves as a roadmap for success, helping entrepreneurs define their vision, attract investors, and secure funding. A strong business plan not only details the products or services but also includes market research, operational strategies, and financial planning.

Why Investors and Lenders Require a Business Plan

Investors and lenders don’t just fund ideas, they fund well-researched, executable strategies. A solid business plan helps by:

- Demonstrating financial viability – Investors need to see profit potential and a return on investment (ROI).

- Reducing investment risks – Lenders assess risk before approving loans, and a business plan shows risk management strategies.

- Providing clear growth strategies – Investors want to know how the business will scale over time.

- Outlining funding requirements – A business plan explains how much funding is needed and how it will be used.

Key Differences in Business Plans for Women-Led Businesses

Women-led businesses often have unique challenges and opportunities that should be reflected in their business plans:

- Funding Approach – Women entrepreneurs frequently seek grants, microloans, and women-focused investment funds.

- Emphasis on Impact – Many women-led businesses focus on social entrepreneurship, sustainability, and community-driven initiatives, making mission alignment crucial.

- Networking & Mentorship – Highlighting affiliations with women-focused business networks and mentorship programs can strengthen investor confidence.

- Work-Life Balance Strategies – Investors may appreciate strategies that ensure business sustainability while supporting family responsibilities.

A well-crafted business plan tailored to these unique aspects increases the chances of securing funding and scaling successfully. In the next section, we’ll explore the essential components of a business plan that attracts investors.

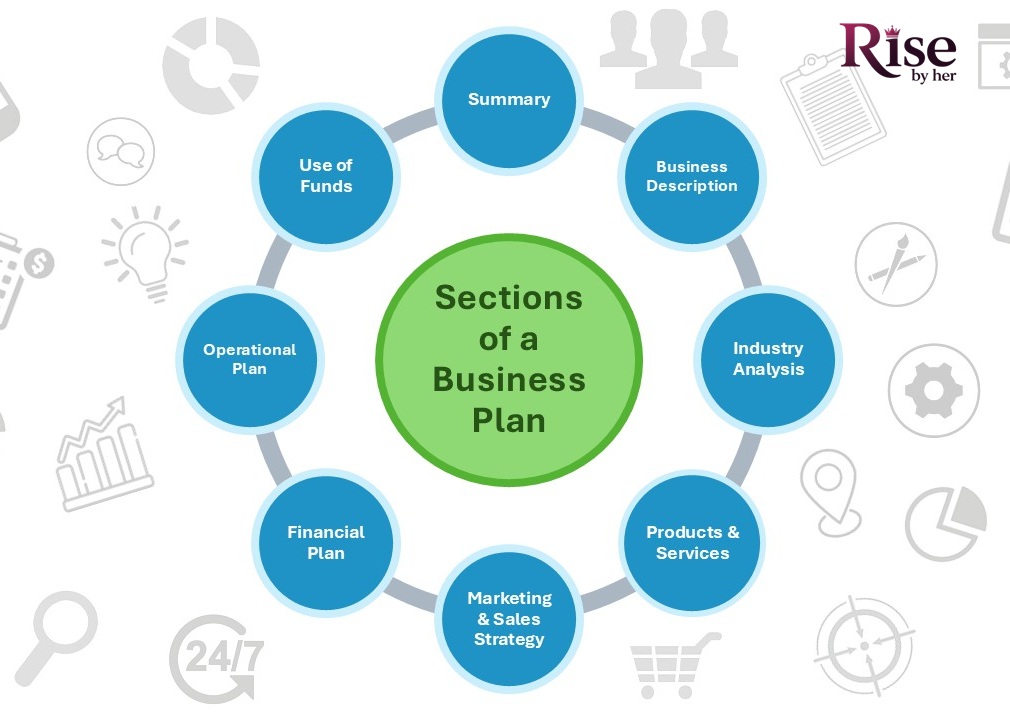

Essential Sections of a Business Plan

A well-structured business plan is crucial for securing funding and guiding business growth. Below are the key sections every business plan should include:

Executive Summary

This is the first section but should be written last. It provides a high-level overview of your business, including:

- Business name and mission statement

- Products or services offered

- Target market and competitive advantage

- Funding requirements and expected return on investment (ROI)

Business Description

This section explains what your business does and why it exists. It includes:

- Your business model (e.g., e-commerce, service-based, retail)

- The problem your business solves

- Your company’s vision and long-term goals

Market Research & Industry Analysis

Investors want data-backed evidence that your business can succeed. This section includes:

- Industry trends and market size

- Target audience demographics and customer needs

- Competitive analysis – Strengths and weaknesses of competitors

Products & Services

Describe your offerings in detail, including:

- Unique Selling Proposition (USP) – What makes your products/services stand out?

- Pricing strategy

- Development plans for future products/services

Marketing & Sales Strategy

Your plan for attracting and retaining customers should cover:

- Marketing channels (SEO, social media, paid ads, influencer partnerships)

- Sales strategy and customer acquisition model

- Branding and positioning strategies

Financial Plan & Projections

This section is critical for investors and lenders. It should include:

- Startup costs and funding requirements

- Revenue model and pricing strategy

- Projected income statement, balance sheet, and cash flow for 3–5 years

Operational Plan

This section details how your business will function daily, covering:

- Business location and logistics

- Technology and tools needed for operations

- Team structure and hiring plans

Funding Request & Use of Funds

If seeking funding, explain:

- How much capital is needed

- How the funds will be allocated (e.g., marketing, product development, staffing)

- Expected ROI for investors

A well-crafted business plan that includes these essential sections not only attracts investors but also provides a clear roadmap for success. In the next section, we’ll discuss how to tailor your plan for different types of funding sources.

Tailoring Your Business Plan for Investors & Lenders

What Investors Look for in Women-Led Businesses

Investors and lenders evaluate women-led businesses based on:

- Scalability & Market Potential – Can the business grow sustainably?

- Strong Financial Projections – Clear revenue models and realistic cash flow.

- Competitive Advantage – What makes the business unique?

- Founder’s Leadership & Vision – Experience, expertise, and business acumen.

- Social Impact & Sustainability – Investors increasingly favor businesses with positive societal impact.

Grants, Loans, and VC Funding Opportunities for Women in 2025

Women entrepreneurs can access various funding sources, including:

- Grants: Non-repayable funds, such as the Cartier Women’s Initiative and Amber Grant.

- Loans: Low-interest options like SBA Women-Owned Business Loans and SheEO Loans.

- Venture Capital (VC): Women-focused investors like BBG Ventures and Astia fund high-growth startups.

Common Mistakes to Avoid in Your Funding Request

To improve funding success, avoid:

- Unclear Financials – Provide detailed, data-backed projections.

- Overly Optimistic Estimates – Keep growth expectations realistic.

- Vague Fund Allocation – Clearly explain how funds will be used.

- Ignoring Risks – Address potential challenges and mitigation strategies.

- Generic Applications – Tailor each pitch to the specific funding source.

Writing Tips for an Impactful Business Plan

A well-crafted business plan should be clear, engaging, and persuasive. Whether presenting it to investors or publishing it online, these strategies will help make your plan more impactful.

SEO Tips for Online Visibility (If Publishing It Online)

If you’re sharing your business plan on a website or blog, optimizing it for SEO ensures it reaches the right audience. Here’s how:

- Use Relevant Keywords – Include terms like “women entrepreneurs,” “business funding for women,” and “how to write a business plan” throughout the content.

- Optimize Headings & Subheadings – Use H1, H2, and H3 tags for better readability and search engine ranking.

- Internal & External Links – Link to relevant pages on your website and authoritative sources, such as funding programs.

- Engaging Meta Description – Write a compelling summary (under 160 characters) with keywords to increase click-through rates.

- Mobile Optimization – Ensure your document is mobile-friendly, as many users access content via smartphones.

Using Storytelling to Showcase Passion & Vision

Investors want to connect with your mission and purpose. Storytelling makes your business plan compelling and memorable:

- Start with a Personal Narrative – Share what inspired you to start your business.

- Highlight Real-Life Impact – Include testimonials, case studies, or examples of how your product/service solves a problem.

- Make It Relatable – Investors support businesses they believe in, so convey your values and long-term vision authentically.

Creating a Visually Appealing & Well-Structured Document

A well-structured, visually appealing business plan increases readability and professionalism:

- Use Clear Headings & Bullet Points – Break down information for easy scanning.

- Incorporate Infographics & Charts – Visual data improves understanding and engagement.

- Choose a Clean Layout & Font – Stick to professional fonts (Arial, Times New Roman) and a simple color scheme.

- Include a Table of Contents – Helps readers navigate quickly.

A polished business plan not only impresses investors but also ensures your message is clear and impactful.

Tools & Resources for Women Entrepreneurs

Women entrepreneurs have access to various free resources that can help with business planning, funding, and networking.

Free Business Plan Templates

Creating a business plan from scratch can be overwhelming. These free templates simplify the process:

- SBA (Small Business Administration) Business Plan Template – A structured template covering all essential sections.

- Bplans Free Templates – Industry-specific business plan samples for guidance.

- Score.org – Offers step-by-step business planning tools.

Government & Private Funding Sources

Funding is crucial for business success. Women entrepreneurs can explore:

- Government Grants:

- Women’s Business Centers (WBCs) – Provide funding and training.

- Grants.gov – Lists federal grants available for small businesses.

- Private Funding Sources:

- Cartier Women’s Initiative – Grants for impact-driven women entrepreneurs.

- SheEO – Peer-funded loans with zero-interest repayment.

- Tory Burch Foundation Capital Program – Provides affordable loans for women-led businesses.

- Venture Capital & Angel Investors:

- BBG Ventures – Invests in female-founded tech startups.

- Golden Seeds – A network of angel investors funding women entrepreneurs.

Online Communities & Mentorship Programs

Networking and mentorship are key to business success. Consider joining:

- Women’s Business Enterprise National Council (WBENC) – Provides certification and networking opportunities.

- Ellevate Network – A global community supporting women professionals.

- Ladies Who Launch – A nonprofit helping women scale their businesses through funding and mentorship.

- Facebook & LinkedIn Groups – Join business-focused communities like Women Entrepreneurs Network for peer support.

Conclusion & Next Steps

Starting a business is an exciting yet challenging journey, and a well-prepared business plan significantly improves your chances of success.

Encouragement to Act

Your business plan is more than just a document—it’s your blueprint for success. Whether you’re seeking funding, launching your first product, or scaling operations, taking the time to craft a strong business plan will set you apart. Don’t wait for the perfect moment—start today.

Where to Seek Feedback on Your Business Plan

Before submitting your business plan to investors or lenders, get feedback from:

- Business Mentors & Advisors – Join mentorship programs or seek guidance from experienced entrepreneurs.

- Small Business Development Centers (SBDCs) – Many offer free business plan reviews.

- Peer Networks & Online Forums – Share your draft with women entrepreneur communities for constructive criticism.

- Industry Experts & Coaches – Consider hiring a business consultant for a professional review.