What Is Decentralized Finance (DeFi) and Why It Matters for Women

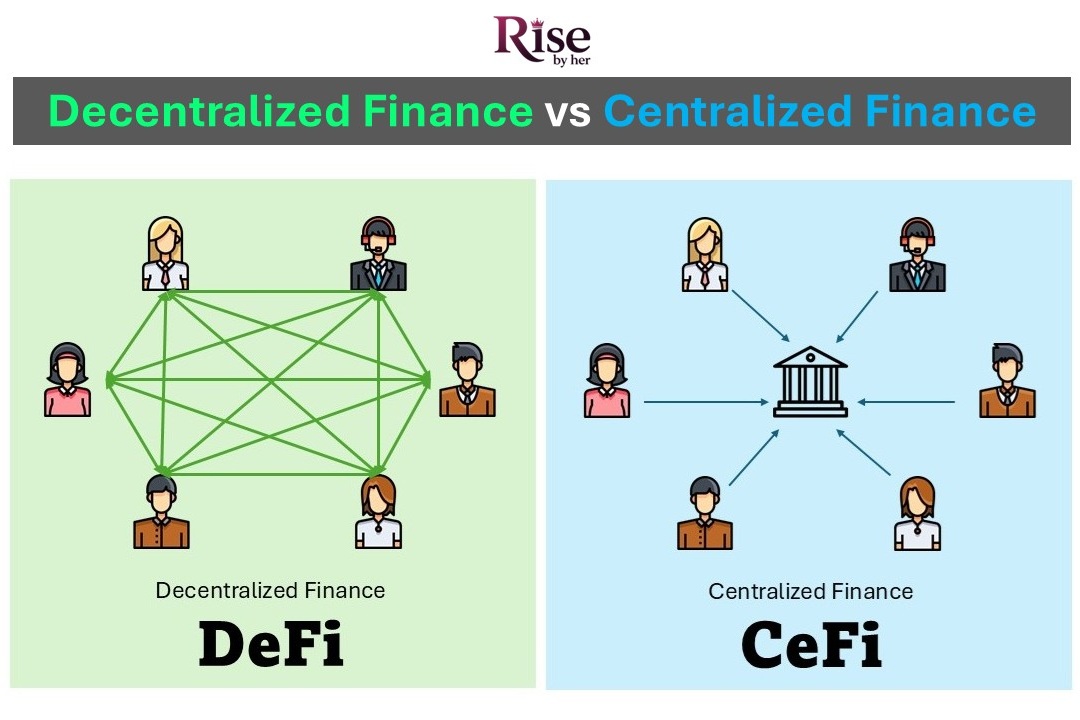

In today’s fast-changing financial world, Decentralized Finance, or DeFi, is rewriting the rules of money. But what exactly is DeFi, and why should women pay attention to it in 2026?

Put simply, DeFi is a financial system built on blockchain technology, a digital alternative to traditional banking that removes the need for banks, brokers, or even credit checks. It allows anyone with an internet connection and a crypto wallet to save, invest, lend, borrow, and earn interest, all without needing permission from institutions. It’s often referred to as “open finance,” and that openness is exactly what makes it so powerful.

But here’s the bigger picture: DeFi isn’t just about technology, it’s about empowerment. For women around the world, especially those underserved or ignored by traditional banks, DeFi provides a new gateway to financial independence. It offers a chance to take control of your money, make it grow, and participate in a financial system that isn’t gatekept by legacy structures.

In many parts of the world, women still face barriers to accessing credit, owning assets, or even opening a bank account. With DeFi, those barriers disappear. No one asks for your gender, your income level, or your approval rating. You simply connect your wallet and go.

In 2026, with more women entering the Web3 space, learning about “what is DeFi” and how it works is not just smart, it’s essential. Whether you’re an entrepreneur, investor, freelancer, or simply curious about crypto, DeFi offers tools that can help you build wealth on your own terms.

So, if you’ve ever felt locked out of the financial system or unsure where to start investing, this is your moment. DeFi is still young, and there’s room at the table. And in this blog, we’ll show you exactly how to get started.

How DeFi Helps Women Take Control of Their Finances

Imagine a financial world where you don’t need a credit score to get a loan, pay zero bank fees, and can earn interest just by holding your assets, all from your smartphone. That’s exactly what Decentralized Finance (DeFi) offers, and it’s transforming how women approach money.

Access to Global Finance Without Credit Scores

Traditional banks often create barriers for women, especially single mothers, freelancers, or women in developing regions. Many are denied access to loans, investment opportunities, or business capital due to rigid credit systems. DeFi bypasses these outdated requirements. With just a crypto wallet, any woman, anywhere in the world, can access a range of financial services 24/7.

This means no more gatekeeping. Whether you’re in New York or Nairobi, you can participate in global finance on equal footing.

Lower Fees and More Control Over Your Money

Tired of high transaction fees, monthly maintenance charges, or long processing times? With DeFi, you’re in full control. Transactions often cost pennies, and funds are transferred in minutes, not days. Unlike traditional institutions that hold your money and charge you to access it, DeFi platforms let you manage your own funds through smart contracts and secure wallets.

This level of control is a game-changer for women who want financial independence without relying on institutions that may not always serve their best interests.

Save, Invest, and Earn Interest Independently

In DeFi, you can deposit your crypto and start earning passive income immediately through mechanisms like staking, lending, or yield farming. It’s similar to putting money into a savings account, only the returns are often much higher.

And because you’re not tied to a bank, you can grow your wealth without red tape. For women looking to fund businesses, save for a home, or build generational wealth, these DeFi tools open up powerful possibilities.

Beginner-Friendly DeFi Tools to Start Growing Wealth

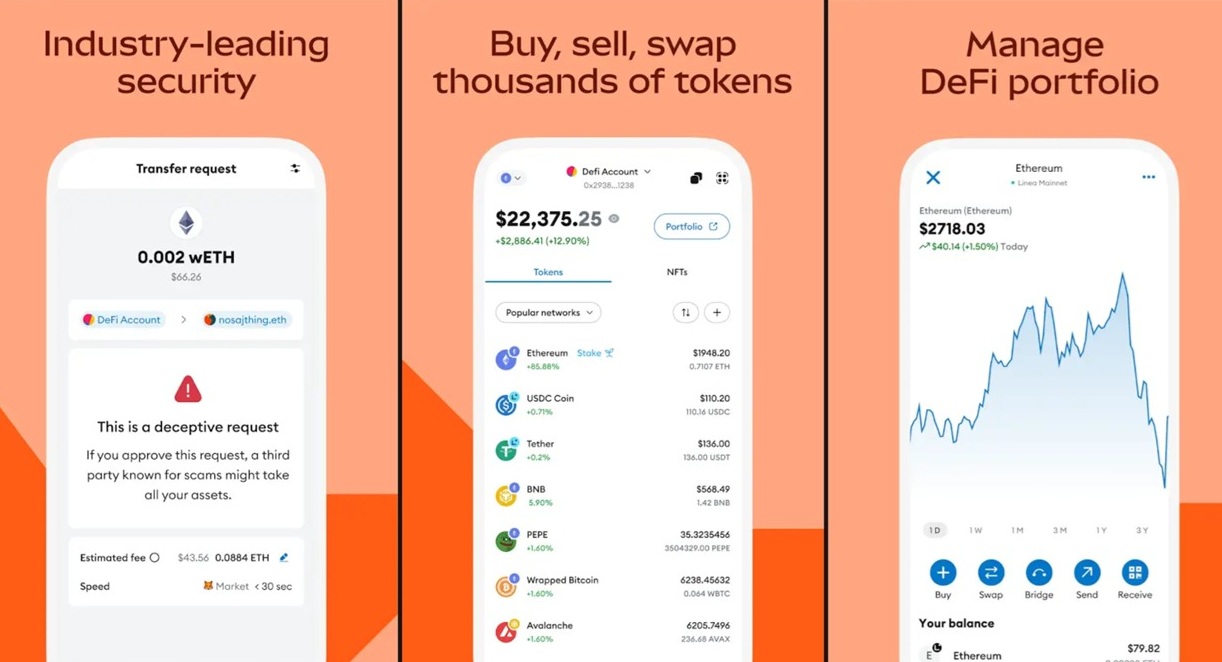

Getting started with Decentralized Finance (DeFi) doesn’t have to be intimidating. In fact, with the right tools, any woman can dive into DeFi, even with zero technical background. Here are some of the best DeFi apps for beginners that are user-friendly, secure, and mobile-ready to help you start taking control of your finances.

MetaMask: Your Gateway to DeFi

If you’re new to DeFi, MetaMask is your first stop. It’s a free crypto wallet (available as a browser extension or mobile app) that allows you to store, send, and receive digital assets securely. Think of it as your digital purse, you’ll use MetaMask to connect to DeFi platforms, sign transactions, and manage your funds.

- Why women love it: Simple interface, secure private key management, and quick setup.

- Pro tip: Always write down your seed phrase and never share it; this is your only recovery key.

Aave & Compound: Earn by Lending or Borrowing

Once your wallet is ready, you can start growing your assets with Aave or Compound, two of the most popular DeFi lending platforms.

- How they work: You deposit crypto (like USDC or ETH) into a smart contract and earn interest over time. You can also borrow against your crypto; no credit check needed.

- Why they’re beginner-friendly: clean dashboards, stable interest rates, and strong community support.

Uniswap: Swap Crypto Instantly

Need to exchange one cryptocurrency for another? Uniswap lets you swap tokens directly from your wallet, no sign-up or ID required.

- Why women should try it: No centralized exchange, fast swaps, and full control over your funds.

- Perfect for: Diversifying your crypto, trading tokens, or investing in new DeFi projects.

Zerion & DeBank: Track Your Portfolio Like a Pro

Once you’re active in DeFi, it helps to keep an eye on your assets. Zerion and DeBank are sleek, mobile-friendly apps that show your total balance, investments, loans, and DeFi activity in one place.

- Why they’re helpful: Real-time portfolio tracking, simple charts, and DeFi protocol integration.

- Bonus: You can connect multiple wallets and even get alerts on performance.

Quick Safety Tips for DeFi Beginners

- Always double-check website URLs to avoid phishing scams.

- Use a hardware wallet (like Ledger) for large amounts.

- Enable two-factor authentication (2FA) on all connected platforms.

- Never share your private key or seed phrase. Ever.

With these tools, you don’t need to be a tech expert to start your DeFi journey. Whether you want to save, invest, swap, or track, these apps are built to make your experience simple, safe, and powerful.

DeFi Risks Every Woman Should Understand Before Investing

DeFi opens exciting opportunities for women to gain financial freedom, but just like with any investment or new technology, it comes with its risks. Being aware of these risks will help you move smarter, protect your money, and avoid common pitfalls in 2026 and beyond.

Volatility of Crypto Markets

One of the first things to understand is that crypto prices can change rapidly, sometimes by double-digit percentages in a single day. That means if you’re investing in tokens or providing liquidity, your returns might go up… or down. This is called market volatility, and it’s very common in DeFi.

- Tip: Start with stablecoins (like USDC or DAI), which are designed to stay pegged to the US dollar, for lower-risk entry.

- Mindset: Don’t invest more than you’re willing to lose and always plan long-term.

Scams, Rug Pulls, and Shady Projects

Unfortunately, not all DeFi projects are legit. Some are created by anonymous teams that disappear with investor funds, known as a “rug pull.” Others might be cleverly disguised phishing attacks or fake tokens that promise high returns but are designed to drain your wallet.

- Tip: Only use verified platforms (like Aave, Compound, or Uniswap), check reviews, and do your own research.

- Rule: If it sounds too good to be true, it probably is.

How to Protect Your Wallet from Phishing

The biggest threat in DeFi is often human error. Phishing scams are everywhere, fake websites, fake customer support, or direct messages asking for your wallet info.

- Golden rule: Never share your seed phrase or private key, even if someone claims to be from customer support.

- Check URLs carefully: fake sites often look nearly identical to real ones.

- Bookmark official sites of DeFi tools you use.

Use Hardware Wallets and Multi-Signature Tools

If you’re serious about security (and you should be), using a hardware wallet like Ledger or Trezor adds a strong layer of protection. These physical wallets store your private keys offline, making them nearly impossible to hack.

For even more control, consider multi-signature wallets, which require more than one person or device to approve a transaction, great for women managing family funds or business finances.

- Hardware wallet = personal vault

- Multi-sig = shared protection with trusted parties

How Women Can Earn Passive Income with DeFi

Imagine your money working for you; even while you sleep. That’s the promise of passive income, and with Decentralized Finance (DeFi), it’s more accessible than ever for women in 2026. Whether you’re looking to grow your savings, supplement your income, or invest for the future, DeFi offers powerful tools to earn without needing a full-time financial background.

Let’s break it down.

What Is Yield Farming in DeFi?

Yield farming is one of the most popular ways to earn passive income with DeFi. It involves lending or staking your crypto in liquidity pools and earning rewards, usually in the form of additional tokens.

- Example: On platforms like Yearn.Finance or Curve, you can deposit stablecoins like USDC or DAI and start earning interest automatically.

- Think of it as a high-yield savings account, but without the bank.

Staking Crypto for Beginners

Staking is a simpler option for beginners. It means locking up a cryptocurrency to support the network’s security and earn rewards in return like earning dividends.

- Popular staking tokens: ETH, SOL, ATOM

- Beginner-friendly platforms: Lido, Coinbase, or Binance (staking section)

- Rewards: Typically range from 4% to 12% annually depending on the token

Why women love it: No complicated setups, just stake and earn.

Liquidity Provision: Be the Bank

With liquidity provision, you’re supplying tokens to decentralized exchanges like Uniswap or Balancer so others can trade, and you get a share of the trading fees.

- You’ll usually need to provide two tokens in equal value (like ETH and USDC).

- Great for those ready to explore a bit more of the DeFi ecosystem.

Warning: Be aware of impermanent loss, when token prices shift, your returns may vary. Start small!

Best Platforms with Low Entry Barriers

These beginner-friendly platforms let you start earning $10 to $50, and offer intuitive dashboards:

- Zerion: Connect your wallet and explore DeFi yield options

- Aave: Lend stablecoins and earn passive interest

- ReactorFusion or Beefy Finance: Auto-compound your earnings

- Lido: Stake ETH without running your own validator

DeFi vs Traditional Savings Accounts

Let’s compare:

| Method | Average Return | Accessibility | Middlemen |

| Traditional Bank Savings | 0.5% – 2% | High | Yes (banks) |

| DeFi Yield Farming | 5% – 15%+ | Medium | No |

| DeFi Staking | 4% – 12% | Easy | No |

| Liquidity Pools | Varies (up to 20%+) | Medium | No |

With DeFi, your returns can be much higher, and you stay in control of your assets 24/7.

DeFi Education Platforms to Learn and Grow Confidently

Getting started with Decentralized Finance (DeFi) can feel intimidating, but it doesn’t have to be. Today, there are more resources than ever designed specifically for women who want to learn DeFi, understand Web3, and build financial confidence in 2026 and beyond.

Whether you’re a total beginner or looking to deepen your knowledge, these DeFi education platforms for women can help you level up at your own pace.

Top DeFi Courses for Women

a. SheFi: Empowering Women in Web3

SheFi is one of the leading DeFi education communities for women, founded by Maggie Love. It offers structured cohorts, masterclasses, and an inclusive community where women can learn about crypto, DeFi, and investing.

- Beginner-friendly, supportive space

- Hands-on lessons on wallets, staking, NFTs, and DAOs

- Great for networking with women already in the industry

b. DeFi University

DeFi University is a comprehensive learning hub that explains DeFi tools and protocols step-by-step. Ideal for those who want to understand the mechanics behind platforms like Aave, Curve, and Uniswap.

- Tutorials, articles, and roadmap-style courses

- No tech background required

- Visual, easy-to-understand formats

YouTube Creators Teaching DeFi to Beginners

YouTube is packed with free DeFi education. Here are some creators that simplify complex topics, including a few who speak directly to women in finance:

- CryptoWendyO: Covers crypto and DeFi trends with a relatable tone

- Girl Gone Crypto: Explains DeFi and blockchain in a fun, approachable way

- Finematics: Visual breakdowns of DeFi concepts like liquidity pools and staking

Blogs and Newsletters for Women in Web3

- Bankless: Great for intermediate-level DeFi insights and trends

- Women in Blockchain Newsletter: Updates and interviews with female leaders in crypto

- Coindesk Learn: Educational guides on DeFi, NFTs, and crypto security

Tip: Subscribe to newsletters to stay updated without feeling overwhelmed.

Join Online Communities & Discords

Learning is easier when you’re not alone. Join these inclusive spaces where you can ask questions, share tips, and get inspired:

- SheFi Discord: Connect with women actively learning and investing in DeFi

- Rabbithole Discord: Earn NFTs and crypto while learning hands-on

- Stacker Chats: Community for women and non-binary folks in tech and Web3

Bonus: Follow hashtags like #WomenInWeb3 and #CryptoForWomen on X (formerly Twitter) for daily tips and role models.

Conclusion: Your Financial Future Is in Your Hands

Decentralized Finance isn’t just a tech trend, it’s a tool for transformation. For women ready to take ownership of their finances in 2026, DeFi offers real freedom: the freedom to earn, invest, save, and grow on your own terms.

You don’t need permission from a bank. You don’t need perfect credit. You don’t even need to be a tech expert. All you need is curiosity, courage, and a willingness to start small.

The DeFi space is still evolving, which means you’re not late, you’re early. That’s where the opportunity lies. Whether you’re building wealth, launching a business, or just exploring new ways to manage money, DeFi gives women the power to lead the future of finance.

So, go ahead, set up your first wallet, try out a beginner-friendly platform, and join a supportive community. Your journey to financial independence starts now.

Because when women take control of money, they change the world.

Explore more on: