Index fund investing does not have to be complicated or intimidating. In 2026, more women entrepreneurs are choosing index funds as a simple, low-stress way to grow wealth while staying focused on building their businesses. With minimal time, lower risk, and long-term growth potential, index fund investing offers a smart path to financial confidence without needing to be a market expert.

So, what exactly is index fund investing? In simple terms, an index fund is a type of investment that tracks a group of companies (like the S&P 500) allowing you to invest in hundreds or even thousands of stocks at once. That means less risk, more diversification, and minimal effort on your part. It’s a set-it-and-forget-it strategy perfect for busy women juggling businesses, families, and personal goals.

As a female entrepreneur, your money should be working just as hard as you are. Index funds offer low fees, consistent long-term growth, and passive income potential, without the need to constantly monitor the stock market. It’s no wonder so many smart women are shifting away from stock-picking and diving into this more stable investment path.

In this beginner-friendly guide, you’ll learn how index funds work, why they’re ideal for women business owners, which ones to consider in 2026, and how to get started with confidence. Whether your goal is financial independence, early retirement, or funding your next big business idea, this guide is designed to support your journey every step of the way.

Ready to make your money grow? Let’s break down index fund investing: one smart step at a time.

What Is Index Fund Investing and How Does It Work?

If you’re a female entrepreneur looking for a simple, stress-free way to grow your money, index fund investing might be your new best friend. It’s one of the smartest and most beginner-friendly ways to build wealth without needing to study the stock market every day.

What Is an Index Fund?

An index fund is a type of investment that tracks the performance of a specific market index, such as the S&P 500, Nasdaq 100, or Dow Jones. Instead of trying to pick individual stocks, you’re buying into an entire collection of companies; automatically.

Think of it like buying a fruit basket instead of picking out individual apples, bananas, and oranges. You get a little bit of everything, which reduces your risk and increases your potential for long-term gains.

Index Funds vs. Mutual Funds vs. Stock Picking

- Index Funds are passively managed and follow the market. This keeps fees low and performance consistent.

- Mutual Funds are often actively managed, meaning someone is choosing stocks for you (usually at a higher cost).

- Stock Picking involves selecting individual companies to invest in. It can be exciting, but it’s risky, time-consuming, and often requires deep knowledge.

Why Index Funds Are Ideal for Female Entrepreneurs

As a busy woman running a business, your time is valuable. Index funds let you invest passively, with no need to watch the market daily or stress your portfolio.

Benefits include

- Low fees: More of your money stays invested.

- Instant diversification: Spread across hundreds of companies to lower your risk.

- Long-term growth: Historically strong performance when held over time.

- Set it and forget it: Perfect for entrepreneurs juggling multiple responsibilities.

Whether you’re saving for retirement, financial independence, or your next big idea, index fund investing for women entrepreneurs is a smart, low-stress way to start building real wealth.

Why Women Entrepreneurs Should Invest in Index Funds in 2026

In 2026, more women than ever are building businesses, growing wealth, and taking control of their financial futures. If you’re a female entrepreneur, investing in index funds is one of the smartest financial moves you can make, especially if you’re aiming for long-term stability and financial freedom.

The Rise of Female Wealth & Investing Power

According to Fidelity’s 2023 report, women now control over $10 trillion in U.S. financial assets, a number expected to triple by 2030. More women are launching startups, managing households, and investing for their futures. But despite these strides, many women still hesitate to invest due to lack of time or confidence. That’s where index funds come in.

Why Index Funds Work for Women in Business

Index fund investing is low-maintenance, reliable, and perfectly suited to the demands of entrepreneurial life.

Here’s why more female founders are turning to index funds:

- Build retirement savings: Contribute to an IRA or solo 401(k) and let your money grow passively.

- Emergency fund booster: Earn higher returns than a regular savings account without taking huge risks.

- Generational wealth creation: Diversify early and watch your investments grow over time for your children or future goals.

- No need to actively trade: Forget trying to time the market or analyze stock-index funds do the work for you.

- Time-efficient: As a busy entrepreneur, you can invest once a month and let compound interest do the rest.

Long-Term Goals, Long-Term Gains

Index funds align beautifully with long-term financial goals like early retirement, business expansion, or financial independence. They give you the ability to grow wealth in the background while you focus on running your business.

Whether you’re just getting started or looking to diversify your income streams, index fund investing for female entrepreneurs is a powerful, passive way to build your financial future.

Best Index Funds to Consider for Long-Term Growth in 2026

Choosing the right index funds is key to building a strong, passive income portfolio. Whether you’re a busy female entrepreneur or just starting your investment journey, these top-performing index funds offer a balance of growth, stability, and long-term potential. Below are some of the best index funds for women to consider in 2026, including their fees, performance trends, risk levels, and ideal use cases.

S&P 500 Index Funds (e.g., VOO, SPY)

- What it is: Tracks the top 500 U.S. companies (think Apple, Amazon, Microsoft).

- Popular choices: Vanguard S&P 500 ETF (VOO), SPDR S&P 500 ETF Trust (SPY)

- Why it’s great: Diversified exposure to large-cap U.S. stocks.

- Fees: Low expense ratios (VOO – 0.03%, SPY – 0.09%)

- Risk Level: Moderate

- Perfect for: Long-term wealth building, retirement portfolios

Total Stock Market Funds (e.g., VTI)

- What it is: Covers the entire U.S. stock market (large-cap, mid-cap, small-cap).

- Popular choice: Vanguard Total Stock Market ETF (VTI)

- Why it’s great: Broader exposure than the S&P 500.

- Fees: 0.03% expense ratio

- Risk Level: Moderate

- Perfect for: Entrepreneurs looking for long-term, all-market exposure

International Index Funds (e.g., VXUS)

- What it is: Invests in companies outside the U.S.

- Popular choice: Vanguard Total International Stock ETF (VXUS)

- Why it’s great: Adds global diversification to your portfolio.

- Fees: 0.07% expense ratio

- Risk Level: Medium to high (based on global markets)

- Perfect for: Women seeking global growth opportunities

ESG & Women-Focused Index Funds (e.g., SHE by SPDR)

- What it is: Funds focused on environmental, social, and governance (ESG) principles or gender diversity.

- Popular choice: SPDR SSGA Gender Diversity Index ETF (SHE)

- Why it’s great: Supports companies with strong female leadership.

- Fees: 0.20% expense ratio

- Risk Level: Moderate

- Perfect for: Values-based investors, socially conscious women

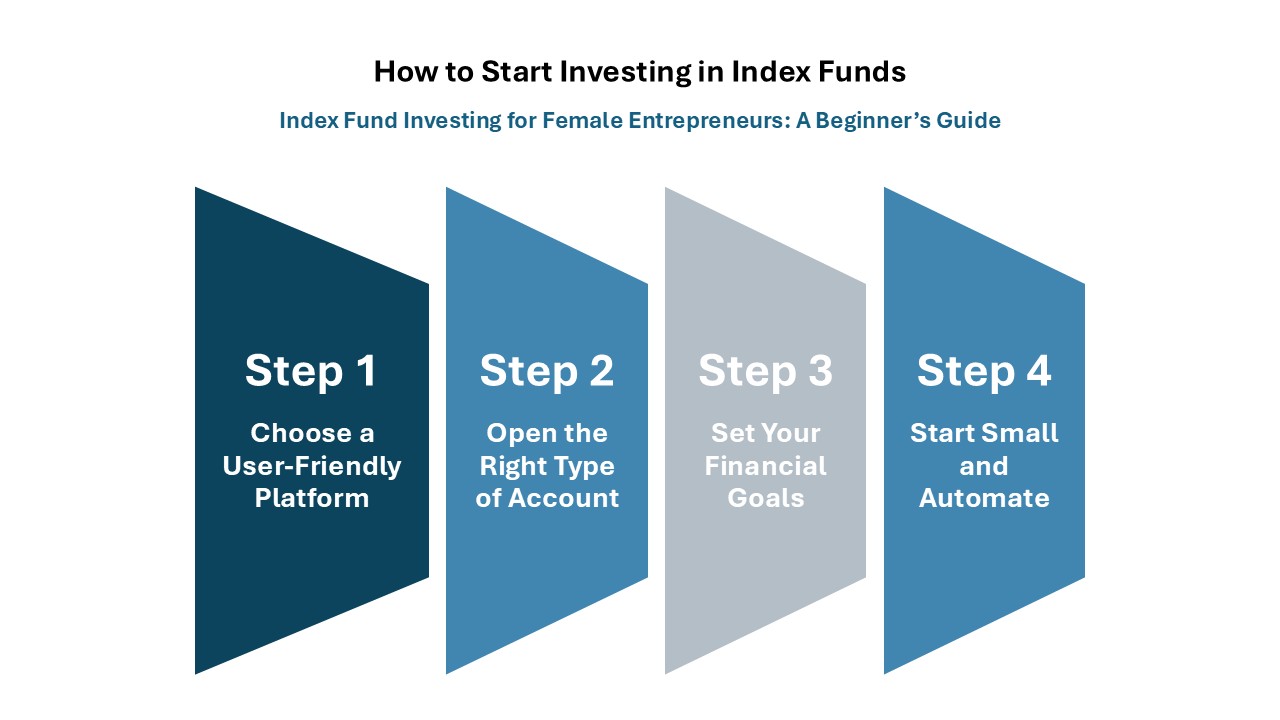

How to Start Investing in Index Funds Step by Step

If you’re ready to build wealth on autopilot, index fund investing is one of the smartest moves you can make. And the good news? Getting started is simpler than you might think, even if you’ve never invested a dollar before. Here’s a step-by-step guide tailored for female entrepreneurs and beginners looking to grow their money passively.

Step 1: Choose a User-Friendly Brokerage Platform

Start by picking a trusted investment platform. Most are free to open and easy to use:

- Vanguard: Great for long-term investors with low fees.

- Fidelity: Offers zero-commission trading and lots of educational tools.

- Charles Schwab: Ideal for beginners with excellent customer support.

- Robinhood: User-friendly app for mobile investing on the go.

Step 2: Open the Right Type of Account

Depending on your financial goals, you’ll want to choose the appropriate account:

- Roth IRA or Traditional IRA: Best for retirement savings with tax benefits.

- Individual/Taxable Account: More flexible and perfect for long-term wealth outside retirement.

Step 3: Set Your Financial Goals

Ask yourself:

- Are you saving for retirement?

- Building an emergency fund?

- Looking for long-term passive income?

Knowing your “why” helps determine how much to invest and which funds to choose.

Step 4: Start Small and Automate

You don’t need a fortune to begin. Start with what you can, $50, $100, or more. Set up automatic monthly contributions and let compound growth do the heavy lifting.

Common Index Fund Investing Mistakes to Avoid

Even though index fund investing is one of the simplest and most beginner-friendly ways to build wealth, there are still some common pitfalls that can slow down your financial progress, especially for busy female entrepreneurs.

Let’s walk through the biggest mistakes to avoid so your money works for you, not against you.

Trying to Time the Market

One of the most common mistakes is trying to “buy low and sell high.” Sounds easy in theory, but in practice, even professional investors get it wrong.

Why it’s risky: The market is unpredictable. Waiting for the “perfect” moment often means you stay out too long and miss out on gains.

Better strategy: Stay consistent. Invest regularly and let compound growth take the wheel.

Ignoring Fees and Taxes

Low fees are one reason index funds are so powerful, but not all platforms or fund types are equal.

- Watch for: High expense ratios or hidden brokerage fees.

- Tax traps: Selling index funds too soon may lead to capital gains taxes.

Skipping Consistent Contributions

You don’t need a lump sum to start. Inconsistent investing is one of the biggest growth blockers.

Solution: Automate monthly contributions, even small ones add up over time.

Forgetting About Diversification

While index funds are naturally diversified, make sure you’re not putting all your money into one type (like just the S&P 500).

Consider: Adding international or sector-specific funds for better balance.

Avoiding these mistakes can help you stay confident, consistent, and on track toward financial freedom, without all the stress.

Essential Tools and Resources for Women New to Index Fund Investing

Starting your index fund investing journey doesn’t have to feel overwhelming, especially when there are so many helpful tools and communities designed just for women. Whether you’re a busy entrepreneur, side hustler, or full-time mompreneur, these platforms and groups can guide your next smart money move.

Top Investment Apps and Platforms for Beginners

These user-friendly apps make it easy to research, invest, and manage your portfolio from your phone.

- Wealthfront: Great for automated investing with goal tracking and tax-loss harvesting.

- Betterment: Beginner-friendly robo-advisor that builds diversified portfolios based on your goals.

- Vanguard: Known for its low-cost index funds like VTI and VOO. Ideal for long-term investors.

- M1 Finance: Combines automated investing with customization. You can build your own “pie” of index funds.

Blogs, Podcasts & Courses by Women, for Women

Sometimes the best advice comes from those who understand your journey.

- HerMoney (by Jean Chatzky): Offers empowering money advice tailored for women, from investing to career growth.

- Ellevest: An investing platform + learning hub created specifically for women to close the gender wealth gap.

- The Clever Girls Know Podcast: Hosted by Bola Sokunbi of Clever Girl Finance, it breaks down complex topics like index fund investing into relatable, actionable insights.

Communities for Support & Accountability

Investing is easier (and more fun) when you’re not doing it alone.

- Facebook Groups: Try Women Investing to Financial Freedom or Smart Money Mamas Investing Circle.

- Reddit: Subreddits like r/femalefinancialindependence and r/investing are packed with real advice and personal wins.

- Ellevest Community Hub: Connect with other women learning to invest and grow their wealth.

By using these tools and tapping into supportive communities, you’re not just learning—you’re building a lifestyle of long-term wealth. And you’re not doing it alone.

Make Index Funds Part of Your Long-Term Wealth Strategy

If you’re a female entrepreneur, there’s never been a better time to take charge of your financial future, and index fund investing is one of the smartest ways to start. With low fees, broad diversification, and the power of long-term growth, index funds give you a solid foundation to build wealth without the stress of daily market decisions.

Whether your goal is to retire early, build an emergency fund, or leave a legacy for your family, index funds can help you get there. They’re perfect for busy women who want their money to work hard while they focus on building their businesses or raising families.

Remember, you don’t need to be a financial expert to begin. The key is taking small, intentional steps today:

- Open an account on a trusted platform like Vanguard or Betterment

- Choose a few diversified index funds like VTI or SPY

- Set a monthly auto-invest amount (no matter how small) and stick with it

Start small, stay consistent, and let compound growth do the heavy lifting.

If this guide helped you feel more confident about index fund investing, don’t stop here. Subscribe to my newsletter for weekly insights on building wealth as a woman, simple tips, investing updates, and financial empowerment straight to your inbox.

You’ve got the mindset, now let’s build the money to match. Your future self will thank you.