Are you struggling to save money, pay off debt, or plan for the future? Wondering how to take control of your finances without feeling overwhelmed? Short-term financial goals are the answer. They break big financial ambitions into manageable, actionable steps that deliver quick wins and build confidence.

Why should women focus on short-term goals? Because they create a clear roadmap to financial independence, reduce stress, and help you make smarter money decisions today. Whether it’s building an emergency fund, paying down high-interest debt, or starting to invest, these goals set the foundation for long-term wealth.

The benefits are real: improved budgeting skills, more savings, faster debt repayment, and greater financial security. You don’t need a six-figure salary or advanced finance knowledge to get started, small, consistent actions can have a big impact.

In this guide, you’ll discover 10 practical, achievable short-term financial goals designed specifically for women. By following them, you’ll gain control over your money, feel empowered, and start building wealth step by step in 2026.

1. How to Create a Realistic Monthly Budget for Women

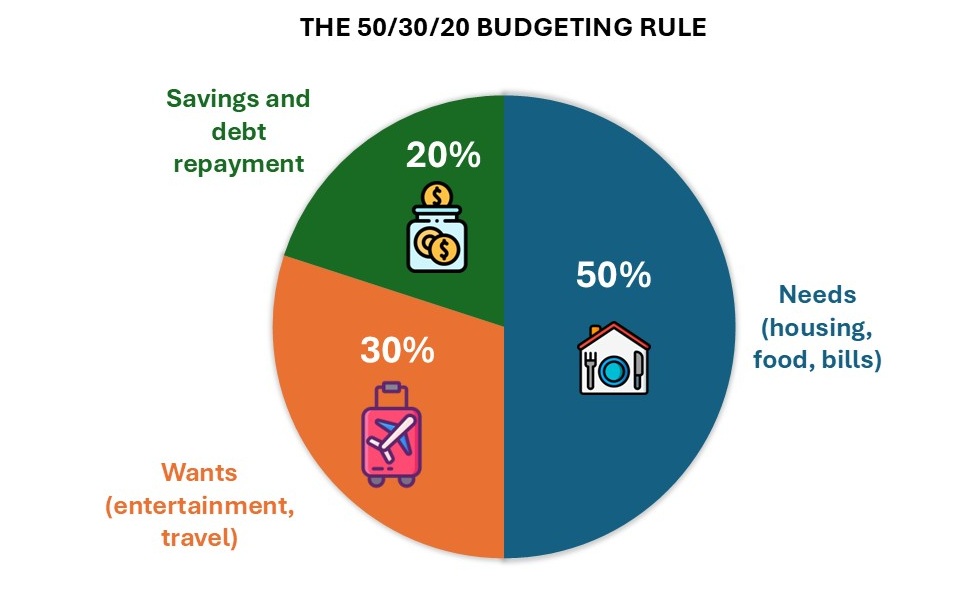

One of the most empowering budgeting tips for women is to create a monthly budget that aligns with your lifestyle, values, and income. A budget gives you a financial roadmap, showing exactly where your money is going and how to make it work for you. Start by tracking all your income and expenses. Then, try using the 50/30/20 rule:

- 50% of your income goes to needs (housing, food, bills)

- 30% goes to wants (entertainment, travel)

- 20% goes to savings and debt repayment

This method is simple, sustainable, and easy to personalize.

Pro Tip: Use free tools like Mint, YNAB (You Need A Budget), or EveryDollar to stay organized and automate your tracking.

When you know exactly what you’re spending, you’ll spot the hidden “money leaks”, small purchases or subscriptions that add up fast. Fixing those leaks gives you the freedom to redirect money toward your financial goals, like saving, investing, or starting that business you’ve dreamed of.

2. Build a $1,000 Emergency Fund to Secure Your Finances

When it comes to emergency savings for women, starting with a $1,000 goal can make a big difference. Life is unpredictable, and unexpected expenses like car repairs, medical bills, or last-minute travel can hit at any time. Having a small emergency fund gives you a financial cushion so you don’t have to rely on credit cards or loans when life throws a curveball.

This is one of the most practical and empowering first steps in your wealth-building journey. You don’t need to save it all at once. Start with just $10 or $25 a week and build it up over time. Choose a separate high-yield savings account so the money is safe, accessible, and growing a little with interest.

Pro Tip: Automate your savings by setting up a small recurring transfer from your main account. You won’t even miss the money, and it builds your safety net in the background.

It gives you peace of mind and helps you avoid going into debt for small emergencies. That stability builds confidence and sets the stage for bigger financial goals ahead.

3. Cut 3 Non-Essential Expenses to Save More Money

One of the smartest ways to take control of your finances is to trim the fat from your spending. As part of your smart money moves for women toolkit, cutting just three non-essential expenses can instantly free up cash to fuel your financial goals.

Start by reviewing your bank statements and subscriptions. Are you paying for a gym membership you don’t use? Subscribed to multiple streaming services you barely watch? Grabbing takeout more often than you thought? These little habits can quietly drain your money each month.

Pro Tip: Cancel or pause services you don’t truly need and set a small weekly cash limit for treats or fun spending. This keeps you mindful without feeling deprived.

You’ll be shocked at how quickly small savings add up. Redirect that freed-up cash to your emergency fund, debt payoff, or investment account. This one habit helps you take back control, align your spending with your values, and accelerate your journey to financial independence.

4. Pay Off One Small Debt Quickly and Reduce Financial Stress

If you feel like debt is holding you back, you’re not alone. Many women carry debt from credit cards, personal loans, or even buy-now-pay-later services. But here’s the good news: you can take back control by starting with just one small balance. Choose a manageable debt that you can realistically pay off in the short term. This could be a $300 store card or a personal loan with a few hundred dollars remaining.

You can follow the debt snowball method, where you pay off the smallest balance first for quick wins, or the debt avalanche method, which targets the highest interest rate to save more money over time. Whichever strategy you choose, make it a priority and add a little extra to the monthly payment if possible.

Paying off even one small debt can lift a huge mental weight. It builds confidence, reduces stress, and helps free up more money in your budget. As a woman working toward financial independence, eliminating debt is one of the smartest steps you can take to build long-term wealth.

Start small, stay consistent, and remind yourself that every dollar you pay off is a step closer to financial freedom.

5. Set a Weekly Savings Goal to Achieve Short-Term Financial Wins

Saving money doesn’t have to feel overwhelming. In fact, starting small is often the best way to build momentum. One powerful short-term habit is setting a weekly savings goal. Whether you choose to save $20, $30, or $50 each week, the key is consistency.

Pick a fun or meaningful mini goal that motivates you. Maybe you want to save for a weekend getaway, upgrade your laptop, or launch your side hustle. By breaking that goal down into smaller weekly targets, it becomes more manageable and achievable. For example, saving $25 a week adds up to $1,300 in a year. That’s money you can use to invest, build an emergency fund, or fund a dream.

Why it works: Building the habit of saving each week strengthens your money mindset. It proves to yourself that you can save money even on a tight budget, and that small, smart moves add up over time. This strategy helps you grow wealth while building confidence in your financial journey.

6. Start Investing with as Little as $100: A Beginner’s Guide for Women

Think investing is only for the wealthy? Think again. Today, women can start building long-term wealth with as little as $100. Thanks to beginner-friendly platforms, investing is now more accessible, educational, and empowering than ever.

Why this matters for your financial goals

- Compound growth: Even small investments grow over time if you stay consistent.

- Accessibility: You don’t need to be an expert or have thousands in the bank.

- Confidence boost: Taking your first investment step builds financial empowerment.

Beginner platforms for women

- Fidelity: Great for beginners with educational tools and no-account minimum.

- M1 Finance: Offers fractional shares and automated investment.

- Ellevest: Designed specifically for women, aligning with career goals and life stages.

Starting early, even with just $100, allows time for compound interest to do its magic. It turns small money into big gains over the years. The key is to begin, learn, and grow as you go.

7. Improve Your Financial Literacy to Make Smarter Money Decisions

The more you understand money, the more confidently you can grow it. Financial literacy isn’t just for experts, it’s a foundational tool every woman needs to build wealth and make smart decisions.

Why it matters

- Knowledge builds confidence: When you understand how money works, you make empowered choices.

- Better decisions: From saving and investing to avoiding debt traps, literacy helps you plan your future wisely.

- Financial independence: You gain control over your money instead of letting money control you.

Smart ways to boost your financial literacy

- Read one finance book: Start with Smart Women Finish Rich by David Bach or Clever Girl Finance by Bola Sokunbi.

- Listen to empowering podcasts: Try HerMoney with Jean Chatzky or So Money by Farnoosh Torabi.

- Follow finance influencers on social media: Look for female voices who share relatable tips.

Building financial knowledge is like building muscle. You get stronger over time. One book, one episode, or one post a day can completely shift your mindset and move you toward wealth, independence, and security.

8. Boost Your Credit Score and Unlock Better Financial Opportunities

Your credit score is more than just a number, it’s your financial reputation. Whether you’re applying for a loan, buying a car, or renting an apartment, a good credit score can save you serious money and stress.

Why it matters

- Lower interest rates: Higher scores mean better loan and credit card offers.

- More opportunities: Strong credit gives you access to mortgages, business loans, and rental approvals.

- Financial freedom: A good score gives you options, not obstacles.

Actionable credit tips for women

- Pay your bills on time, every time. Set up automatic payments if needed.

- Reduce credit utilization: Keep your credit card balance under 30% of the total limit.

- Consider a credit-builder card if you’re just starting out or rebuilding credit.

Improving your credit score doesn’t happen overnight, but small consistent steps can make a big difference in a few months. When your score goes up, your financial options expand, and that’s a powerful step toward long-term wealth.

9. Automate Your Savings and Bills to Simplify Money Management

When it comes to building wealth, consistency is key. By automating your savings and bill payments, you take the manual work out of the equation and ensure your money is working for you, without you even thinking about it.

Why it matters

- Build wealth effortlessly: Automating savings means you’re consistently setting money aside for your future, even if it’s just a small amount.

- Save time and stress: You don’t have to remember to transfer funds or pay bills each month.

- Avoid late fees and penalties: Set up automatic bill payments to ensure you’re never late, which helps protect your credit score.

Automation turns good intentions into consistent actions. By making savings and bill payments effortless, you protect your wealth-building progress and prevent money leaks that could set you back. It’s an easy and powerful way to stay on track with your financial goals.

10. Create a Simple 6-Month Wealth Plan to Build Financial Confidence

A goal without a plan is just a wish. To build wealth, you need a roadmap. A 6-month wealth plan helps you transform your financial aspirations into clear, actionable steps. The best part? It gives you a sense of direction and measurable progress.

Why it matters

- Clear goals lead to focused action: When you know exactly what you’re working toward, it’s easier to stay motivated.

- Set deadlines for success: A 6-month plan provides a sense of urgency and pushes you to act.

- Trackable progress: You’ll see your goals evolving, which builds momentum and confidence.

How to create your simple 6-month wealth plan

- Set three clear goals

- Break them down into monthly actions

By creating a clear and time-bound plan, you shift from dreaming about financial freedom to actively working towards it. These small, incremental steps add up over time, creating lasting wealth and financial empowerment. A 6-month plan is an achievable goal that sets the foundation for larger long-term wealth-building strategies.

Conclusion

Building wealth isn’t an overnight process, but with the right mindset and strategies, every woman can achieve her financial goals. By focusing on these 10 powerful short-term financial goals, you’re taking the first crucial steps toward financial independence and long-term success.

Remember, small changes, like automating your savings, paying off a small debt, or starting your investment journey with as little as $100, can lead to big results over time. The key is consistency and commitment. By setting clear goals, breaking them down into actionable steps, and tracking your progress, you’ll build the financial confidence you need to make smarter money moves.

Your financial journey is unique to you, and with each goal you accomplish, you’re one step closer to securing the wealth and freedom you deserve. Whether you’re saving for an emergency fund, paying off debt, or investing for the future, stay committed, stay informed, and most importantly, stay empowered.

Start today and make 2026 the year you take control of your financial future!