What Financial Independence Really Means

Financial independence for women isn’t just about having a big savings account or a high-paying job. It’s about freedom, the ability to make choices without being limited by money. Whether it’s leaving a toxic relationship, starting a business, taking a career break, or retiring early, financial independence means having control over your life, on your terms.

Women often face unique financial challenges that make this journey more complex. The gender pay gap is still very real, with women earning less on average than men for the same work. Many women also step away from their careers to care for children or aging family members, which can impact their lifetime earnings, retirement savings, and career progression. And let’s not forget that women statistically live longer, which means their money must stretch further.

In 2026, financial independence for women matters more than ever. With rising living costs, economic uncertainty, and increasing digital opportunities, it’s crucial for women to take charge of their finances. It’s not just about surviving, it’s about thriving, building wealth, and creating a future where you call the shots.

Financial independence isn’t a luxury. It’s a necessity. And it starts with educating yourself, setting goals, and using the right tools to make your money work for you.

The First Steps Toward Financial Independence

If you’re wondering how to start your financial independence journey as a woman, the first step is understanding exactly where you stand. You can’t build wealth without knowing your current financial health. That means getting real about your income, debt, expenses, and savings. Review your bank statements, check your credit score, list all debts (yes, even the sneaky ones like store cards), and get a clear picture of your monthly cash flow.

Once you know your numbers, it’s time to set specific financial goals for women that support your independence. Start small but think big. Do you have an emergency fund that covers at least three to six months of living expenses? If not, that’s your first target. Next, tackle high-interest debt. Create a debt payoff plan using either the snowball method (smallest balances first) or the avalanche method (highest interest rates first).

From there, move toward wealth building. Begin investing, even if it’s just a small monthly amount. Consistency matters more than perfection. Use this foundation to build your personalized financial roadmap, one that reflects your goals, lifestyle, and values.

Quick tip: Try using a budget app for women or a free financial planner worksheet to help you visualize your roadmap and stay on track.

Financial independence doesn’t happen overnight. But with the right mindset and a clear plan, it’s 100% achievable, one step at a time.

The First Steps Toward Financial Independence

Budgeting has a reputation for being boring, restrictive, or overwhelming. But when you find the right system that fits your lifestyle, it becomes your secret weapon for financial independence. The key is choosing budgeting tools that work for women and make managing money feel empowering, not exhausting.

Best Budgeting Apps for Women

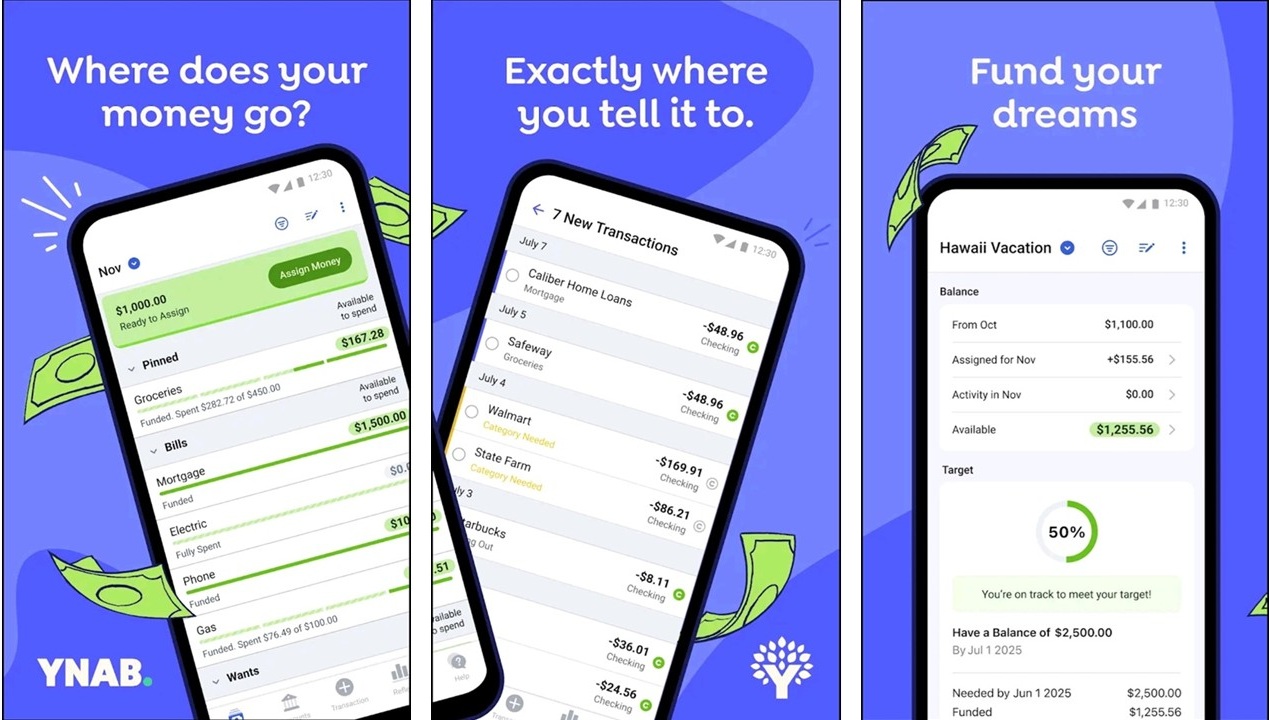

Start with tech that does the heavy lifting. Apps like You Need a Budget (YNAB) are great for hands-on budgeters who want to assign every dollar a job. Mint is perfect if you want a more automated, visual breakdown of your spending. And if simplicity is your vibe, EveryDollar offers a clean interface and zero-based budgeting that makes it easy to track where every cent goes.

Popular Budgeting Methods That Work

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings or debt payoff. This method is great if you like balance without micromanaging every category.

- Zero-Based Budgeting: Every dollar has a job. You plan exactly where your income goes until your budget hits zero. Ideal if you’re goal-oriented and want full control.

- Envelope System: A more traditional method where you use cash (or digital envelopes) to assign limits to categories. Great for avoiding overspending.

How to stay consistent

Budgeting doesn’t mean saying no to lattes or fun. It’s about saying yes to your long-term freedom. Make your budget flexible, check in weekly (not just once a month), and use tools that feel intuitive. Most importantly, celebrate your wins, even the small ones.

Pro tip: Pick a budgeting method that fits your energy, not someone else’s Instagram highlight reel. This is your journey.

Top Saving & Investing Resources for Women

Saving and investing don’t have to be overwhelming or reserved for the Wall Street elite. Today, women have access to beginner-friendly platforms and tools that make building wealth not only possible but empowering. The key is knowing where to start and which resources are worth your time.

High-yield savings accounts and automation tools

If your money is sitting in a traditional bank account earning pennies, it’s time for a glow-up. High-yield savings accounts like those from Ally, Marcus by Goldman Sachs, or Capital One 360 offer better interest rates and no monthly fees. Combine these with automation tools like Qapital or Chime’s Save When You Get Paid feature to effortlessly move money into savings each payday. This is how you start building wealth on autopilot.

Best beginner investing platforms for women

When it comes to investing, platforms like Fidelity and Vanguard offer low-cost index funds and IRAs that are perfect for long-term wealth building. For a more tailored approach, Ellevest is a robo-advisor built by women, for women. It considers things like career breaks and longer life expectancy — key factors in women’s financial planning.

Resources to understand stocks, ETFs, and retirement accounts

Don’t let the jargon stop you. Websites like Investopedia, The Budgetnista, and Girls That Invest break down financial terms into language you’ll understand. Want to explore IRAs, ETFs, or index funds without getting bored? Try BiggerPockets Money Podcast or HerMoney with Jean Chatzky for fun, informative guidance.

Tip: Start small. Even $50 per month invested in an index fund today can grow into thousands over time. The best day to start investing was yesterday. The best next? Right now.

Debt Payoff Strategies That Free You Fast

Debt can feel like a weight that holds you back from reaching your financial goals. But with the right tools, strategies, and mindset, you can break free faster than you think. Whether you’re tackling credit card debt, student loans, or personal loans, there’s a clear path to financial freedom.

Use debt tracking tools and calculators

Before you crush your debt, you need a clear picture of where you stand. Free online tools like the Debt Snowball Calculator by Undebt.it or NerdWallet’s Debt Payoff Calculator can help you map out your total balances, interest rates, and timelines. These tools let you visualize progress and stay motivated every month.

Avalanche vs. snowball method explained

Two of the most popular strategies for paying off debt are the debt avalanche method and the debt snowball method.

- The avalanche method prioritizes paying off debts with the highest interest rates first, saving you more money over time.

- The snowball method focuses on paying off the smallest debt first, giving you quick wins and momentum.

Not sure which is best for you? Use calculators like Tally’s debt strategy tool to compare and decide.

Best apps to automate your debt payoff plan

Apps like Tally, Qoins, and ChangEd automate extra payments toward your debt using spare change or set contributions. They help you pay off balances faster without the mental stress of constant budgeting.

Pro tip: Set reminders or autopay for your minimums, then use these tools to throw extra money at your target debt. Every little bit adds up, and the faster you pay it down, the sooner you start building wealth.

Must-Follow Blogs, Podcasts & Communities

When you’re on the path to financial independence, having the right voices in your corner makes all the difference. Whether you’re looking for practical tips, personal stories, or a community of like-minded women, these top resources can keep you motivated, informed, and inspired.

Top personal finance blogs for women

Looking for real talk about money from women who’ve been there? These blogs deliver everything from budgeting tips to investment advice, all tailored for women at every stage of their financial journey:

- Clever Girl Finance: Founded by Bola Sokunbi, this blog empowers women with free courses, relatable money advice, and real success stories.

- The Budget Mom: Focused on debt payoff and budgeting for everyday women, her methods are easy to follow and highly effective.

- Her First $100K: Created by Tori Dunlap, this blog blends financial education with feminist empowerment and a bold voice.

Best podcasts for women’s financial empowerment

If you prefer learning on the go, plug into these powerful personal finance podcasts hosted by women:

- HerMoney with Jean Chatzky: Covers money, careers, relationships, and retirement, all from a woman’s perspective.

- So Money with Farnoosh Torabi: Features interviews with top entrepreneurs and financial experts, with a focus on practical money advice.

- Clever Girls Know: The podcast side of Clever Girl Finance, full of relatable, actionable insights from women just like you.

Online financial communities for women to join

Surrounding yourself with others on the same mission can keep you going. Consider joining:

- Facebook groups like “Women’s Personal Finance” or “Financially Savvy Women” for peer support and advice.

- Reddit’s r/FinancialIndependence and r/FIREyFemmes for community wisdom.

- Ellevest Community: Offers tools, resources, and events for ambitious women growing their wealth.

You don’t have to walk the path to financial freedom alone. With the right content and community, you’ll always have guidance, inspiration, and accountability.

Your Personalized Toolkit

Every financially independent woman needs her own go-to toolkit, and the good news is, there are powerful resources out there that won’t cost you a dime. From downloadable budget templates to free investment checklists, these tools are made to help you take control of your money with confidence.

Free budget templates and money trackers for women

If you’ve ever felt overwhelmed trying to track your income, savings, or debt, these ready-to-use tools will be your new best friends:

- Monthly budget planners tailored for women who manage households, side hustles, or full-time careers.

- Net worth tracking spreadsheets to help you see the big picture of your financial progress.

- Investment checklists that break down the steps to start investing in index funds, ETFs, and retirement accounts.

Top free and paid online courses for financial education

No matter where you are in your money journey, there’s a course that fits. These are great places to start:

- Clever Girl Finance: 100% free courses designed by women, for women.

- Coursera and Udemy: Look for high-rated courses on financial literacy, investing basics, and debt reduction taught by female experts.

- Ellevest Workshops: Aimed at helping women build wealth through money mindset, salary negotiation, and investing.

Final Motivation: Start Today, Not Someday

Here’s the truth: financial independence isn’t a far-off dream reserved for the ultra-rich or finance nerds. It’s a path every woman can walk, and the sooner you start, the more power you must shape your future. Every small step you take today compounds over time. Whether it’s setting up your first high-yield savings account, downloading a budget template, or just tracking your spending for the week, it all adds up. Don’t wait for the “perfect moment”, the perfect moment is now.

Because when you start today, you give your money time to grow. You build confidence with every dollar you save, every debt you pay off, and every smart financial move you make. You stop living paycheck to paycheck and start building wealth, security, and freedom on your terms.

So, what’s one thing you can do today? Pick something small but meaningful:

- Choose a budgeting app and set it up

- Opening a savings account

- Watch a 10-minute money course

“You don’t need to do it all — you just need to begin.“

Want support and weekly motivation to keep going?

Subscribe now for smart money tips, empowering tools, and resources made just for women on their financial independence journey.

Your future self will thank you.