Have you ever wondered if there’s a way to make money while you sleep? Welcome to the world of dividend stocks, a smart, steady, and powerful way to build wealth over time. Whether you’re a career-driven professional, a stay-at-home mom planning, or simply a woman ready to take control of her finances, understanding how dividend stocks work can open the door to long-term financial independence.

More women are stepping into the investment world, and you can do the same without a finance degree or a big budget. Dividend investing is one of the simplest ways to grow your money with less stress and more consistency. It’s about creating a life where your money works for you.

Dividend stocks pay you just for owning them, like getting a small paycheck from your investments. Reinvest those payouts and you build a powerful snowball of passive income over time.

In this guide, you’ll learn:

- What dividend stocks are and how they work

- Why dividend investing matters in today’s economy

- How women can use this strategy to build long-term wealth

- Common mistakes to avoid

- Simple tools to help you start confidently

It’s time to make your money work smarter, not harder. Ready to unlock the power of passive income? Let’s dive into the world of dividend investing, because your financial freedom starts now.

What Women Need to Know About Dividend Stocks

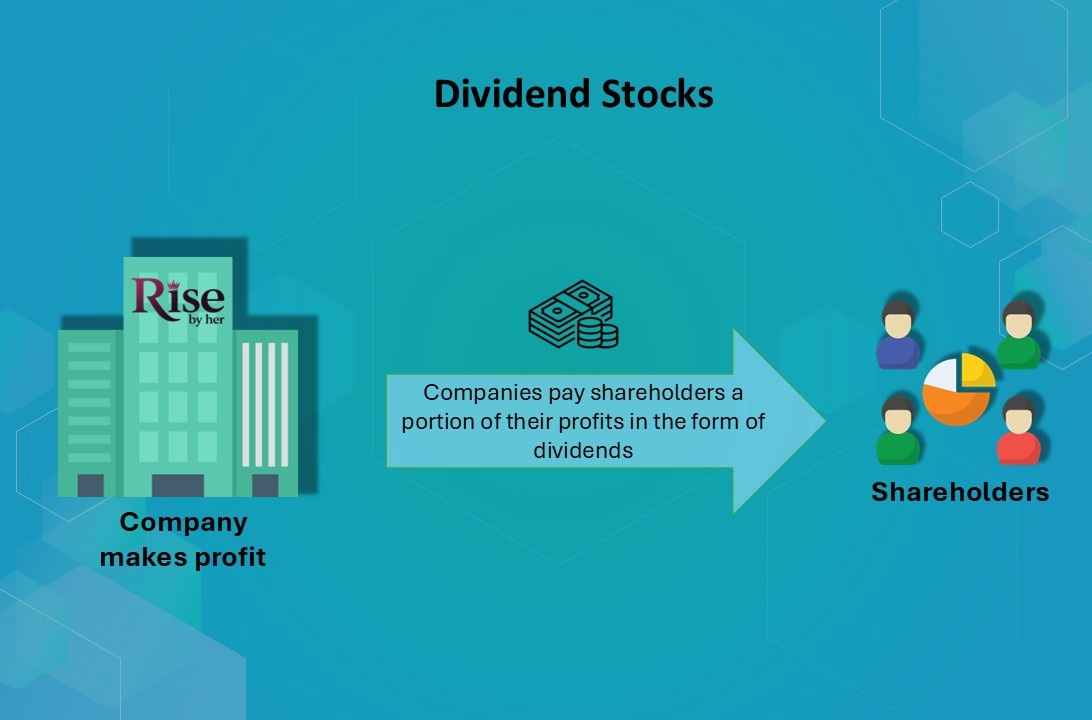

When you think of investing, you might picture buying a stock and waiting for it to grow in value. But there’s another smart, lesser-known way to make your money work for you: dividend stocks. These are shares in companies that don’t just grow in price; they also pay you a portion of their profits on a regular basis, simply for holding the stock. It’s like getting a thank-you check for being a loyal investor.

So, what exactly is the dividend? In simple terms, it’s a cash payment (or sometimes additional stock) that a company distributes to its shareholders from its earnings. Not all companies pay dividends, but those that do are often well-established businesses with steady revenue and a commitment to rewarding their investors.

Most dividend-paying companies issue payments quarterly, meaning you’ll receive income four times a year. However, some go above and beyond with monthly dividends, and a few may pay once or twice annually. These payouts are typically small individually, but over time, and especially when reinvested, they can grow into a significant stream of passive income.

You’ll find dividend stocks across many industries, but some of the most trusted examples come from household names. Companies like Coca-Cola, Johnson & Johnson, and Procter & Gamble have paid consistent dividends for decades. In fact, many of these firms are known as “Dividend Aristocrats”, a title given to companies that have increased their dividend payments every year for 25 years or more.

Dividend stocks are a great option for women who want to build a stable, long-term investing strategy, especially if you’re focused on generating passive income, planning for retirement, or just looking for smarter ways to grow your money in 2025 and beyond.

How Dividend Stocks Create Reliable Income for Women

Now that you know what dividend stocks are, let’s break down how they work, because once you understand the process, you’ll see just how simple (and powerful) this form of investing can be.

Dividend Declaration: Where It All Begins

It starts when a company’s board of directors declares a dividend. This announcement includes how much will be paid out per share, the record date, and the payment date. For example, if you own 100 shares of a company that pays a $0.50 quarterly dividend, you’d receive $50 every three months just for holding the stock.

These companies typically make these decisions based on their profits and future outlook. So, consistent dividends can also be a sign of a company’s financial health.

The Ex-Dividend Date: Timing Is Everything

To receive the dividend, you must own the stock before the ex-dividend date. This is a key term to remember. If you buy the stock on or after the ex-dividend date, you won’t qualify for the next payout. It’s a simple but important rule for new investors to keep in mind when timing their purchases.

Dividend Yield: Measuring Your Return

One of the most helpful tools for evaluating dividend stocks is the dividend yield. This is calculated by dividing the annual dividend by the current stock price. For instance, if a stock pays $4 annually and trades at $100, its yield is 4%. This helps you compare the potential return of different dividend stocks, especially useful if you’re looking for passive income or income-focused investing strategies.

Reinvestment: Grow Your Wealth Over Time

Many investors choose to reinvest their dividends using a Dividend Reinvestment Plan (DRIP). Instead of pocketing the cash, your dividends are automatically used to buy more shares of the stock, no extra fees, no effort. Over time, this reinvestment can create a compounding effect, helping your portfolio grow faster without needing to invest more out-of-pocket.

Understanding these mechanics is essential if you want to make the most of dividend investment. And the good news? Once you set it up, much of the process can run on autopilot, giving you more time to focus on your goals, career, or side hustle while your money keeps working for you.

Ready to explore the benefits of dividend stocks for women investors? Let’s keep going.

Why Dividend Investing Is a Smart Choice for Women in 2026

In a world of economic uncertainty, high inflation, and unpredictable markets, dividend stocks are having a serious moment in 2026. If you’ve been feeling nervous about investing, you’re not alone. Many women are looking for smarter, safer ways to grow their money without riding the emotional rollercoaster of the stock market. That’s exactly why dividend investing is gaining so much attention this year.

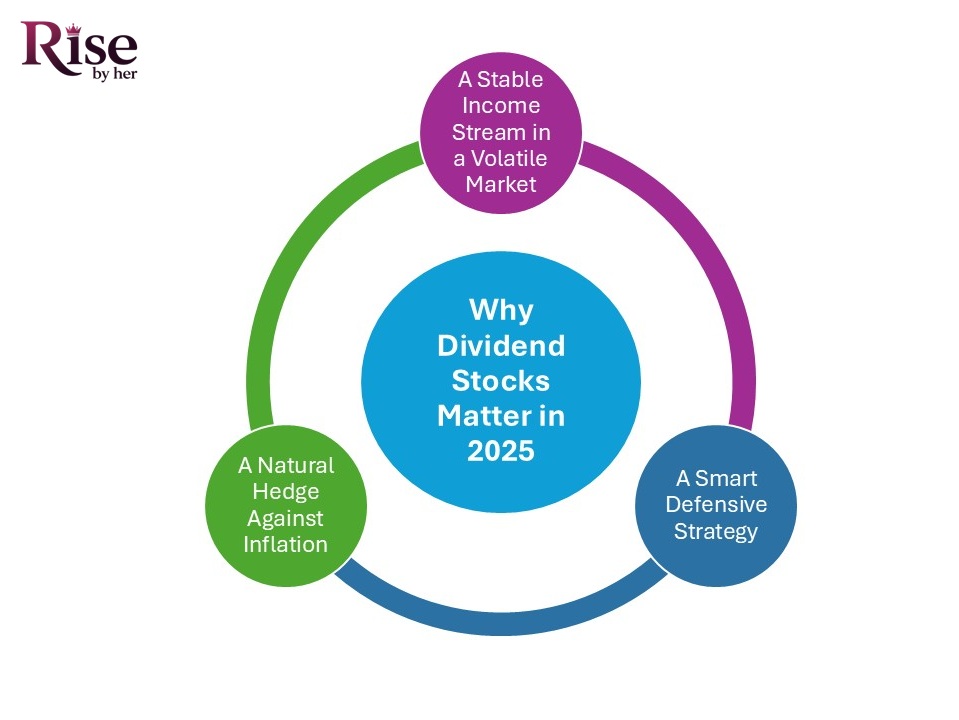

A Stable Income Stream in a Volatile Market

Let’s face it: market volatility is becoming the new normal. One day stocks are up, the next they’re falling fast. But dividend stocks offer something most growth stocks can’t: steady, predictable income. Regardless of what the market is doing, many dividend-paying companies continue to reward investors with regular payments. That means even during rough patches, your portfolio can still generate cash flow, and that’s a game changer for long-term wealth building.

A Smart Defensive Strategy

In 2025, more investors are playing defense, and dividend stocks are a powerful part of that strategy. When markets drop, dividend-paying companies typically fall less than high-growth, high-risk stocks. Why? Because they’re often large, established businesses with stable cash flows and strong financials. Think of dividend stocks as your financial anchor, keeping you grounded when the market feels like it’s drifting.

A Natural Hedge Against Inflation

With inflation still squeezing everyday budgets, dividend investing is one of the few tools that can help you fight back. As prices rise, your money loses buying power. But regular dividend payments can help offset inflation’s impact; especially if the companies you invest in consistently raise their dividends over time. That extra income can be used to cover rising expenses, reinvest, or build up your emergency fund.

In short, dividend stocks aren’t just a smart investment, they’re a strategic move for women who want more control, less stress, and a portfolio that works with the economy, not against it.

Coming up next, we’ll explore how you can choose the right dividend stocks and avoid common beginner mistakes. Let’s keep building your financial confidence, step by step.

Dividend Investing Strategies That Empower Women

If you’ve ever thought investing was only for Wall Street pros or finance bros in suits, it’s time to flip that script. In 2025, more women than ever are stepping into the investing world, not just to grow wealth, but to own their financial independence. And one of the most accessible and powerful tools to get started? Dividend investing.

Aligning Dividend Investing with Your Life Goals

One of the most exciting things about dividend stocks is how they can be tailored to fit your unique goals. Want to retire early? Use your dividends to build passive income that supports your future lifestyle. Saving for your child’s education, a home purchase, or your dream travel adventures? Dividends can become a steady stream of extra income that helps you fund those ambitions without constantly dipping into savings.

Think of every dividend payment as a small win, a reminder that your money is working hard, even while you sleep.

Easy to Start, Perfect for Beginners

Don’t we have thousands to invest? That’s okay. One of the biggest myths in investing is that you need a lot of money to get started. Thanks to apps and platforms that support fractional shares and low-cost investing, you can begin building your dividend portfolio with as little as $5 or $10. Many companies offer DRIPs (Dividend Reinvestment Plans), which automatically reinvest your dividends, helping your money grow faster without lifting a finger.

Dividend investing is a beginner-friendly way to learn by doing, all while generating real returns.

Building a Supportive Community of Women Investors

Investing doesn’t have to be a solo journey. In fact, it shouldn’t be. By connecting with other women who are exploring dividend investing, you can share tips, celebrate wins, and learn from each other’s experiences. Whether it’s through online forums, social media groups, or local investing circles, building a supportive community can turn investing into something empowering, not intimidating.

When women invest, we don’t just grow wealth, we grow confidence, community, and choices.

Dividend investing is more than a money move, it’s a mindset shift. It’s about showing up for your financial future in a smart, sustainable way. And the best part? You don’t have to do it perfectly to make progress.

Next up, we’ll cover how to get started with dividend investment, with simple steps you can take today.

Step-by-Step Guide to Starting Your Dividend Portfolio

Ready to dip your toes into dividend investing? Good news: you don’t need to be a stock market expert or have a six-figure salary to start building a passive income. With a few simple steps, you can begin your dividend journey and start growing wealth that works quietly in the background while you live your life.

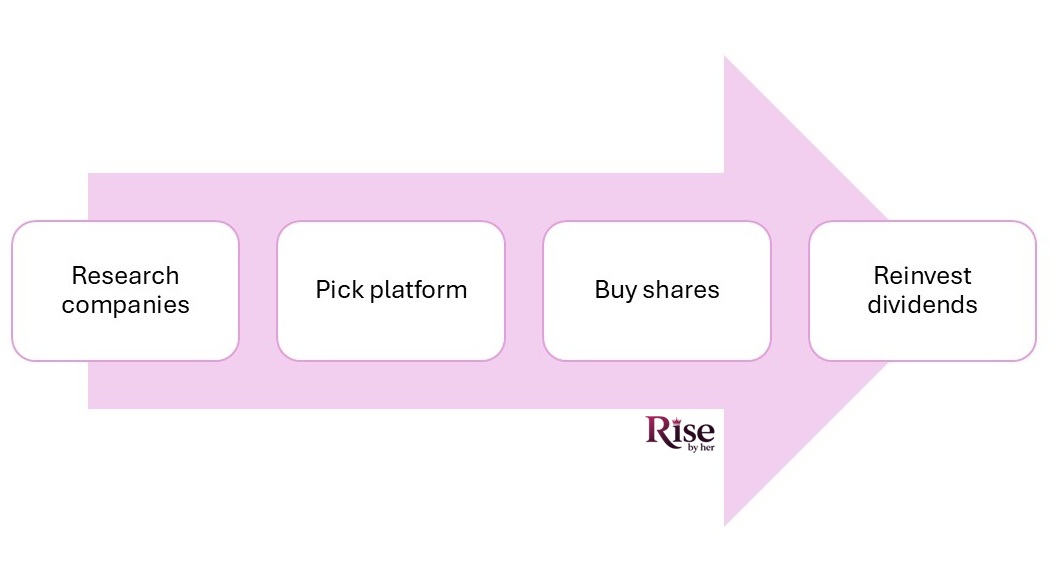

Do Your Research: Look for Strong, Reliable Companies

The first step is understanding which companies are worth investing in. Start by looking for businesses with a strong history of paying consistent dividends. These are often large, stable companies with reliable profits and long-term growth. You’ll also want to check the dividend yield (the return you’ll earn from dividends alone) and the company’s payout ratio, which shows how sustainable their dividend payments are.

Good places to begin your search include:

- Dividend Aristocrats (companies that have increased dividends for 25+ years)

- Sectors like utilities, consumer goods, and healthcare

- Free tools like Yahoo Finance, Seeking Alpha, and Morningstar for research

Diversify: Don’t Put All Your Eggs in One Basket

One of the golden rules of investing is diversification. Don’t just buy stock in one company or stick to one industry. Spread your investments across different sectors like tech, real estate, consumer goods, and energy to reduce risk. This way, if one company or industry takes a hit, your other investments can help balance things out.

Consider dividend-focused ETFs (exchange-traded funds) if you’re just starting out. These funds hold shares in many dividend-paying companies, giving you instant diversification with minimal effort.

Reinvest Your Dividends for Long-Term Growth

Once you start receiving dividends, you can choose to reinvest them automatically through a Dividend Reinvestment Plan (DRIP). Instead of taking the cash out, your dividends are used to buy more shares of the stock, increasing your investment and future payouts. Over time, this creates a compounding effect, where your money grows faster without any extra work.

Reinvesting is one of the most powerful ways to build wealth through dividends, especially if you’re playing the long game.

Starting small is perfectly fine. What matters most is starting. With a bit of research, a few smart choices, and a long-term mindset, dividend investing can become your secret weapon for financial independence in 2025 and beyond.

Next, we’ll look at common mistakes to avoid so you can stay confident and in control as you build your dividend portfolio.

Dividend Investing Mistakes Women Should Avoid

Dividend investing can be a powerful way to build passive income and long-term wealth, especially for women looking to take control of their financial future. But like any investment strategy, it comes with a few traps that can hurt your progress if you’re not careful. Before you jump headfirst, let’s walk through the most common mistakes new investors make, and how you can avoid them.

Chasing High Yields Without Doing Your Homework

It’s tempting to go straight for stocks offering very high dividend yields. After all, who wouldn’t want a bigger payout? But here’s the truth: if it seems too good to be true, it probably is. Extremely high yields can be a red flag that the company is in trouble. The stock price may have dropped drastically, or the dividend may not be sustainable long term.

Instead, look for consistent, moderate dividend yields from financially strong companies with a proven track record. These are more likely to offer stable, long-term income rather than a short-lived payout followed by a cut.

Putting All Your Eggs in One Basket

Another mistake is that many beginners make. Lack of diversification. Maybe you find one company that seems like a winner, or you stick to a single industry you’re familiar with. But investing heavily in one company or sector puts your entire portfolio at risk if something goes wrong.

A smarter approach is to spread your investments across sectors, like healthcare, utilities, tech, and consumer goods. Better yet, consider dividend-focused ETFs or index funds to automatically diversify while keeping it simple.

Ignoring the Payout Ratio

The payout ratio tells you how much of a company’s profits are going toward dividends. If that number is too high (say, 80% or more) it might be a warning sign. A high payout ratio means there’s less room for the company to reinvest in growth or weather a financial downturn. And if earnings drop, the dividend might get slashed.

As a rule of thumb, look for payout ratios under 60%, especially for companies in cyclical or volatile industries.

By avoiding these common missteps, you’ll protect yourself from unnecessary risk and set a solid foundation for growing your dividend income the smart way.

Best Tools and Resources for Confident Dividend Investing

Starting your dividend investing journey can feel overwhelming, but the good news is, you’re not alone. There’s an entire ecosystem of platforms, learning hubs, and communities designed to help you succeed. Whether you’re just starting out or already growing your portfolio, having the right tools and resources at your fingertips makes all the difference.

User-Friendly Investment Platforms

The first step is choosing an investment platform that makes it easy to buy and manage dividend stocks. Look for brokers that offer:

- Low fees or commission-free trades

- Access to dividend-paying stocks and ETFs

- Dividend Reinvestment Plans (DRIPs)

- Mobile apps and user-friendly dashboards

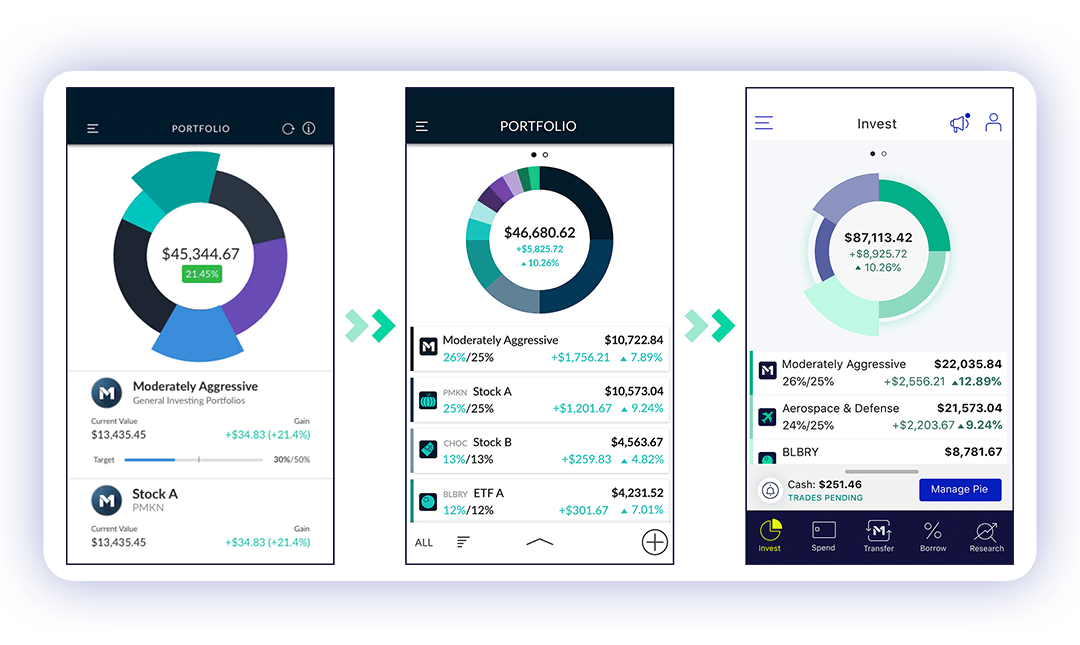

Top-rated platforms for beginners and long-term investors include:

- Fidelity: Known for no account minimums and free trades

- Charles Schwab: Great educational tools and DRIP support

- Robinhood: Simple interface for new investors

- M1 Finance: Allows automatic reinvestment and portfolio balancing

These platforms can help you get started with as little as $5 to $100, depending on your financial goals.

Learn as You Grow with Trusted Financial Education

Knowledge is power: especially when it comes to your money. Stay informed with resources that break down complex investing topics into real, relatable language.

Some of the best educational resources for dividend investment include:

- Podcasts like The Dividend Guy or BiggerPockets Money

- YouTube channels such as Ryan Scribner and Minority Mindset

- Blogs like The Motley Fool, NerdWallet, and Investopedia

- Courses on Udemy or Coursera that focus on investing for beginners or women in finance

Regularly consuming this kind of content keeps you confident, informed, and ready to make smart investment choices.

Join Online Communities for Women Investors

You don’t have to navigate this alone. Joining online forums and groups can provide motivation, accountability, and valuable peer-to-peer learning.

Check out:

- Facebook Groups like Women Investing in Stocks or Ladies Building Wealth

- Reddit communities like r/dividends or r/femalefinancialindependence

- Online events and webinars by platforms like Ellevest, HerMoney, or Invest Like a Woman

These spaces allow you to ask questions, celebrate wins, and share experiences with women on similar financial journeys.

Conclusion

Dividend investing isn’t just for Wall Street pros, it’s a powerful, approachable wealth-building strategy that any woman can master. Whether you’re saving for early retirement, planning for your children’s education, or simply building a more secure financial future, dividend stocks offer stability, passive income, and long-term growth potential to help you get there.

In 2025, with market volatility and inflation top of mind, dividend stocks are more relevant than ever. They can serve as a buffer against economic uncertainty while helping your money grow (quietly and steadily) in the background.

The best part? You don’t need a finance degree or a six-figure salary to get started. With just a little research, the right investing platform, and the support of a like-minded community, you can begin your dividend journey with confidence. The tools are here. The knowledge is available. And the time to invest in your financial independence is now.

Remember: every dollar you invest today is a step closer to the freedom, flexibility, and future you deserve.

So, why wait? Start small, stay consistent, and let your money work for you: one divided at a time.